Credit: The State of Sustainable Fleets 2020

While diesel and gasoline engines will still be the main power source for commercial vehicles for the next decade, fleets are now testing and buying sustainable vehicle technologies in record numbers. That’s according to a new study of fleet use of sustainable vehicle platforms for medium- and heavy-duty fleets, such as natural gas, propane, electric, and renewable fuels.

Clean technology consulting Gladstein, Neandross & Associates has authored what it calls the first comprehensive, technology-neutral industry report to examine the current state of sustainable vehicle platforms among fleets and identify trends for the future.

In the report, The State of Sustainable Fleets 2020, the authors note the industry is experiencing “a critical inflection point where alternative fuel vehicle adoption is expanding from the gradual uptake in niche applications seen over the past several decades, to faster and broader adoption within the last few years.”

Produced with support from sponsors Daimler Trucks North America, Penske Transportation Solutions, Shell Oil, and Exelon, the report identifies four key findings:

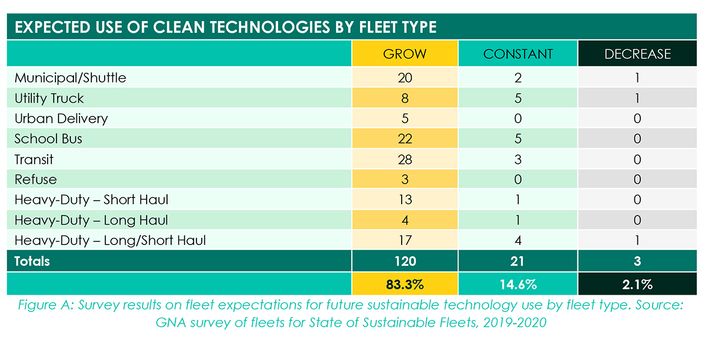

- About 98% of the fleets surveyed expect to increase or continue the same level of use of sustainable vehicle technologies and fuels.

- Natural gas, propane, battery electric, and hydrogen fuel cell electric vehicles, the four sustainable vehicle technology platforms covered in the study, are all growing in terms of vehicle sales, fuel sales, and investment.

- Sustainability is the top motivator for purchasing decisions among early adopter public, private, and even for-hire fleets in deploying clean vehicle technologies.

- Fleets report there is no material performance loss when switching to most renewable fuels and would use more if available when it is a cost-neutral, drop-in replacement.

Through interviews and surveys, the report gathered data from stakeholders with real-world experience deploying sustainable vehicle technologies, including progressive fleet owners and operators, original equipment manufacturers, and infrastructure providers. The analysis includes public, private, and for-hire fleets, including school, municipal/shuttle, urban delivery, refuse, utility, transit, short-haul, and long-haul sectors.

“I think the thing that was most notable was all these sustainability technologies are growing, both in terms of vehicle sales and fuel metrics,” said Erik Neandross, chief executive officer for Gladstein, Neandross & Associates, in a webinar. “Overwhelmingly, the early adopters… 98%, said they plan to continue at the same level or more their use and investment in these technologies. That was frankly a little surprising, because in the early years, there were some hiccups along the way.”

However, Brian Cota, vice president of sales for national accounts for Daimler Trucks North America, did not find that 98% number terribly surprising. “Our customers have their own sustainability and green initiatives they want to push forward with. The truck OEs also have their compliance and regulatory standards we need to move forward with on the trucks we manufacture and what kind of carbon footprint we put out there. So the momentum is there.”

Sustainability was the top motivator for early fleet adopters, followed by cost benefits and regulations.

“As an early adopter in our industry, regulations played an important role as we began experimenting and demonstrating the use of natural gas in our fleet in the early 1990s,” said Waste Management in the report. “Once the technology was successfully proven, Waste Management moved forwards with its transition to a natural gas fleet because it makes both environmental and economic sense.”

Natural Gas and Propane

After decades of development, the report says, medium- and heavy-duty natural gas vehicles have achieved technological and commercial maturity. Fleets leading adoption of heavy-duty NGVs report seeing low total cost of ownership through fuel cost savings and reduced maintenance, while simultaneously achieving steep emission reductions.

Credit: The State of Sustainable Fleets 2020

Today there are approximately 90 models of Class 2 through Class 8 compressed natural gas vehicles. Commercial natural-gas vehicle sales grew 19% from 2017 to 2018 and another 13% in 2019, which set a record with more than 6,000 units sold. About 85% of the 53,000 registered NGVs in America today are in heavy-duty applications, specifically goods movement, refuse, and public transit.

Over 70% of surveyed urban delivery, transit, utility, and refuse fleets plan to continue purchasing and piloting NGVs over the next two years.

The propane vehicle and fuel market (also referred to as liquified petroleum gas, LPG or propane autogas) continues to grow, driven by increasing adoption in the school bus sector and several other fleet types. This trend is expected to continue as school district orders of new propane buses from leading OEMs grew 26% from 2015 – 2019 and comprised 44% of all propane vehicle sales over the same timeframe.

Medium-duty Class 3 through 6 vehicles are another strong market for propane vehicles, supporting urban delivery vehicles, vans, utility trucks, and shuttle fleets. Approximately 90% of commercial fleet propane refueling takes place at relatively inexpensive, easy-to-install private fueling stations, complemented by 765 public-access propane stations nationally. Fleets that choose private fueling pay on average 38% less for propane autogas compared to diesel and gasoline on a gasoline-gallon-equivalent basis, according to the report.

Electric Vehicles

“Of course there’s tremendous enthusiasm on battery and fuel cell electric,” Neandross said, with development moving quickly, both among new market entrants and traditional players.

The vast majority of battery-electric vehicles in the market today are for people transport, with more than 2,000 battery-electric transit and school buses already deployed or in the process of being procured. However, across all vehicle classes, the report notes, OEMs are introducing or expanding BEV commercialization efforts.

“Big-name trucking fleets are placing large orders, making commitments to purchase, and demonstrate medium- and heavy-duty BEVs in their everyday operations – a critical first step to an eventual wider-scale commercialization,” the report says. Today, at least 21 OEMs offer for sale more than 90 medium- and heavy-duty BEV models. Collectively, OEMS expect to offer at least a dozen more Class 3-6 BEV models within the next three years.

“Of the fleets that have some experience [with battery-electric vehicles], 70% said within the next 24 months they expect to be investing in and using BEV if they aren’t already,” he said.

Although still in demonstration and pre-commercial phases, medium- and heavy-duty fuel cell electric vehicles (FCEVs) are generating a great deal of interest. Over the last two years, truck and bus OEMs have announced accelerated, ambitious efforts to demonstrate and commercialize fuel cell models in medium- and heavy-duty applications.

“On the fuel cell side, we are seeing about a dozen fleets running hydrogen-fuel cell buses in transit. More and more investment is happening by OEMs, infrastructure and fuel providers, and even the fleets. Overall, we found that the hydrogen fuel cell product offering will double in the next two years. And there’s some data that shows the fuel cost of hydrogen should come down pretty soon.”

Last year, Daimler Trucks North America President and CEO Roger Nielsen made headlines when he proclaimed, “The future is electric.” When asked about that, DTNA’s Cota said, “We still anticipate for this decade that diesel is still going to be the main player. We have customers that are running natural gas successfully, and we think they will continue to. Battery electric has a lot of promise,” he said, especially for Class 6-7 medium-duty vehicles that spend a lot of time in lower speed and lower mileage delivery applications and come home every night. Class 8 day cabs that come home every night are also a likely application.

Credit: The State of Sustainable Fleets 2020

“With hydrogen and fuel cell, as you start thinking about a long range over-the-road truck, it’s going to be hard to compete with diesel in the near term from a cost of ownership perspective.”

Greener Vehicle Fuels

The report also discusses how diesel and gasoline vehicles become more “green” as well. “Everyone expects diesel and gasoline are going to continue to dominate for the better part of the next decade,” Neandross said. Through combinations of OEM and fleet efforts, average heavy-duty vehicle efficiency is significantly improving, the report notes, and some individual Class 8 tractors are achieving as much as 10 mpg in real-world use.

The report also highlights the benefits and challenges across drop-in renewable fuels, including renewable diesel, biodiesel, renewable natural gas, renewable electricity, renewable hydrogen, and renewable propane. The report found that fleets are fans of these fuels, with the biggest challenge being able get enough to meet their needs at a competitive price.

California’s renewable diesel consumption nearly tripled between 2015-2019 to 620 million gallons, notes the report.

“Renewable diesel consumption provides multiple benefits to Ruan,” the company is quoted as saying in the report. “We get competitive pricing in California for renewable diesel/biodiesel blends. It also helps bring recognition and awards for sustainability to Ruan, which is a positive in conversations with current and prospective customers.”

For Drew Cullen, senior vice president of fuels and facility services for Penske Transportation Solutions, renewable diesel offers potential maintenance benefits.

“One of the things that really excites us about renewable diesel is just how clean of a fuel it is and what the potential impact is to the emissions control systems in terms of things like DPF filters and what it could do to help with the maintenance associated with those vehicles. It’s finally come down in certain markets where it’s very competitive with diesel (price wise).”

The report also tracked “some big improvements in the use of renewable natural gas,” Neandross said. The report says the average carbon emissions from renewable natural gas sold in California in the fourth quarter of 2019 improved 59% over the same quarter the previous year.

“Not to be left behind, propane has made some big strides,” Neandross said. “Some new near-zero-emission propane engines have been brought to the market. It has a relatively low incremental costs on both the infrastructure and the vehicle side, so for school districts as one example, it provides a nice way to get into lower-emission technology at a lower cost. And like natural gas, paired with low-emission propane engines, we’re seeing early stages of a renewable propane fuel industry. Like renewable diesel, we need more supply to come on-line.”

Overcoming Challenges

While adoption of sustainable vehicle technologies is increasing, fleets acknowledge that there are still barriers to overcome, and the report explores those challenges.

The need for more fueling infrastructure and incremental capital costs are consistent challenges found across all vehicle platforms, it notes.” However, fleets that have successfully deployed sustainable vehicle technologies in their regular operations have spent considerable time to understand and adapt to new technologies in ways that remove barriers, which fleets say is critical to maximize payoff.”

Lack of sufficient fueling infrastructure and high capital costs remain top concerns for adoption. “Not all trucking companies are located in an area where they have access to infrastructure,” noted Total Transportation Services.

The full report is available at www.stateofsustainablefleets.com

Source: https://www.truckinginfo.com

CUT COTS OF THE FLEET WITH OUR AUDIT PROGRAM

The audit is a key tool to know the overall status and provide the analysis, the assessment, the advice, the suggestions and the actions to take in order to cut costs and increase the efficiency and efficacy of the fleet. We propose the following fleet management audit.