Commercial fuel-cell electric vehicle deployments are picking up steam in the U.S. Here are the manufacturers at the head of the pack.

Like battery-electric vehicles (BEVs), hydrogen fuel-cell electric vehicles (FCEVs) offer fleets a zero-emission solution that will satisfy the demands of government regulations and a global movement to decarbonize transportation. The difference is the electricity is generated onboard in the fuel cells using a chemical reaction between hydrogen and oxygen. FCEVs therefore require additional componentry on the truck, along with a new fueling infrastructure to supply the hydrogen. For the effort, these hydrogen-powered vehicles have far superior range to BEVs and fill up in about the same time as a gas or diesel truck.

Buses and passenger vehicles around the world have used the technology for decades, while Asia and Europe have executed several commercial trucking deployments in the past five or so years. Now hydrogen is hitting the U.S. trucking market, with a fair number of meaningful deployments.

Before detailing those, let’s explain what exactly a hydrogen fuel cell is and how it powers a Class 8 truck.

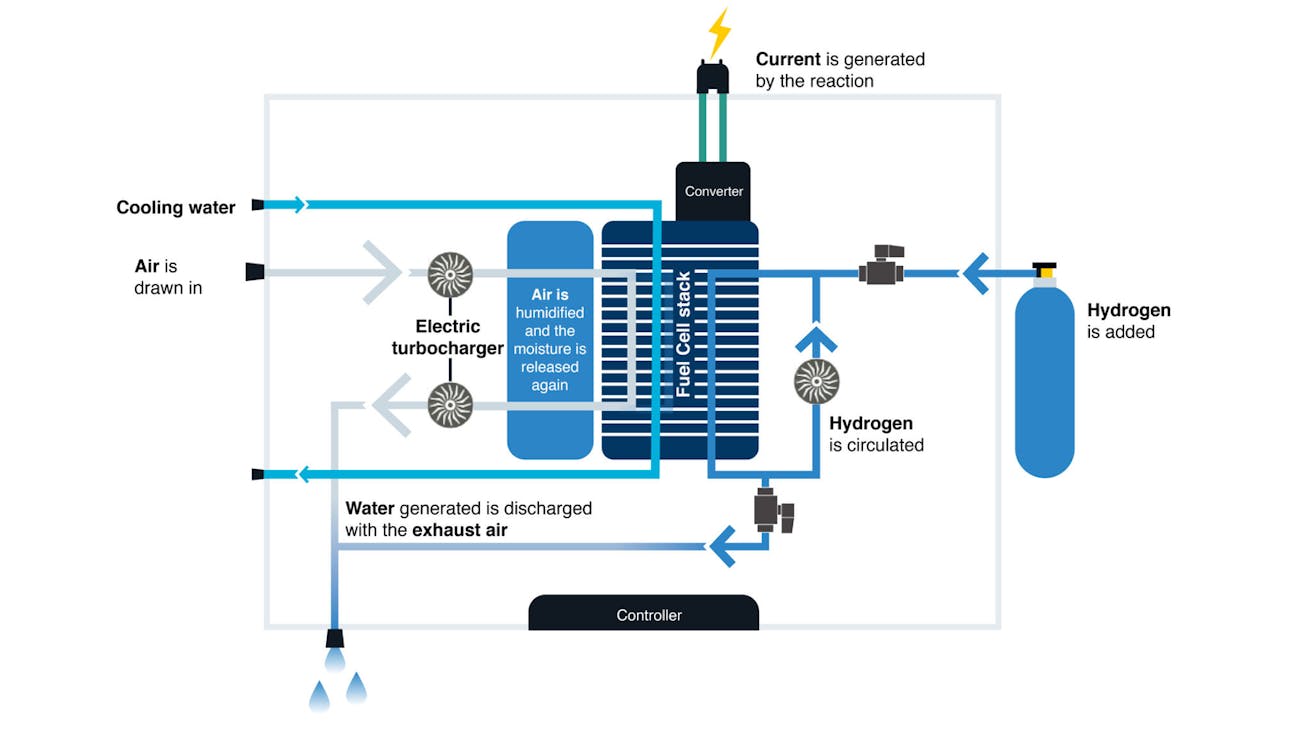

According to Wido Westbroek, senior director of fuel cell strategic projects for Cummins, a PEM (proton exchange membrane) fuel cell has many layers within it. There are materials that bring hydrogen from one side and air from the other, and when the oxygen and hydrogen come into contact at the membrane level, a reaction occurs. “The byproduct of that is electricity,” he explained. “We put these layers together into what’s called a stack, and we collect the electricity that is coming off a stack.” That electricity is then delivered throughout the truck where needed—whether to charge a battery or to drive electric motors that drive the wheels of the truck.

This past March, Sen. Chris Coons (D-Delaware) introduced a bill called the Hydrogen for Trucks Act of 2022 to establish a grant program to support the adoption of heavy-duty hydrogen trucks and fueling stations. The government would allocate $200 million from 2023 to 2027, with grants not to exceed $20 million. Along with $200 million in incentives, if passed, the act also would provide data and benchmarks for different types of fleet operations.

This is an important step because for fuel-cell trucks to become economically feasible, the technology will need a lot of initial help.

“The costs of hydrogen, vehicles, and hydrogen production all must come down significantly to make hydrogen economically competitive with alternatives,” noted Mike Roeth, executive director of the North American Council for Freight Efficiency (NACFE), which released a detailed confidence report on the viability of FCEVs. After speaking with industry experts and researchers, Roeth surmised that “these costs will be reduced through scale and innovation over time.”

The burden now is on vehicle and powertrain manufacturers to pilot and commercialize FCEVs to show fleets where and how these trucks will work. Here are some of the largest and most intriguing developments in the industry.

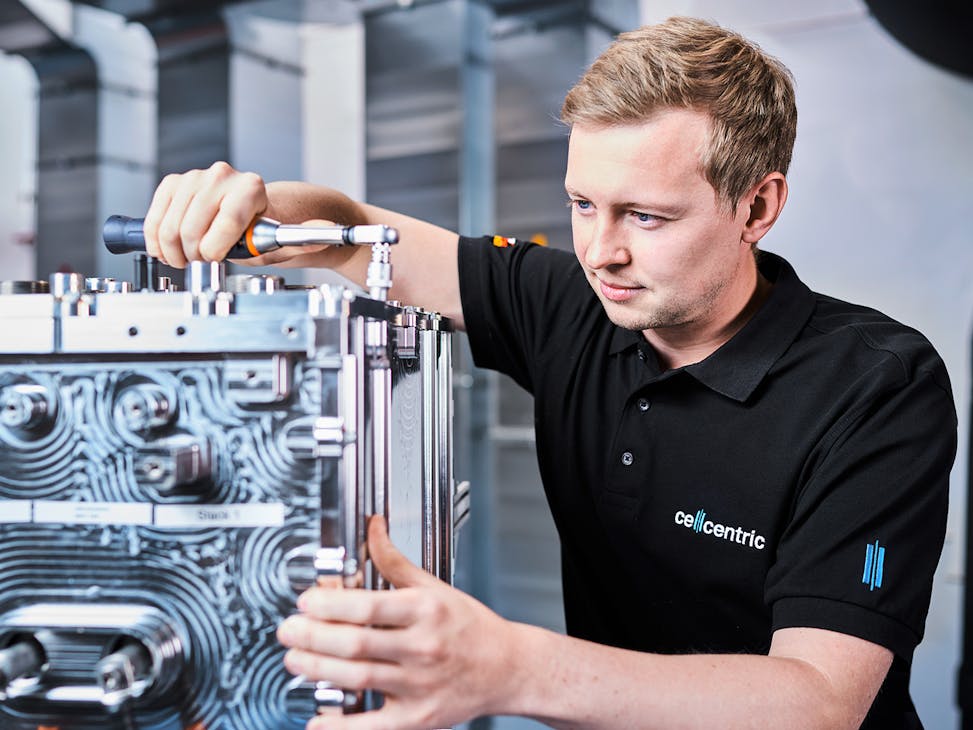

cellcentric

An evenly split joint venture between Daimler Truck and Volvo Group created in 2021, cellcentric’s goal is to develop, produce, and commercialize hydrogen fuel cell systems for long-haul trucking and other applications. The competing OEMs found, for this specific case, they are stronger together and have a better chance of success by sharing the heavy R&D costs. That puts cellcentric in an enviable position where it “doesn’t have to worry about the next financials,” Daimler Truck CEO Martin Daum said.

Along with “extremely strong and committed parents” and “an absolutely strong financial base,” other advantages Daum said the joint venture has include hundreds of patents, ready-to-go fuel cells, manufacturing know-how, and an eager customer base.

Currently, cellcentric is conceptualizing plans for customer tests in 2024 and large-scale series production in 2025. All vehicle-related activities, however, will remain independent.

Cummins

Cummins has been heavily involved in adopting electrical technologies and electric battery systems, though in recent years the legacy engine manufacturer also has integrated hydrogen to reach its goal of carbon neutrality by 2050. The company said 11,000 of its engineers globally are working on meeting that target.

“With hydrogen, you can power very, very large things and go much longer distances in a more practical way than you can with just battery power,” Westbroek said. “We now see that hydrogen is really the final step in the journey [to zero emissions], so we need to adopt that ourselves.”

To that end, Cummins acquired Hydrogenics in 2019, an established global leader in large fuel cells for heavy-duty mobility. European deployments include buses, delivery vans, and refuse trucks. The Columbus, Indiana-based powertrain maker has also invested in Loop Energy, which develops fuel cell technology.

So far, Cummins has completed more than 20 fuel-cell truck initiatives, hitting the light-, medium-, and heavy-duty segments. Its Class 8 demonstration hydrogen truck, revealed in 2019, used a 90-kW fuel cell, scalable up to 180 kW, and 100-kWh lithium-ion battery.

Features of Cummins’ fully integrated fuel-cell truck system include low temperature starts (down to minus-40 degrees Celcius), water-free operation, software to manage performance and optimize lifespan, and unlimited starts and stops without degradation.

Last fall, Cummins opened the Hydrogen Fuel Cell Powertrain Integration Center in West Sacramento, California.

“With the most advanced hydrogen infrastructure system in the country, California provides a great ecosystem for advancing alternative power technologies,” said Amy Davis, president of Cummins’ New Power business.

The site will focus on PEMs, though the company is also investing in solid oxide fuel cells.

Westbroek noted that Cummins had 11 vehicles go through fuel-cell integration at its California site, some of which have been leased out onto the road, with more vehicles to be converted over the course of this year and into next.

“These are Class 8 trucks,” he said. “Some of them are drayage operations, some of them will be short line-haul trucks—all of them hydrogen.”

Kenworth Trucks

As part of the Port of Los Angeles-led $82.5 million Shore-to-Store project, Southern Counties Express (SCE) piloted a Kenworth T680 FCEV in drayage operations. Kenworth delivered 10 of these FCEVs total, which use Toyota’s fuel cell electric system. The demonstration project was aided by a $41.1 million grant from the California Air Resources Board’s Zero- and Near-Zero Emissions Freight Facilities (ZANZEFF) program.

The pilot route went from a rail yard to a warehouse, then from the warehouse to terminals at the Ports of L.A. and Long Beach.

“We put in about 3,600 miles on the truck during the demonstration project,” said Ivan Hernandez, SCE’s dispatch supervisor.

Drivers reported that the FCEV was quieter than a diesel truck and had “great torque, [a] comfortable Kenworth cab, good visibility, and other driver-friendly features.”

“This demonstration project offered a great opportunity to test the Kenworth T680 fuel-cell electric vehicle in our daily operations and provide feedback to further enhance its development,” said Jay Mason, VP of equipment and maintenance for Universal Logistics Holdings, SCE’s parent company.

The day cab also made an appearance at the White House, where U.S. Energy Secretary Jennifer Granholm revealed plans to provide $60 million in funding for 24 research and development projects.

Paccar, Kenworth’s parent company, received about $33 million from the SuperTruck 3 program to develop and demonstrate 18 Class 8 FCEVs and BEVs, along with advanced batteries and a megawatt charging station.

Hino Trucks

Hino debuted its prototype FCEV, a modified XL8, last August at ACT Expo. Since 2020, Toyota Group-owned Hino and fellow subsidiary Toyota Motor North America had been jointly developing the truck, along with other zero-emission Classes 4-8 commercial vehicles, as part of the company’s Project Z. Toyota has one of the more successful consumer FCEVs, the Mirai, which began production in 2014.

Earlier this year, Hino was awarded a grant from the Japanese government to demonstrate the FCEV in real-world California port applications.

The joint study, running through 2026, will include monitoring and analysis of the operational and maintenance interval data to optimize vehicle efficiency and safety.

Hyundai Motor

In 2020, Hyundai Motor deployed 10 of its XCIENT Fuel Cell trucks in Switzerland, and through its NorCAL ZERO project, plans to put 30 FCEVs on California roads by early 2023. The trucks will use a 6×4 drive configuration, and logistics service provider Glovis America will operate the trucks, which are expected to have a range of 500 miles per fill-up. The Swiss pilot has already accrued more than 1 million kilometers (622,000 miles) of real-world road use.

Hyundai Motor also received a $500,000 grant from the South Coast Air Quality Management District (AQMD) to demo two Class 8 XCIENT Fuel Cell trucks in Southern California as part of a U.S. Environmental Protection Agency (EPA)-funded project to reduce emissions from diesel trucks in the South Coast Air Basin. The trucks will be tested in long-haul freight operations between warehouses over a 12-month period.

Hyzon Motors

Based in Rochester, New York, Hyzon spun off of Horizon Fuel Cell Technologies in 2020 and began trading publicly in mid-2021. Like Cummins, the company puts its fuel-cell technology on existing vehicles, which range from city buses to medium- and heavy-duty trucks around the world, while fuel cell-optimized chassis are in development.

“Hyzon is a relatively new company, having only been set up in early 2020, but the business was set up on the back of almost two decades of technology development through the parent company, Horizon, a technology developer in the core fuel cell technology that’s needed to drive heavy trucks on hydrogen,” explained Craig Knight, CEO of Hyzon Motors.

Leveraging its decades of experience with fuel-cell technology, Hyzon has developed an onboard hydrogen storage system that the company reported reduces weight by 43%, costs by 52%, and component count by 75%. The current range for heavy-duty trucks is 500 miles, though that will increase in future fuel-cell iterations.

Hyzon has several deployments in Europe. German fleet rental company Hylane GmbH recently purchased 18 Hyzon vehicles, with deliveries expected to begin in late 2022. Customers are expected to only pay for the miles driven, while Hylane would cover maintenance and downtime costs.

Hyzon has also been piloting a 2022 Freightliner Cascadia fuel-cell platform in California since last year. According to Knight, “Our California pilot with TTSI is operating out of the Port of Long Beach and conducting four runs per day. As part of this trial, the Hyzon truck and loaded trailer are regularly crossing the Vincent Thomas Bridge in and out of Terminal Island, a steep incline that electric trucks have struggled with. The California pilot is crucial to providing Hyzon with data and learnings as we work to deploy more vehicles in the United States.”

Up to 15 more demo trucks should be on U.S. roads by the end of the year.

“As the most common resource in the world, hydrogen is the smart solution to get to zero-emissions transport and energy independence,” Knight said. “Not just from a TCO and performance perspective, but because of its ability to scale cost-effectively.”

Nikola

Since going public in June 2020, Nikola Corp. has hit some rough patches, with its founder and former executive chairman Trevor Milton leaving due to fraud allegations and subsequent severing of high-profile projects with General Motors and Republic Services.

The company has managed to weather the storm, with the Nikola Tre BEV now in production at the company’s Coolidge, Arizona, plant. The next step is for Nikola to get its FCEVs to that stage.

During the third quarter and Q4 of 2021, Nikola completed seven alpha builds of its Class 8 Tre FCEV. These vehicles have been going through validation testing. Two are with Anheuser-Bush in Southern California as part of a three-month pilot program. This included beer deliveries around Los Angeles during Super Bowl weekend in February.

“The trucks that we are running every day with Anheuser-Busch are on regular public roads, regular workloads,” Mark Russell, CEO of Nikola, said during the company’s Q4 2021 earnings call. “Those made the run from Phoenix to Los Angeles with fuel to spare. That truck is designed to go up to 500 miles … And that’s absolutely critical because range is everything in commercial transportation.”

After completing the pilot program with Anheuser-Bush, Nikola will continue pilot testing the Tre FCEV with TTSI in the Port of Long Beach and from there with other customers, Russell stated.

“Validation of the alpha fleet will continue through the rest of the year,” he said. “In Q2, we’ll be building beta versions of the Tre FCEV, which will incorporate ongoing improvements learned from continuing testing with the alpha fleet. Beta vehicles will start their validation in both the U.S. and in Europe in the second half of 2022 and continue in the first half of 2023. And then, Tre FCEV series production is scheduled to start in the second half of 2023.”

Nikola has also teamed with TA-Petro to build hydrogen fueling stations and invested $50 million in West Terre Haute, Indiana, to produce clean hydrogen with Wabash Valley Resources.

“The Wabash solution can generate electricity as well as hydrogen transportation fuel, which should provide the flexibility to support future truck sales and hydrogen station rollout in the region,” said Pablo Koziner, president of energy and commercial at Nikola.

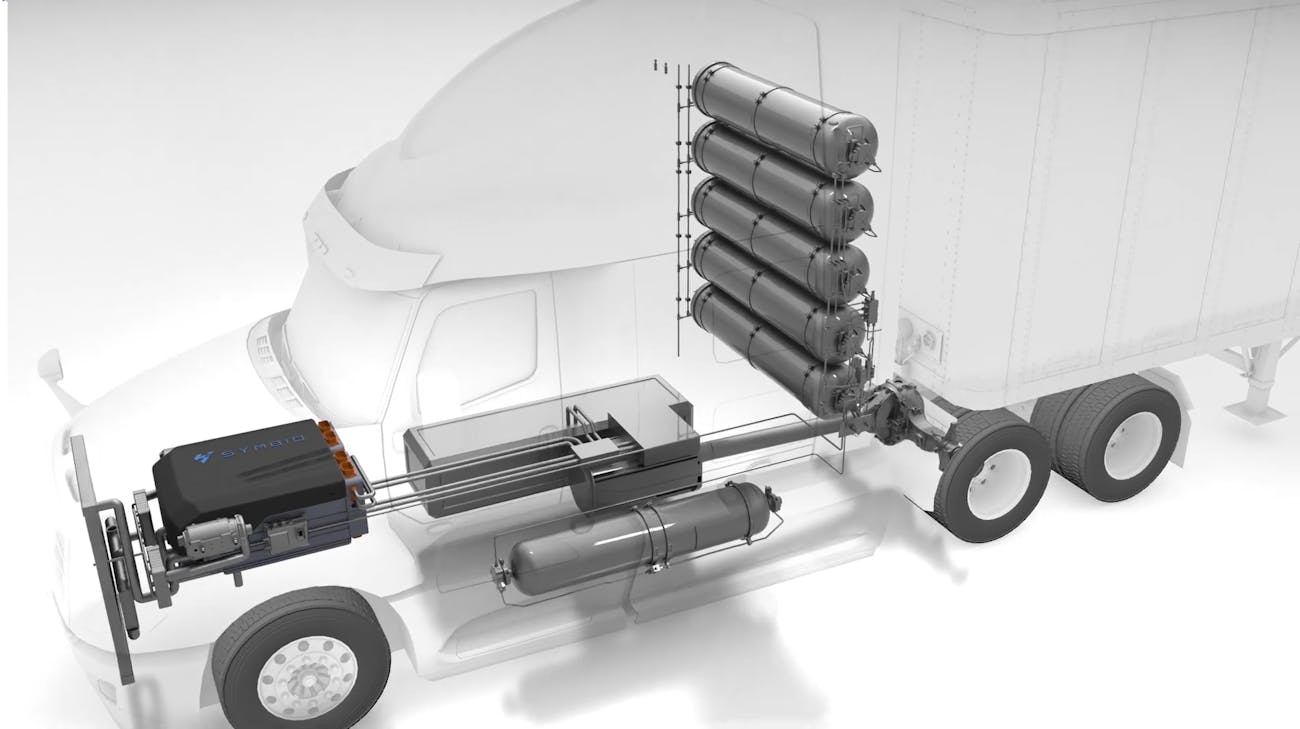

Symbio

Symbio, a joint venture between Faurecia and Michelin, has also entered the commercial vehicle fuel-cell field. Last month, the California Energy Commission (CEC) selected Symbio, along with a few industry partners, to develop and demonstrate a hydrogen-fueled, regional-haul Class 8 truck. The CEC will provide a $2 million grant to vet if an FCEV can match a 15L diesel truck’s performance.

This Symbio H2 Central Valley Express project will commence in the latter half of 2023. For one full year, the modified Freightliner Cascadia truck will traverse a 400-mile route between the Inland Empire and Northern San Joaquin Valley. Air Liquide, Shell, and Trillium all have existing hydrogen infrastructure in the region to support fueling.

“Michelin has been in hydrogen for about 20 years,” said Anthony Reyes, VP of hydrogen services for Michelin. “The initiative started with an R&D project in Switzerland. Michelin, for some time now, has been looking to grow with, around, and beyond tires. Since then, we’ve created four different generations of fuel cells up to today. Those fuel cells have been tested in automobiles, in ferries, in buses, in stored systems for Airbus—a number of different scenarios.”

Today, Reyes said, that fourth-generation fuel cell is “really ready for primetime commercial vehicle scenarios.”

Reyes said Symbio is already shipping with partners in Europe, including Stellantis, Peugeot, Citroen, and Opel utility vans.

“For fuel cells, in general, people have been using this since the ’60s. This technology is proven, people always believed in it, the time was just not right,” noted Rick Breunesse, Symbio director of business development. “Ten years ago, the market was not ready to go full-scale. Now, we have all these ingredients together with the infrastructure, and there is drive for it. People want to reduce CO2. There is legislation in place. And now you see, the time is ripe, with the right players.”

Source https://www.fleetowner.com/