Autonomous vehicles have been the biggest buzz in the auto industry for several years, but recent crashes have brought sensationalist tabloid headlines, too. Where does the truth lie, and when will self-driving cars become reality? A Ricardo whitepaper takes a deep dive into the whole complex subject and comes up with some surprising answers.

Much of the automotive industry and countless tech companies are working feverishly to bring self-driving vehicles to market, but their work has hit the headlines for all the wrong reasons – the handful of highly publicised accidents that have highlighted the risks involved in early on-the-road testing. Some commentators, perhaps understandably, are beginning to question the wisdom of pushing so fast into this avenue of development.

Indeed, it is worth asking why there is such a sense of urgency. Why are these connected and automated vehicles (CAVs) suddenly top of everyone’s priority list? What are the drivers behind this sudden shift in thinking? These are among the questions addressed in a White Paper just published by Ricardo. Entitled “The automation revolution coming to mobility and transport by 2025”, the report warns in no uncertain terms that “CAVs are coming a lot faster than many observers expect.”

DRIVERS FOR AUTOMATION

One of the most frequently cited reasons for the promotion of automated vehicles is that of safety. Vehicles driven by computers don’t get tired, distracted or impatient, it is argued. Another potential benefit, more easily demonstrated, is that vehicles under the control of optimised route planning and powertrain efficiency software will be more environmentally friendly than those piloted by erratic humans.

And while in the short term automated vehicles themselves may not do much to relieve inner-city congestion, they will at least allow their drivers to make more productive use of their time in the car. Longer term, too, widespread automation of the vehicle parc could help speed-up journey times by coordinating traffic flows and preventing overloading of particular routes, much as air traffic control networks already do for commercial aviation.

But why is this race for automation happening right now? Again, the consensus is that it has been triggered by a combination of simultaneous pressures and developments. Environmental concerns have hastened the arrival of electric vehicles, which are inherently easier to control through their electronics, and the timely maturing of smartphone technology in millions of people’s pockets now offers a ready-made interface for user-friendly consumer access to a wide range of transport options, including cars.

IMPACTS OF AUTOMATION

If connected and automated vehicles do become as widespread as some are predicting, what will be the consequences for the automotive industry? And how will this impact on the way in which we use the various modes of transportation available to us?

Once again, there is a measure of general agreement that the arrival of CAVs is likely to result in a decline in overall unit sales of vehicles across a variety of categories. Fully robotic taxis would become prevalent within city regions, say the Ricardo paper’s authors: “….and with good coverage the need for personal car ownership could be reduced to the point where it could become redundant.”

In the new mind-set of the market, argue some, people will become less intent on owning a vehicle and the focus will shift towards using pooled vehicles as a service; the early stages of this are already evident in the car-share schemes being run by companies such as GM, BMW, Mercedes-Benz and Smart.

The consequences of this shift will be profound at all levels of the supply chain, and some OEMs – especially premium manufacturers – will have to fundamentally realign their business models. Premium manufacturers invest heavily in the status and public standing of their brand names and, as the Ricardo report points out, while vehicle manufacturers are able to enjoy a high value path when selling to consumers, the value path to mobility providers will be of much lower value. Consumers would effectively disappear from the sales equation, and in a future automated scenario the business model of the industry would shift from a B2C to a B2B one, much like the way today’s major airlines deal with aircraft builders and leading companies.

LOWEST COST TRANSPORT

Perhaps counter-intuitively, the study’s authors also contend that automated vehicles could provide highly affordable travel at similar cost levels to public transport. The key here is ride-sharing in robotic vehicles. This is expected to increase significantly in urban areas and will begin to blur the distinction between what is private transport and what is public.

“Mobility with automated driverless ride-sharing will achieve substantial cost benefits, be highly affordable and comparable to the cost for public transport,” predicts the report, adding that “it is a possible scenario that automated ride-sharing will become the standard mass mobility mode in the future.”

The context of these forecasts is a world of ever-increasing urban populations, with a range of projections suggesting that 80 % of the world’s 9 bn people by 2050 will be living in urban areas, placing huge demands on city transport systems. “In response to these urban challenges,” suggests the report, “it is anticipated that in urban areas there will be a convergence towards a range of CAVs including buses, robotic taxis, pods and a multitude of smaller two- and three-wheeled vehicles, maximising the utilisation of each mode of transport in a safe, clean and efficient manner.”

THE BUSINESS CASE FOR AUTONOMY

The robotic taxi that could be key to revolutionising urban transportation will be a very complex vehicle, capable of at least Level 4 operation or, more likely, fully driverless Level 5 service. Its necessarily sophisticated sensor and connectivity systems, along with its high-efficiency batteries and powertrain, will mean that it costs between three and four times the price of current personal cars. Yet despite this high upfront cost, says the study, the economics of running a fleet of ‘robotaxis’ could provide a strong business case.

Unrestricted by the need to conform to driver hours regulations, robotic taxis will be highly utilised vehicles, running continuously for some 20 hr through each day until they need recharging. The expectation is that they will cover some 400 km each day, equating to 145,000 km per year; Ricardo estimates an 8-10 year lifespan for the complete vehicle, making a convincing economic proposition.

“Even with the significant increase in vehicle purchase costs, the economics for robotic taxis are significantly better than [for] personal car ownership,” predict the authors, adding that “this is without factoring in the ever-increasing parking costs within cities, or the inconvenience of hunting for a parking space.”

The impacts of these seismic shifts on the many value chains within the transportation sphere are impossible to predict, but are sure to be highly significant. But on an environmental level, especially if city centres become barred to all traffic except electric vehicles and CAVs, the benefits stand to be great. Socially, however, major impacts will be felt within the community of transport professionals: driving jobs at all levels are expected to be at high risk, most notably for those who earn their living from driving taxis, vans, trucks and buses.

SIGNIFICANT CHALLENGES

Formidable technical obstacles must be overcome before industry and society can fully commit to CAVs. These challenges have been gruesomely highlighted by accidents that have occurred recently on US roads, where regulation of testing protocols is comparatively relaxed.

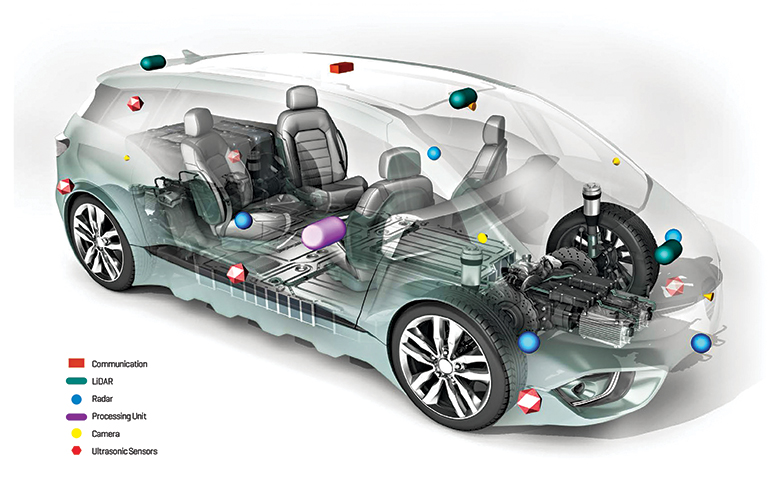

For terrestrial CAVs, the road infrastructure and communication networks must be upgraded, and the vehicles themselves will have to progress upwards through the five technology levels identified by the SAE.

One very practical issue is that of gaps in maps. If CAVs are to be truly autonomous, they will need accurate digital maps of wherever they travel: the world has more than 30 mn km of roads, the vast majority of which have not yet been digitally mapped. And without a map, an autonomous car is quite literally lost. Filling these gaps is a major task, though researchers from MIT’s Computer Science and Artificial Intelligence Laboratory have created RoadTracer, an automated method that uses aerial photography to build road maps 45 % more accurate than existing approaches.

And as far as vertical mobility is concerned, widespread uptake of private drones, whether autonomous or human-piloted, will entail a complete rethink of today’s air traffic control systems, which at the moment are largely geared around scheduled commercial aviation timetables.

OUTLOOK FOR CAVs

In their report, Ricardo’s authors summarise the top five (engineering) challenges CAV as a complete ecosystem must solve to achieve the widespread deployment goal of Level 4 capabilities by 2035, as:

1. Developing reliable algorithms for intelligence, learning, sensor fusion and object detection;

2. Ensuring safety by design in vehicles with multiple safety-critical functions;

3. Achieving robustly validated systems, considering the enormous complexity of the environment;

4. Ensuring cybersecurity resilience; and

5. Reducing costs of all aspects of the systems.

But beyond these largely technical tasks, there is the much broader question of societal impacts of widespread CAV deployment, as well as the still unresolved behavioural question of how a near-autonomous vehicle can reliably and safely hand back control to the human driver, when required.

Picking winners and losers at this stage is also difficult, for so much depends on the way CAV rollout evolves. As an example, one potentially undesirable outcome could involve automated vehicle travel becoming such good value that people migrate away from public transport modes, thus increasing – rather than reducing – congestion on road systems. Yet the whitepaper concludes that, as a future scenario, the automated robotic taxi, offering mobility as a service, has the potential to significantly disrupt the traditional vehicle OEM sales model. The growth of this new type of mobility service will result in a far wider and deeper value chain, built up from the necessarily multifaceted businesses that together create the new ecosystem.

In this scenario, the vehicle OEM moves from business-to-consumer sales as it is today to a business-to-business provider, with the attendant lower margins. Then, only the fittest are likely to survive.

But perhaps what is most surprising is the speed at which this revolution – or at least the first four stages of it – is expected to unroll. The report concludes that, as a result of heavy upfront investments, several OEMs and start-ups are promising Level 4 automated vehicles from around 2021. These will offer automated, hands-off, eyes off-capabilities over defined routes and circumstances.

Yet, add the Ricardo experts, the fully automated vehicle, capable of unrestricted operation anywhere and in any conditions, and akin in skill to a trained human driver (Level 5), is not expected until beyond the late 2030s. However, the big impact will come from automated mobility as a service provision and, in the scenarios investigated in the Ricardo report this will not require such a high level of automation. Hence, concludes the study, by 2025 widely deployed Level 4 mobility service systems are a realistic possibility.

This article is an edited version of a feature in the Q2 issue of Ricardo’s RQ magazine. To obtain a copy of the report ‘The automation revolution coming to mobility and transport by 2025’ please visit: https://automotive/ricardo.com/revolution

By Ricardo RQ magazine

Source: https://autotechreview.com

CUT COTS OF THE FLEET WITH OUR AUDIT PROGRAM

The audit is a key tool to know the overall status and provide the analysis, the assessment, the advice, the suggestions and the actions to take in order to cut costs and increase the efficiency and efficacy of the fleet. We propose the following fleet management audit.