It is crucial to know all the vehicle fleet’s costs in order to: establish and control the fleet’s budget; establish the prices and rates of the offered services; know the cost of every mile/kilometer traveled; know the Total Cost of Ownership (TCO); calculate the disposal/replacement periods of each vehicle; control and follow up the fleet’s economic performance; calculate the fleet’s main economic and financial indicators; do an ABC analysis of the fleet’s costs; have a costs history registry to predict future forecasts; find the level of relationship between service and direct costs; and gather valuable information for decision making.

Join to The Fleet Management Group

In this group, you can know and share knowledge, experiences and meet people interested in Fleet Management over the world. Each week we publish posts, conferences, news, scientific papers, and technology related to Fleet Management.

In this group, you can know and share knowledge, experiences and meet people interested in Fleet Management over the world. Each week we publish posts, conferences, news, scientific papers, and technology related to Fleet Management.

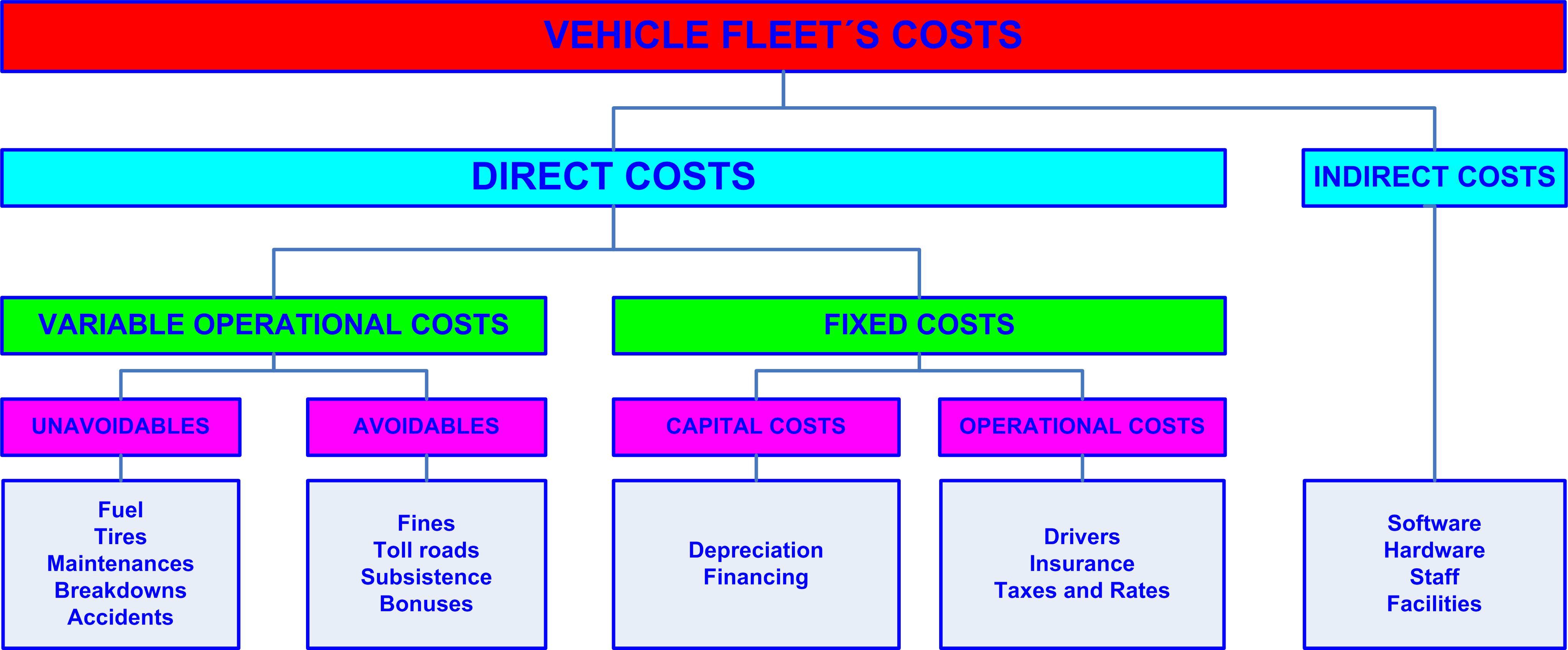

Vehicle fleet’s costs are classified in two types:

- Direct costs: the costs related to a vehicle’s possession and exploitation, and are divided in two subcategories:

- Fixed costs: the costs sustained by a vehicle whether it’s being used or not, and are computed per units of time, normally by a natural year

- Variable operational costs: the costs related to the vehicle’s activity, and are computed by distance traveled or hours used

- Indirect costs: the costs attributed to a vehicle, not by possession or exportation, but as a result of fleet management, like software, hardware, the involved staff, and the necessary facilities (offices, parking, fuel storage).

Graphic 1 shows the vehicle fleet’s costs structure.

Graphic 1: vehicle fleet’s costs structure.

VEHICLE FLEET’S FIXED COSTS

Fixed costs are those related to a vehicle’s possession and are divided in capital costs and operational costs.

1. Capital costs

The capital costs are the acquisition costs and the chosen financing. They’re divided in depreciation and financing.

- Depreciation: the decrease in the value of a vehicle, complimentary equipment, or fitting bodies during their period of use. Depending on the chosen financing option the decreasing will be equal to the amortization during its service life or to an inferior period.

- Financing: the sum of financing costs of a vehicle, complementary equipment or fitting bodies in a year. A vehicle’s financing can be done in following main ways: If the vehicle is acquired through credit or a loan, it’d be the annual interest rate; if the company has issued its own debt, then it’d be the sum of the annual interest amount paid to the buyers; if the company uses its own funds, it would have to calculate the opportunity cost to invest the resources in other investment.

If the vehicle, complementary equipments, or fitting bodies have been acquired through renting/leasing, the acquisition and financing costs are included in the annual fee.

2. Operational Costs

The operational costs are the following:

- Drivers: the annual gross cost of the company’s drivers of the vehicles destined to perform a service. In Spain this includes the gross salary and the social security contributions

- Insurance: the annual costs of the insurance for the vehicle, complementary equipments, fitting bodies and commodities.

- Taxes and Rates: the annual costs of taxes and rates, such as the technical inspection of the vehicle that is mandatory in some countries like Spain, transportation cards, taxes on mechanised vehicles, tachograph inspection, and any other authorization or taxes over transportation.

VEHICLE FLEET’S VARIABLE OPERATIONAL COSTS

Variable operational costs are those related to the vehicle’s use. There are two types of variable direct costs: those that are related to the use of vehicles, and those that may or may not be related to the use of the vehicles and depend on the service performance and how the fleet is managed.

1. Unavoidable costs

The unavoidable costs of a vehicle fleet are those related to the vehicle’s use, and are the following:

- Fuel: annual cost of fuel for vehicles and complimentary equipment

- Tires: annual cost of acquisition and repair of tires.

- Maintenance: annual costs of plannified maintenance in accordance to the vehicles manufacturer and preventive maintenance, which have to include workforce, spare parts and oil/lubricants

- Breakdowns: annual costs of breakdowns, which have to include workforce, spare parts and oil/lubricants

- Accidents: annual costs of traffic accidents, which have to include the vehicle’s repair and compensation to any third-party that the organization is in obligation to pay

2. Avoidable costs

The avoidable costs of a vehicle fleets are those that can be related or not to the vehicle’s use, and depend on the service performance and how the fleet is managed, and are the following:

- Traffic fines/tickets: total cost of tickets to drivers for any wrongdoing or misconduct

- Toll roads: total cost of payments related to toll roads, that must be paid to travel through them in order to guarantee quality service, or because they are more safe

- Driver’s diet work: annual costs of driver’s trips outside of their permanent residency through a determined period of time

- Bonuses: bonuses paid to the vehicles’ drivers for several reasons such as lowering fuel consumption or traffic accidents

VEHICLE FLEET’S COSTS CONTROL

The accounting department has the average value of the fleet’s costs, but it’s advised to have individual costs assigned to each vehicle.

The organization must establish the frequency for control and follow ups of costs, which would depend on the characteristics, budgets and goals of every organization.

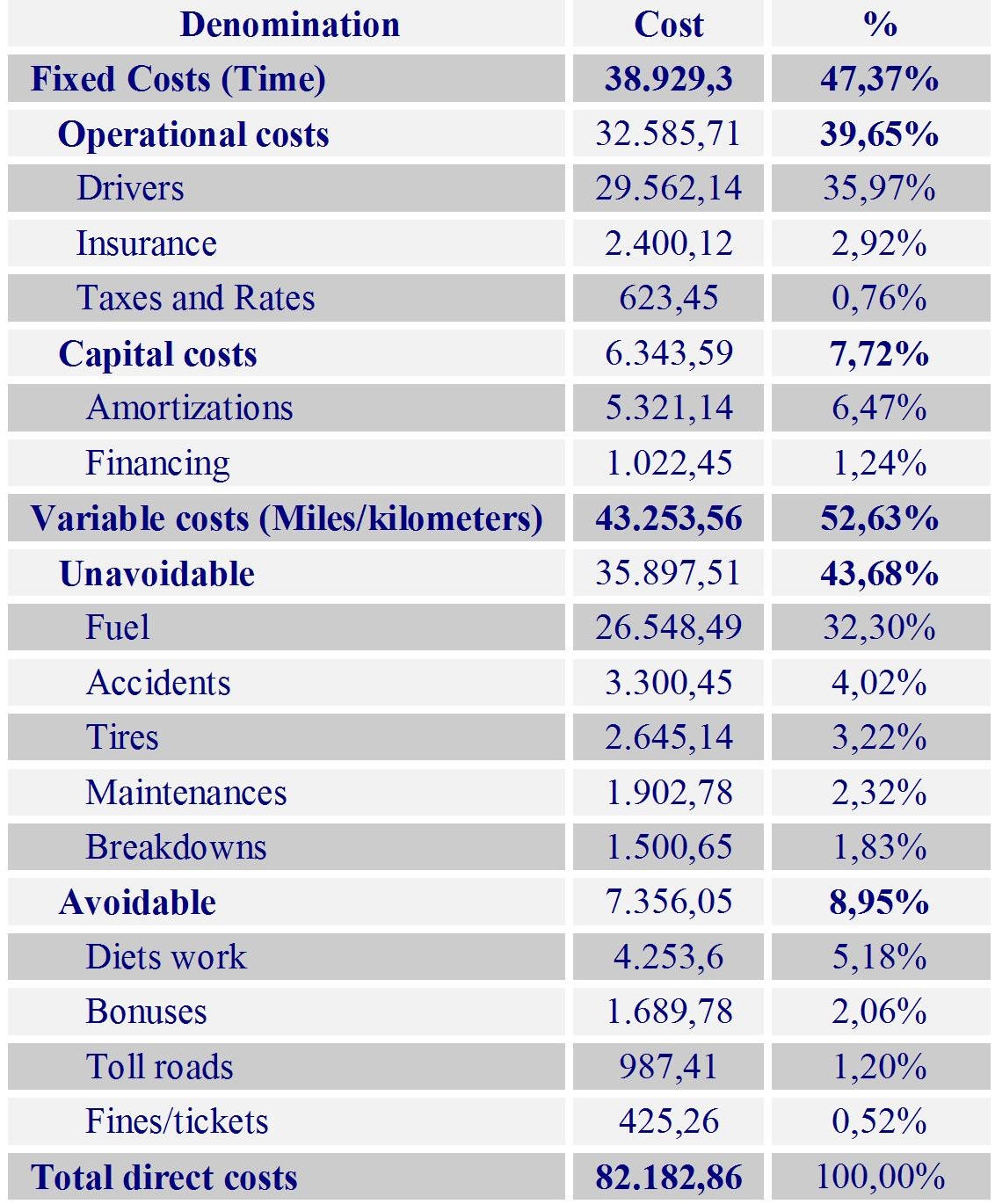

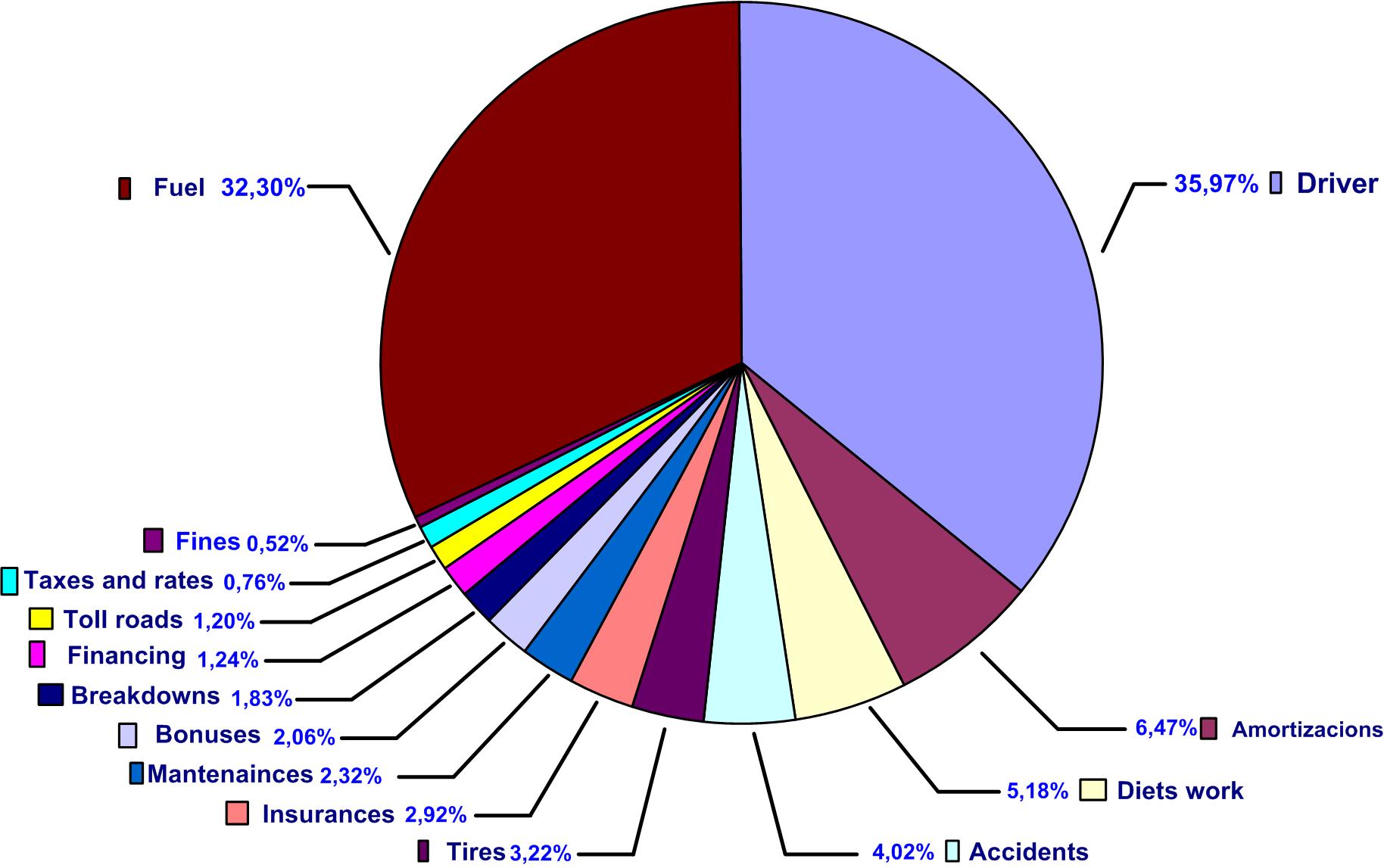

The cost’s control and follow ups are recommended to do for each vehicle individually, for each type of vehicle and an average for the whole fleet. In the following graphics are some examples on how to do said control and follow ups of the vehicles. The chart 1 shows all the direct costs in one year according to graphic 1 for one fleet’s vehicle.

Chart 1: direct costs of a fleet’s vehicle.

Graphic 2 shows the distribution of directs costs

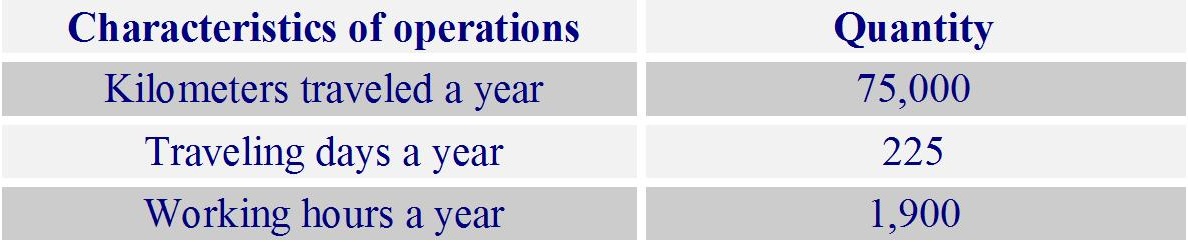

Consider the following operational data in the chart 2.

Chart 2: characteristics of operations of one vehicle of the fleet

The direct costs by distance and time obtained are the following:

Chart 3: direct costs by time and distance of one vehicle of the fleet

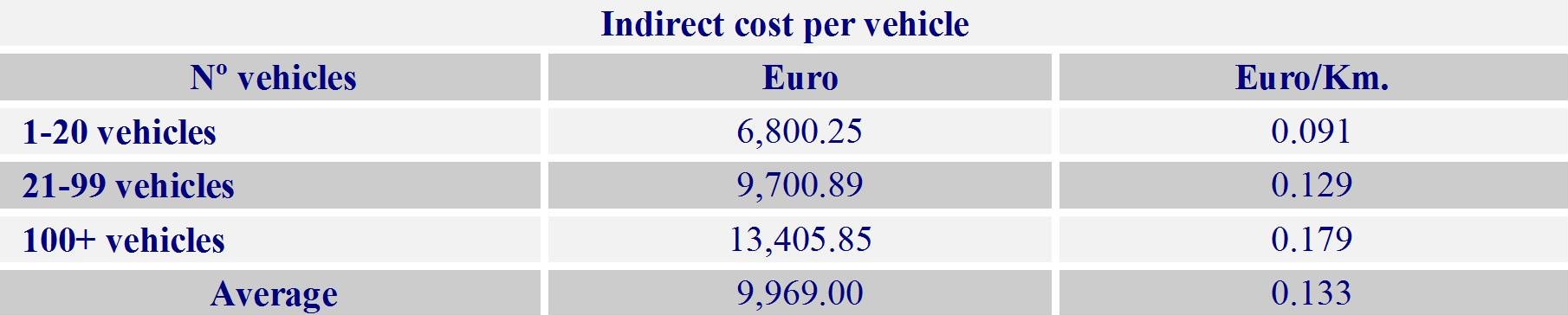

Consider the indirect costs in a fleet that vary according to the number of vehicles, the following data are the cost per kilometer, as shown in the chart 4.

Chart 4: indirect costs of a fleet’s vehicle per kilometer

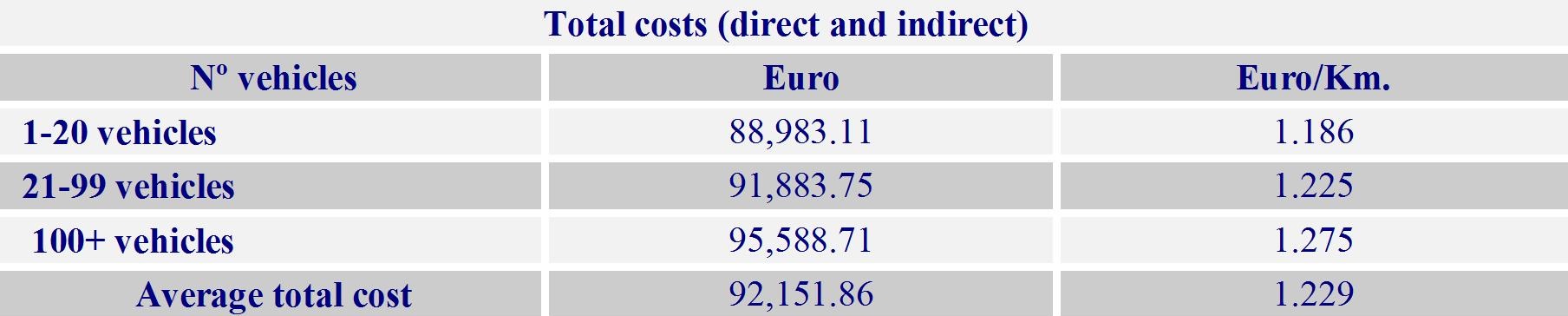

Considering the direct and indirect costs, the cost per kilometer per vehicle is obtained, according to the chart 5.

Chart 5: total costs (direct and indirect) of a fleet’s vehicle

With the obtained data it can be calculated several economic and financial indicators of the fleet, that will depend on each organization.

Tell me your opinión:

info@advancedfleetmanagementconsulting.com

I´m a Fleet Management expert, and the manager of Advanced Fleet Management Consulting, that provides Fleet Management Consultancy Services.

I´m a Fleet Management expert, and the manager of Advanced Fleet Management Consulting, that provides Fleet Management Consultancy Services.