For underwriters, premiums don’t get much more complicated than drivers, their safety record, the training they receive, and where they operate. Technology does play a part—and ‘nuclear verdicts’ have a huge role in the coverage environment.

Technology aboard trucks such as advanced driver assistance systems and dashcams are starting to make a difference, but how much a fleet pays for insurance still comes down to core considerations—safety records, driver training, driving records, driver experience, and where and how far from headquarters tractors operate, insurance stakeholders told FleetOwner.

Lane-departure warning systems. Automatic emergency braking. Blind-spot detection. In-cab video cameras, or dashcams. All upfront technology topics in trucking. Many of these systems gather a ton of data that can be useful to insurance companies—particularly when it comes to determining fault and liability in a crash or simply for coaching truckers to help prevent those costly mishaps. Technology certainly is related to safety and reducing risk for fleets and drivers, underwriters agree. But how much does technology really impact premiums?

See also: How insurance companies, attorneys are using fleet data

These factors are much more tangible to insurance companies: The age and experience of your drivers. Accident history, both for your drivers and collectively your fleet. Out-of-service violations. The age and maintenance of your fleet. Do your trucks and drivers operate through congested places such as the Northeast U.S., the Mid-Atlantic, or many areas of the West Coast?

Especially important, though, is drivers. “Lots of things anchor back to the driver,” said Gary Flaherty, who is senior VP of E&S Wholesale, Commercial Auto, the division of Nationwide Insurance Co. that underwrites all the company’s for-hire trucking business.

Driver quality and training

Insurance underwriters often examine how well—or poorly, for that matter—a fleet’s drivers are trained and how experienced they are. It’s no secret that driver training often is inadequate, flawed, or rushed—and not all CDL schools have done the job well at all, stakeholders said. Coincidentally, compliance began Feb. 7 on new federal commercial driver’s license (CDL) training and testing requirements. The jury is out on whether these new rules go far enough to help correct the disparities in the quality of trucker training, both before drivers reach fleets with their newly minted CDLs and after they’re on the job.

“Insurance people are always telling fleets to please train your drivers better,” said Mark Murrell, president of CarriersEdge, which many U.S. fleets rely on to provide online safety and regulatory training to their truck drivers. Many CarriersEdge resellers also are insurance brokers, he noted.

Nick Saeger, assistant VP of pricing and product for the transportation division of Sentry Insurance Co., a provider of insurance to commercial fleets, was blunt about the topic of driver training. All too often, where the rubber meets the road for insurance companies is in court.

See also: How fleets can tackle driver challenges head-on

“Do we expect [fleets] to be perfect? No. It’s great to have driver training guidelines, but you have to follow them,” noted Saeger, who by trade is an actuary, a person who statistically calculates risk. “If you have these guidelines that you don’t follow, you’re unsafe, and you have to be punished in cases after an accident. Plaintiffs’ attorneys are good at finding that.

“There are a lot of different things in accessing the risk,” he added. “We do look at equipment and the driver and their experience with losses. We look at distance from terminal; geography matters in rates. There are vehicle factors, driver factors. It’s hard to say whether it’s one factor over another.”

Murrell added to the driver discussion: “For liability and risk, often it does end up with the drivers and the focus around drivers. [Underwriters] will consider the safety equipment, but in most cases, driver behavior makes the biggest difference. Accident history, driver violations, [fleet] programs in place to prevent problems. What are you doing to avoid issues? How are you dispatching? Do [drivers] have sufficient time to haul their loads?”

Driver training also is Topic A for Flaherty. When asked what trucking companies can do best and the most to keep premiums under control, he said “largely, it’s [about] the drivers.”

Flaherty reiterated the importance of training, adding that insurance underwriters take a deep dive into whether fleets have a defined set of policies and procedures when it comes to their people behind the wheel. Underwriters also ask whether these fleets enforce their own rules. “That carrier wants to be safe, they want to be reliable, and they want to be consistent,” Flaherty urged.

But where there are drivers, there are missteps, including violations and accidents. Do fleets need a perfect safety record. The answer is “no,” Murrell added. But they do need to show underwriters that they coach their drivers. “What are they doing to rehab a person?” he asked.

“Insurance companies really want to hear what you’re doing to improve things,” Murrell added. “If they hear you’ve got this program that identifies risks before things happen … that’s a much more compelling story. The absence of this kind of story will be filled with premium from the insurance company. Insurance companies like the [carrier] to have a vigorous driver training program.”

Minimum requirements and cost

Commercial trucking is covered by certain federally mandated minimum insurance requirements. There has been much debate whether, in the current environment, these minimums should be raised.

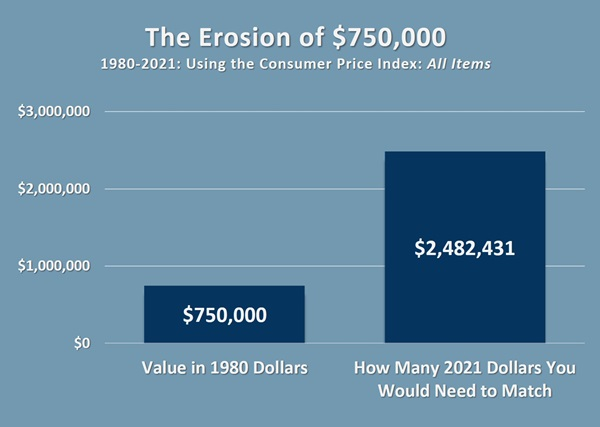

Fleets that transport non-hazardous cargo in vehicles weighing under 10,001 lb. are subject to a $300,000 federal minimum, which goes up to $750,000 for non-hazardous freight hauled in vehicles over 10,001 lb. Oil transported by for-hire or private carriers comes with a $1 million in minimum liability coverage as standard. If your fleet hauls hazardous material or explosives, the minimum is five times that amount: $5 million.

Many underwriters recommend coverages with higher dollar amounts that exceed the federal minimums because the costs from accidents—underwriters sometimes call them “occurrences”—that result in property damage or injuries/loss of life go much higher, especially in this age of nuclear verdicts. Nuclear verdicts are judgments against carriers in excess of $10 million.

See also: Added insurance protection will come with a bigger price tag

What does even minimal insurance cost? Average premium costs can vary quite a bit. According to East Insurance Group (EIG), the cost of liability insurance can range from $5,000 to $7,000 per truck per year for a fleet. But insurance in the Los Angeles area, for example, can cost upwards of $14,000 per year, according to EIG. Costs for new authorities can range between $12,000 and $18,000. For owner-operators with a permanent lease with a motor carrier, the average cost can be $3,000 to $5,000 per year. For owner-operators with their own authorities, the costs can be much higher—about $9,000 to $12,000 per truck per year, according to EIG.

Many insurers calculate rates by using somewhat complicated algorithms, which are based on a series of aforementioned variables from each fleet, according to Flaherty and Saeger. These algorithms generate annualized premiums. Some motor carriers pay premiums annually, all at once, while many are offered payment plans, either monthly or even weekly. Owner-operators often find weekly premiums most useful, Flaherty said, as they may not have dedicated shippers.

Emerging trends

Whether it’s a driver or fleet equipment, your safety record and what you and your people behind the wheel do on the road might matter the most to companies that cover the trucking industry. The “variables” matter, according to insurance stakeholders.

Data collected by the Federal Motor Carrier Safety Administration (FMCSA) matters greatly, said Nationwide’s Flaherty. A carrier’s safety and fitness ratings can be viewed at FMCSA’s SAFER website, searched by carrier name, or by U.S. Department of Transportation (DOT) number. Licensing and insurance status information also is available there. The data available on SAFER is updated monthly, and carriers themselves report to FMCSA annually.

“There’s some good kernels in that [FMCSA] data,” Flaherty said. “By the way, that’s always looked at by the plaintiff’s bar. It’s extraordinarily important.”

See also: Trucking insurance rate trends continue in the wrong direction

He said Nationwide’s underwriters have tools that rigorously monitor the FMCSA data. “And we look at that [data] in a place of support,” to coach fleet customers on what the federal information is doing to their premiums and insurability.

Another “variable” that matters to insurers: dedicated safety and compliance officers.

Often this is a crossover duty of the human resources department back at the base terminal, but Flaherty said underwriters are impressed if a fleet relies on an employee dedicated solely to that one task, which often involves training drivers in federal Drug & Alcohol Clearinghouse compliance, obeying hours-of-service requirements, and providing driver coaching.

One such person is Dana Achartz, safety and compliance director at Belleville, Illinois-based carrier Commercial Transport, which runs 155 tank trucks that haul food-grade material such as flour but also hazardous material. Much of her new job as well as her former position is to serve as a lookout for clean driver compliance, especially during new driver onboarding.

Both Commercial Transport and Newman Carriers, the fleet where she also directed safety and compliance, have “zero-tolerance” policies for any driver who tests positive for drugs or alcohol or even if a driver has returned to good standing after satisfying the federal return-to-duty regimen after testing positive. There is an insurance component to the zero-tolerance policy, Achartz said during a recent interview with FleetOwner, but that policy falls back on the fact of the type of cargo that Newman and Commercial Transport’s drivers haul: hazmat, which has the highest federal insurance minimum requirement.

“It’s just kind of a no-brainer to us, with what we do,” Achartz said.

See also: How insurance companies, attorneys are using fleet data

Nationwide’s Flaherty also weighed in on zero-tolerance policies from an underwriter’s perspective.

“We would view a zero-tolerance policy favorably. Zero-tolerance policies are important,” said Flaherty, who added that underwriters look positively when their fleet customers employ officers such as Achartz who are dedicated to safety and compliance. But, he said, “make it a dedicated position within [the] company. They also must have authority. You can’t have [their decisions] being overridden.”

Regarding such compliance and safety directors, Murrell of CarriersEdge noted: “Yes, insurance people will tell you it absolutely does make a difference … whether someone is in that role, or they outsource it. One of the things we noticed in the industry is that [a safety director] takes on tasks done in other departments. Safety people can handle performance reviews, for example. I would be surprised if you don’t find any company over 40 trucks that doesn’t have somebody in a full-time role.”

“Yes, it does matter if they have somebody, but to what end?” asked Dan Clements, senior director of sales and underwriting at the transportation division of Sentry. “What results are they seeing from the efforts of the safety director? Are you seeing fewer claims, fewer out-of-service violations? Are driver behaviors improving?”

Driver turnover and a fleet’s growth are two other trends that underwriters try to spot, Flaherty and Murrell both said.

The for-hire large truckload carrier driver turnover rate hovers at around 95%, according to trucking trade federation American Trucking Associations, so it stands to reason that even the safest and thus most insurable fleets lose and gain drivers with frequency. Private fleet turnover, in contrast, was 16% last year and was as low as 14% as recently as 2018, according to the National Private Truck Council (NPTC). Private-fleet turnover has not been over 19% in the last 17 years, according to NPTC’s most recent Benchmarking Report.

There also was a lot of growth and consolidation among FleetOwner 500 top for-hire companies in 2022, so stability of safety is important to underwriters, Flaherty added.

“There needs to be a level of stability,” he said. “We appreciate transparency with fleets. If you’re planning to grow, let’s talk about that. Nationwide has a risk-management team, and we can help you work through that. Underwriters love stability, but that’s not the reality. The economic situation and this driver situation causes a lot of folks that do what we do to get concerned.”

Murrell added: “Insurance companies will look at turnover. It’s easier to manage stability when people aren’t exiting all the time.”

In-cab video

A lot of technologies interest insurance companies, but their future potential in most respects must still yet play out. The technology that is showing the greatest current utility is in-cab, driver-facing video—or dashcams.

“I’ve been in the dashcam camp for a decade, speaking of technologies,” Nationwide’s Flaherty said. “We have exonerated more drivers with the use of video recording systems. These are going to become standard fare really soon.”

See also: In-cab video: After the worst happens

“The one intangible that nobody talks about is the culture of a company that is willing to make those investments, whether it’s [original equipment on a truck] or an aftermarket solution,” Flaherty added. “Safety must be Job No. 1; all these technologies certainly help. We want to get these everywhere.”

Underwriters “very much love to see dashcams,” Murrell added. “There used to be a lot of pushback from drivers, but there have been a lot of instances where they have proved drivers’ innocence.”

“On the pricing side, yes [dashcams] matter,” Sentry’s Saeger added, “but you have to be doing things with them. Having access to camera footage does make a difference.”

Nuclear verdicts

Awards from juries at trial that exceed $10 million—so-called nuclear verdicts—are driving up the cost of insurance in trucking. From 2010 to 2018, the average verdict size for a lawsuit above $1 million rose nearly 1,000%, from $2.3 million to $22.3 million, according to a 2020 study by the American Transportation Research Institute.

“The million-dollar verdict now is not what it was 15 years ago. Premium has not caught up with the frequency by which those are occurring,” Saeger said. “I don’t have the answer to what that fix might be.”

“Truckers specifically are under attack. It’s what we’re up against,” Clements added.

See also: Trucking continues battle against reptile theory, nuclear verdicts

“The general public views motor carriers very badly. They’re very much kind of a target,” Flaherty also said.

Companion issues with nuclear verdicts will be inflation and the economic pressure on the trucking industry—the pent-up supply chain specifically, Flaherty noted. None of these are going to ease the strain on the insurance market, Flaherty said.

“At the end of the day, the insurance business is a frequency and severity business,” he noted. “Inflation is not going to help any of our costs. Jury pools and verdicts coming out—those are all really feeding one another.”

But “what keeps us up at night: drivers, drivers, drivers, drivers. At the end of the day, trucks don’t drive themselves,” Flaherty emphasized. “Pressures are put on them, from their fleets, shippers, from themselves. We want less frequency and less severity [of crashes].”

Source https://www.fleetowner.com/