With advanced driver-assist systems (ADAS) evolving rapidly, the technology will continue to improve safety as it augments the skill and attention of human drivers. Accidents will still occur, however, and when they do, determining fault and failures will be become more complex when a range of electronic sentinels are involved. A panel discussion during SAE’s 2020 WCX Digital Summit brought together experts in the accident reconstruction field to discuss how ADAS might influence the determining factors contributing to a crash.

Moderated by Origin Forensics’ principal Jarrod Carter, the “Accident Reconstruction in an ADAS future,” panel speakers included: Edward Fatzinger, forensic engineer, Momentum Engineering Corp.; Eldon Leaphart, principal engineer, Carr Engineering Inc.; Alan Moore, consultant, A B Moore Forensic Engineering; and David Plant, mechanical engineer, D P Plant & Associates. Highlights and insights from the discussion follow.

Adoption and market penetration

The ADAS panel discussed the technology as applied on both passenger and commercial vehicles, as well as on motorcycles. The consensus is that passenger vehicles lead in ADAS implementations due to the proliferation of electric power steering (EPS), which allows the system to control lateral position. In terms of market penetration, Moore noted that the adoption-timeline curve was typical for this type of tech, and ADAS will soon play a role in a majority of incidents.

“By the best I’ve seen, we’re at about 20% adoption by the fleet of all passenger vehicles on the road, and that’s important because in a year or two, we’ll be at 25% adoption, which means that half of our two-vehicle crashes will have some ADAS component to it,” Moore explained. “This is a really good time for us to be talking about how ADAS fits into accident reconstruction because a year or two from now, it’s going to be about half of our cases.”

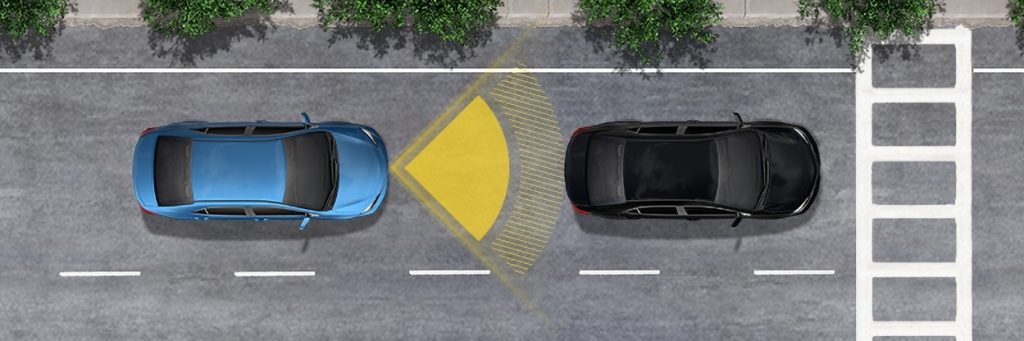

According to Plant, the ADAS-equipped ratio for commercial vehicles from a 2018 study is directly proportional to fleet size. “Smaller fleets, [those] that were less than 10 units, only 24% of those fleets were equipped with some form of ADAS,” Plant said. “Whereas a much larger fleet, greater than 50 units, about three quarters of those fleets were equipped with some form of ADAS. Blind-spot monitoring, which is pretty important on commercial vehicles, seems to have the greatest penetration into the fleets at this point.”

Features and how to alert

Deciding how to alert when an ADAS system calls for intervention, and which features are most needed, varies by vehicle type. Fatzinger noted that motorcycles present a particular challenge for ADAS implementation. “I like the haptic area – vibrate to seat, vibrate to hand grips – and I think it would be the most effective,” he noted in terms of a rider-alert system, adding that rider position will prove a challenge for engineering critical motorcycle ADAS functionality.

“Autonomous emergency braking on motorcycles is going to be quite difficult to achieve,” Fatzinger said. “The rider has to be in a ready position to brace for the deceleration. There’s going to have to be force sensors in the hand grips to tell the system, ‘Hey, the rider’s reacting and applying force to the handlebars.’ The emergency braking realm is going to be pretty far off, but I think the classic lane-departure warnings, blind-spot warnings are going to be pretty easy to achieve.”

On the heavy-vehicle side, Plant noted that each year the technology evolves and improves, with the biggest commercial concerns being collision mitigation and automatic emergency braking (AEB). “Initially, when these systems came out for collision mitigation and AEB, automatic emergency braking wasn’t responding to stopped vehicles. Now, as improvements are made, these systems can respond to stopped vehicles, and can stop at higher speeds,” he said. “This is an evolving technology, and we’re not where 100% of every hazard can be avoided or mitigated, but we’re improving.”

Managing driver complacency

Leaphart noted that one of the biggest challenges with ADAS is getting drivers to understand the limitations of the technology, similar to when ABS was introduced three decades ago. “Similarly, when we look at some of the ADAS technologies in the current state of the art, especially automatic emergency braking, how does the driver interact with that?” Leaphart said. “A very large portion of our field now focuses on the human-factors element of understanding how the driver’s interacting. Did the driver have time, or did they react in a manner appropriate?”

“The positive aspects of ADAS are pretty obvious: Safer driving and more convenient driving,” Moore explained. He noted that the downside is drivers quickly become complacent and over-reliant on ADAS. “If you look in the owner’s manual of most newer vehicles,” Moore said, “the list of reasons why ADAS won’t work is longer than the list of reasons why ADAS will work, because while it’s definitely safer than not having it at all, it still has lots of limitations and lay-person drivers often miss that point.”

“If you imagine a normal driver having a certain level of safety, ideally ADAS would bump that level of safety up to where they’d be a more safe driver,” Moore continued, “but I think what’s actually happening in a lot of the crashes we see is the average driver says, ‘Hey, I’ve got this ADAS, which is giving me an incremental improvement in safety. That means I can reduce my awareness or attention by that increment and maintain the same level of safety.’”

Data access and privacy concerns

Accident reconstruction relies heavily on data, for which ADAS could prove a trove, depending on how much access is provided via the OEMs and via privacy laws. When asked if OEM data-management policies would affect sales, Moore responded, “I don’t think that it affects manufacturers plans for sales all that much, but has a huge effect on their liability exposure. When you put together manufacturer liability exposure and privacy laws, frankly I’m surprised we have the data available today that we do.”

Moore noted that in terms of OEM data access, Toyota is currently leading the OEM pack with its Techstream software, and that GM is also active on this front. “This is going to come down to electronic data,” Moore said. “That’s truly where we’re going to find the answers for a lot of this stuff. Which means we’ll be depending to a great extent on the manufacturers to give us access to that data. We’re completely beholden to manufacturers at this point.”

“Getting data isn’t easy and especially if it’s a matter that goes into litigation,” Leaphart said. “Over time, one would expect EDR [event data recorder; the automotive equivalent to aviation’s black box] regulations would catch up or would inform and consider some of this data. EDR regulations certainly standardize things, and as we get more penetration of these vehicles into the marketplace, one would expect that there would be some sort of a standardization.”

Data accessibility is perhaps less nettlesome on the commercial-vehicle side, Plant noted. “There is data. It is accessible. You can get access to video and data relating to crash involving an ADAS vehicle,” he said. “There are no requirements for an EDR. There is a recommended practice, SAE’s J2728, which does cover heavy-vehicle event data recorders, but I think that the data’s a little more accessible on the heavy-vehicle side than perhaps the passenger-vehicle side, but I agree on this question that it is an issue of privacy.”

Source: https://www.sae.org

CUT COTS OF THE FLEET WITH OUR AUDIT PROGRAM

The audit is a key tool to know the overall status and provide the analysis, the assessment, the advice, the suggestions and the actions to take in order to cut costs and increase the efficiency and efficacy of the fleet. We propose the following fleet management audit.