Fleet needs, service provider capabilities, and data are driving maintenance decisions. Here’s how some fleets are finding the right balance.

Fleet executives have a lot of big maintenance decisions to make, and perhaps the most impactful is who will do it. Keep it all in-house, outsource all of it, or some of both? Pair those decisions with the increasing complexity of today’s trucks, and new concerns have been raised that fleets need to address.

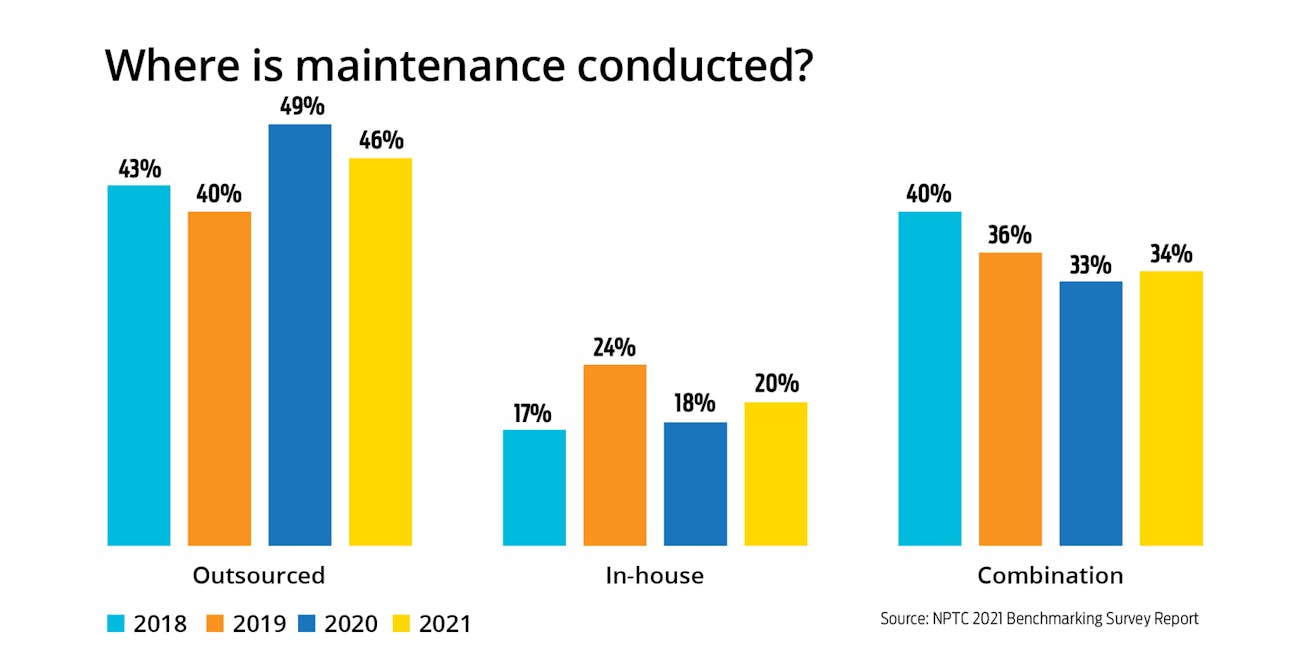

A hybrid approach to maintenance—operating an in-house facility that is supplemented by external vendors—can help strike an ideal balance for many fleets. For example, that approach was evident in the National Private Truck Council’s (NPTC) 2021 Benchmarking Survey Report on In-House vs. Outsourced Maintenance. In particular, the vast majority of all respondents to the NPTC survey indicated that they outsource at least a portion of their maintenance spend. In addition, while 20% of the fleets reported that they conduct all or nearly all maintenance themselves, 34% pursue a combination of maintenance strategies.

At Hub Group, for example, a large amount of maintenance needs are met by dealers and independent tire and service providers. Headquartered in Oak Brook, Illinois, the company provides regional, dedicated, and intermodal services with a fleet of 3,000 power units, 6,000 pieces of trailing equipment, and 45,000 intermodal containers.

While the company operates from 60 locations, it has only six shops in California, Texas, Tennessee, and Georgia, including some with mobile service trucks.

“We’re outsourcing maintenance where we don’t have the equipment density or where it doesn’t make sense to have our own shop,” Gerry Mead, EVP of maintenance and equipment at Hub Group, explained. “Another way to look at it is where operating a shop can be cost-effective because that decision affects total cost of ownership.”

Keeping maintenance work in-house is a cost-reduction strategy and a means of improving vehicle utilization, Mead noted. However, there are considerations that have to be balanced against shop capabilities and investment needs. For example, he related, does the maintenance organization have the expertise and tools? Does it make sense to tie up people and bays for certain types of repairs when the goal is to keep vehicles moving through the shop? There’s also the question of technician availability and the growing need for training and certification.

American Trucking Associations’ Technology & Maintenance Council offers guidelines on how to calculate the number of bays and technicians fleets would need based on equipment density. But the real test of success, according to Mead, comes from determining the quality of maintenance programs.

“Measurements of things like the number of repairs between PMs and repeat failures present a true scorecard you can use to make the right choices,” Mead added.

Finding balance amid complexities

More vehicle components and systems today interact with each other, increasing the likelihood that problems in one area will affect operation in another, explained Jake Schell, associate product manager for Mitchell 1’s Commercial Vehicle Group.

“Not knowing how various systems interact can lead to excessive diagnostic times as well as misdiagnosis,” Schell said. “Consequently, fleet managers may be more inclined to outsource tasks they believe are not cost-effective to take on or simply beyond the capabilities of the shop.”

Dave Walters, senior solutions engineer at Trimble Transportation, pointed out that as assets become smarter, additional investments in training and tooling are required.

“We see fleet shops struggling to stay current with new technology,” Walters said. “The general state of the technician shortage also impacts a fleet’s decision to outsource maintenance. The technician shortage has fleets rethinking standard internal repairs; in some cases, that work is outsourced so technician capacity can be redirected to the inspection process and associated repairs.”

For some fleets and in certain regions of the country, simply finding qualified technicians to staff an in-house facility can be a significant challenge, but the capability of technicians is another key consideration.

“Do they have the expertise and necessary training to work on the entire range of vehicles in your fleet?” asked Eric Woltz, garage management system liaison at Holman, parent of vehicle fleet management company ARI. “This is a particular challenge for many vocational fleet operators as vehicles become increasingly complex. For most organizations, investing in and keeping pace with the training necessary to service the latest models and technology simply isn’t feasible.”

For Woltz, infrastructure is another consideration. “From the facility itself and the necessary equipment to the tools, parts, and software needed to run an efficient in-house operation, you’re looking at a significant capital investment,” he said.

“Beyond that, running an in-house maintenance facility often requires a great deal of administration,” Woltz added. “When you outsource your maintenance to an external facility, you’re able to eliminate virtually all of those variables, allowing you to focus on your core business rather than worrying about turning wrenches.”

According to Mike Dickinson, VP of sales for Cox Automotive Mobility Fleet Services, the different approaches to outsourcing and in-house maintenance operations is a reason some of the company’s clients have both types of programs.

Cox Automotive Mobility Fleet Services, a recently introduced entity, not only unifies brands but also signals what the company sees as the evolution of scheduled and unscheduled maintenance solutions for fleets. The combined workforce of the fleet services group includes more than 1,100 technicians, nearly 800 mobile service trucks, and over 25 shops. Collectively, they offer on-site, emergency mobile, and shop services for light-, medium- and heavy-duty trucks and trailers.

“More fleets are transitioning to this service model once they educate themselves about the challenges that come with in-house maintenance,” Dickinson said. “For starters, the industry’s significant technician shortage is likely to continue for the foreseeable future. Outsourcing takes the burden of recruiting, training, and retaining technicians off their plate. And from a training standpoint, vehicles are more complex, and more diagnostic equipment is needed. With outsourcing, that’s on the provider.”

Using metrics to meet needs

When it comes to metrics, fleets should use those relevant to their operation to decide about outsourcing and to ensure providers are meeting their needs. Understanding technician training costs and time requirements, the investment required in shop tools and technologies, and vehicle uptime rates all help fleets make more effective decisions, Dickinson advised.

“They can also be used to challenge the provider to do better by providing for accountability,” he emphasized.

“In some ways, the decision to outsource maintenance is about opportunity costs,” Dickinson added. “Fleets need to focus on what they do best, whether it’s hauling freight, delivering packages, or providing services. The question is whether managing in-house shops distracts you from what you can do to drive profitability.”

Patrick McKittrick, CEO at heavy-duty repair shop software provider Fullbay, said that one of the bigger trends in maintenance outsourcing is fleets starting to demand more data from service providers. “While this industry is very relationship-oriented, fleets are increasingly using technology to run more profitably,” he stated. “That requires repair shops to modernize their businesses.”

Trimble’s Walters pointed out that an information system that maintains the service schedule of assets and uses fault code information, driver-vehicle inspection reports, and chronic repair alerts helps trucking companies better monitor the health of their equipment. “Fleets should also be monitoring asset downtime, which could be impacted positively or negatively due to outsourcing maintenance activities,” he explained.

When assessing the effectiveness of their maintenance programs, Walters advised that fleets follow metrics that include preventive maintenance compliance, chronic repairs, downtime, frequency as a measure of repairs performed on an asset between PMs, and over-the-road breakdowns. “An increase in frequency quickly identifies a problem program or may be linked to certain repair work being outsourced,” he noted.

For outsourced maintenance, it is important that fleets know and track out-of-service times and repair costs, Mitchell 1’s Schell explained. Truck repair software can be used to evaluate the expected time and cost of repairs against the actual time and cost of outsourced jobs.

“A full suite of programs that empowers the fleet to ensure its vehicles are being properly maintained provides a way to track maintenance and repairs on vehicles flowing through fleet and outsourced service provider shops,” Schell said. “As this data is collected, the fleet can access reports to make informed decisions. For example, knowing the time needed to perform repairs is a powerful way to enable the fleet to better balance workload and reduce downtime.”

“The metrics a fleet chooses to collect depends largely on what goals it hopes to attain,” Schell added. “Nevertheless, there are basic metrics that will provide insight to the overall effectiveness of the maintenance program whether it’s in-house or outsourced.”

According to Schell, those metrics include repair time per job, parts costs, when specific problems develop based on time or mileage, and technician performance in completing jobs in the estimated time as well as comebacks. There is also the amount of time a vehicle spends in the shop, not only the time to perform the service but also how long the vehicle was in the shop waiting.

Ultimately, obtaining and leveraging accurate and timely data from repair providers helps fleets make the right maintenance choice for equipment.

“If a fleet knows exactly what work is being performed and that required inspections and maintenance intervals are being met, they’ll be able to avoid issues,” McKittrick said. “True cost of ownership, cost per mile, uptime, and safety are the most important maintenance metrics to follow.”

“Repair shop software creates a closed loop between the shop and the fleet, sending data back and forth,” he continued. “It facilitates communication about real-time status so the fleet has full transparency. With analytics, that can be used for predictive insights. They’ll be able to maintain safer and more profitable fleets.”

Effective fleet approaches

Running out of Aberdeen, South Dakota, Hell Bent Xpress got its start in 2010. At the time, owner Jamie Hagen, a former company driver for a bulk tank hauler of food-grade liquid products, began leasing his services to the carrier and adding tractors to his fleet. Today, Hell Bent hauls tankers and dry vans across the U.S. and Canada with Mack Anthem tractors.

Over the past year, however, the fleet doubled in size to 10 trucks, so Hagen began doing the math. “At this growth rate, it’s time to consider if we should be performing maintenance in-house,” he said. “That’s a discussion that we need to have, but there are a lot of moving pieces, so the equation gets complicated.”

Focused on making sure that his company’s tractors are well maintained, Hagen handles lubrication, tire work, and some light repairs himself. For anything more complicated, he relies on local Mack Trucks and Utility Trailer dealers.

“We believe it will be less expensive and more convenient to perform maintenance in-house, and we have a mechanic in mind if we go in that direction,” Hagen said. “The question is whether we can justify the expense or if we need to reach 20 or 30 trucks to be able to afford it.”

Hagen also asks if his own time is better spent growing the business rather than managing maintenance and handling some of the work. “What else could I be doing? At what point am I more valuable doing other things?” he asked. “That’s not something you necessarily think about when you’re scaling up rapidly, but now is the right time to ask so we know the answer when it’s time to take the leap.”

Likewise, whether providing services to a job site in Connecticut, an A-list concert in California, or world-class road races, United Site Services (USS) relies on its fleet to deliver temporary fences, portable toilets, hand-washing stations, and roll-off trash dumpsters to its approximately 115,000 customers nationwide.

“Having trucks ready and available to go each day is a key component of delivering a consistent customer experience from coast-to-coast,” Kevin Podmore, VP of fleet and strategic sourcing at USS, explained.

But in 2014, USS’s fleet faced some challenges. The company worked with multiple vendors, each with its own maintenance standards, and this led to inconsistent protocols that reduced uptime. What’s more, Podmore and his team had little visibility into the information they needed to make strategic decisions.

USS needed a comprehensive and consistent PM solution that could be rolled out nationwide, so it expanded its partnership with Penske Truck Leasing. Penske, already a full-service leasing vendor for USS, offered to provide on-site maintenance, add its staff and technology to in-house shops, and hire qualified USS technicians. The lessor also worked with USS to reorganize its maintenance facilities, including some of its larger shops, and added service check-in kiosks.

USS had also struggled to get access to industry standard metrics that could help them plan an effective fleet replacement strategy. Penske provided that visibility through Fleet Insight, a proprietary app that delivers fleet data on maintenance and costs in real time.

According to Podmore, implementing a consistent PM program has helped USS reduce vehicle out-of-service rates and enhance its Compliance, Safety, Accountability scores. It also provides for greater technician engagement and improved driver and customer satisfaction.

“Deciding to outsource is a fleet utilization play,” Jim Lager, EVP of sales and rental for Penske Truck Leasing, said. “It’s about improving uptime and at the same time a fleet’s ability to hire and keep drivers. That is absolutely tied to vehicles. Drivers need trucks to be running to make money, so maintenance has an impact on their satisfaction and retention.”

Not that long ago, operating 50 or 60 power units was enough scale to justify in-house maintenance, Lager noted. Today, fleets of that size, and even larger operations, can see value in outsourcing.

Furthermore, current industry issues are driving interest toward outsourcing maintenance. “Delays in deliveries of new vehicles means running equipment longer, and parts may also be harder to procure,” Lager said. “Individual fleets may not have as much leverage with manufacturers and parts suppliers, but when they have a maintenance partner with full-time procurement expertise, they get more support.”

“That’s especially true as trucks get older,” he added. “If you’re extending a full-service lease, you have the security that the truck will be kept running at a predictable cost. In that case, having a partner is better than going it alone.”

By Seth Skydel

Source https://www.fleetowner.com/