Europeans lease and rent more cars than ever before

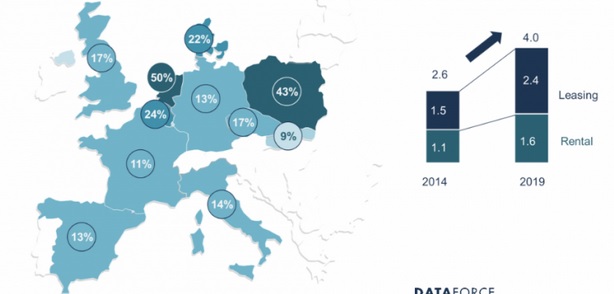

Whether it is short-term rental or operational Leasing, the customers in Europe are getting more and more accustomed to not owning a vehicle themselves, reports Dataforce. Over five years, the total market increased from 2.6 to 4.0 million.

Julian de Groot, Head of Product, Dataforce, attributes this partly to the cultural change of the sharing-economy, where ownership is shifting to using. On the other side, the historically low interest rate allows for interesting lease-prices, which effectively reduces the gap between owning and renting.

According to Mr de Groot, people are also moving away from owning as they want to reduce their capital risk and do not want to deal with expensive repairs.

Today, 1 out of 4 new car registrations is either a leasing or a rental vehicle, up from only 1 out of 6 in 2014.

Poland and Spain booming

In terms of volume, Germany and the UK lead the pack in Europe. Poland, however, is now the fifth biggest market, having grown by a staggering 110% on the waves of the country’s booming economy. Spain has seen even higher growth of 132% since 2014, a sign of the country’s recovery from the crisis.

Netherlands go for private lease

Dataforce reports the leasing market in the Netherlands is number 6 of the European market for volume and has been driven not only by a historical large fleet but has in the last years increasingly benefitted from private leasing contracts. This is in strong contrast with previous Dutch market preferences, as no Dutch person previously wanted a financing contract that wasn’t a straight loan. The market has shifted, however, thanks to basement prices for stock cars. No surprise, the private market has suffered, with only 1 out 5 vehicles being bought by private buyers in 2019

The future of leasing

Mr de Groot believes we will see a gentle increase in the coming years, assuming that interest rates remain low. This will have a slight impact on the expected number of leased vehicles. The general tendency of companies towards a mix of mobility solutions will move them away from providing company cars as an employee benefit, which will in return reduce the corporate leasing requirements.

However, manufacturers are pushing via new rental constructions, for example subscriptions and private leasing. Private customers are becoming more accustomed to financial constructions, which will help support the growth in leasing on this end of the market.

Research done by Dataforce in Germany also shows that almost 50% of rental vehicles are sold to and registered by the next customer within one year. This effect is widely known in the industry, says Mr de Groot, as rental is indeed often referred to as a push channel for sales.

Image copyright: Dataforce

Source: https://www.globalfleet.com

FLEET MANAGEMENT NEWSLETTER

Join to our NEWSLETTER; you’ll get the latest news, articles, publications, training, conferences, events, congresses, and white papers related to Fleet Management, Mobility and Automotive IN your email fortnightly.