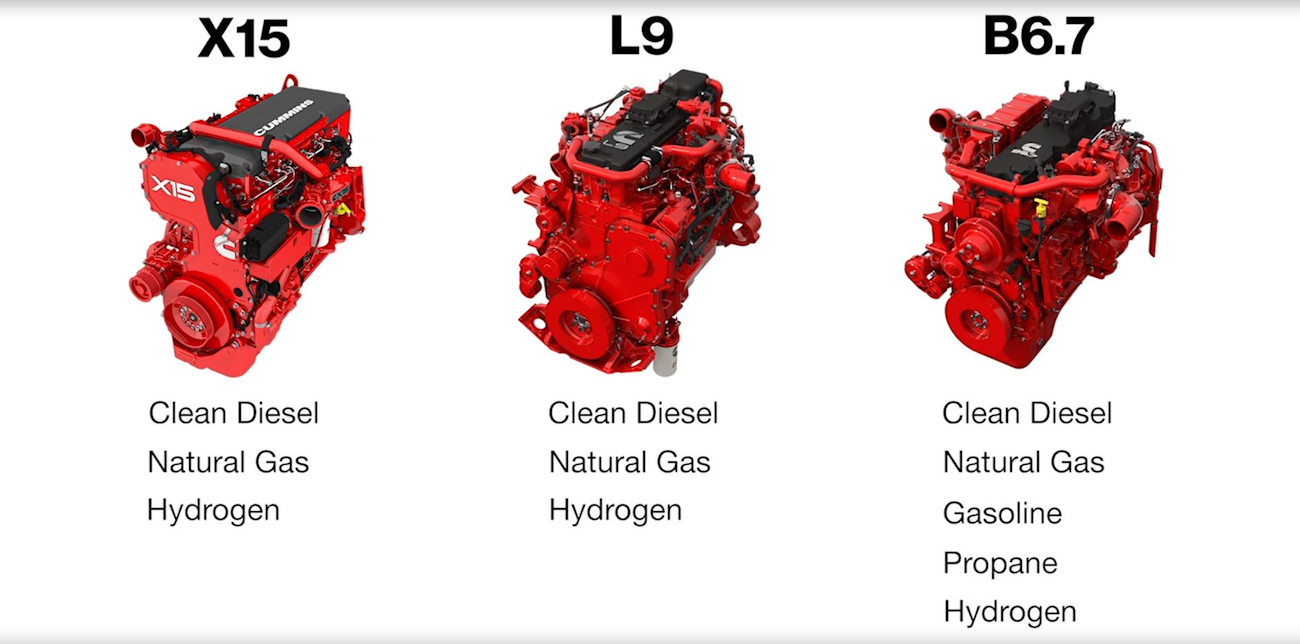

Beginning in 2024, Cummins will apply fuel-agnostic technologies across its X, L, and B-Series engine platforms. Diesel, natural gas, and hydrogen internal combustion engine offerings aim to help the transition to zero-emission powertrains.

The path to a zero-emission destination in trucking is transitory and based on options that fit specific fleet duty cycles. With that in mind, Cummins is expanding its powertrain platforms and giving truck OEMs and fleet end-users access to a range of lower-carbon fuel types.

As the industry’s first “unified, fuel-agnostic” engines, Cummins’ platforms will use engine blocks and core components that share common architectures. Cummins’ new design approach will be applied across the company’s B, L, and X-Series engine portfolios, which will be available for clean diesel, natural gas, and hydrogen.

“We’re designing these products from the outset to accommodate all the fuel needs that we’ll need in the future,” Jonathon White, Cummins’ VP of engine business engineering, said during a Feb. 14 press conference. “That’s a unique situation for us. In the past, we’ve adapted diesel products for natural gas. In this case, we are designing from the outset from all of these platforms to be capable of diesel, natural gas, gasoline in some cases, and in the future, hydrogen fuels.”

See also: Cummins to acquire Jacobs Vehicle Systems for $325M

These new fuel-agnostic platforms will feature a series of engine versions that are derived from a common base engine, which means they have a high degree of parts commonality. Below the head gasket of each engine, there will be largely similar components. Above the head gasket will be different components for different fuel types. Each engine version will operate using a different, single fuel.

Brett Merritt, Cummins’ VP of on-highway business, pointed out that these technologies would not be retrofittable and current products would remain in the market.

“While I think there are some areas as far as digital offerings that will be available from a retro perspective from our current offerings, we would anticipate this truly being a new family of engines,” Merritt advised. “The key there is we are designing this upfront, so rather than retrofitting engines that hit these other fuel areas from a combustion perspective, we are designing that from the outset. We think there are huge advantages from a performance perspective that would not be applicable to our other engines.”

The products will start to roll out—though they won’t all be available at the same point in time—in 2024, noted Amy Boerger, Cummins’ VP, North America on-highway.

“We are working closely with all the OEMs to make sure that we have wide availability of all of them,” she said. “Timing also depends on which platform.”

When looking at the B-Series platform, for example, Cummins first plans to launch a gasoline powertrain and follow with other fuel types in a staged launch, Boerger said. For 2024, the initial product Cummins is launching is the gasoline version of its B6.7 engine, which has some commonality with the European product Cummins has been working on for many years, White added. Propane will also be a fuel option in the B6.7 offering.

“This is a platform portfolio in terms of commonality and the optionality we are planning to provide customers,” White said. “Each powertrain will have to be certified based on the fuel that will be used and the vehicle it will be installed in. A single engine can’t be converted; it would have to be specified at the point of sale and installation to run on that fuel.”

According to Cummins, 80% parts commonality across the platforms will offer similar engine footprints, diagnoses, and service intervals. These commonalities aim to make it easier for OEMs to integrate a variety of fuel types across the same truck chassis, thus minimizing costs to train technicians and re-tool service locations.

‘Destination zero’

These new products are an important element of Cummins’ strategy to further reduce the greenhouse gas (GHG) and air-quality impact of its products and reach net-zero emissions by 2050. This commitment requires changes to Cummins’ products and the energy sources that power them.

Two of the company’s environmental sustainability goals for 2030 include reducing lifetime GHG emissions from newly sold products by 25% and partnering with customers to reduce GHG emissions from products in the field by 55 million metric tons.

See also: What fuel source will dominate trucking in 2030?

“Cummins has said that 2050 is when we will be net neutral on carbon,” said Srikanth Padmanabhan, president, engine business. “Between now and then, I see there are three different stages: the first decade—between now and 2030, and then from 2030 to 2040, and 2040 to 2050.

“By the time we get to 2050, that’s when the grid has to get better in terms of being green, as well as the fact that we need different technologies for battery-electric and fuel cells as well,” he added. “We think for the next 40 years or so, internal combustion engines will still be there as a transitory technology before we get to that destination zero.”

When asked about the pros and cons of comparing hydrogen ICE offerings to hydrogen fuel cell powertrains, Padmanabhan said it’s just a matter of time.

“Hydrogen ICE, for at least the next 15 years or so, would be a good transition technology,” he emphasized. “The same natural gas tanks that we use will also be the same tanks that we use for the hydrogen internal combustion engine. This makes it much easier for the fleets to substitute and do what they need to do.”

Selecting the fuel types

As part of its path to destination zero, Cummins chose the transitory fuel types that it felt made the most sense for trucking business operations.

“The way we picked hydrogen is the easiest to talk about,” Padmanabhan said. “When you think about hydrogen, eventually it will go to fuel cells, which means you need to create the infrastructure that is required for hydrogen. We think about load and duty cycles and how long-haul heavy-duty is going to be very difficult for us to change to battery electric, which means it’s going to be fuel cell electric. So, we asked the question, ‘What is the transitory technology that we need today that will help us get to fuel cell?’ That is how we chose.”

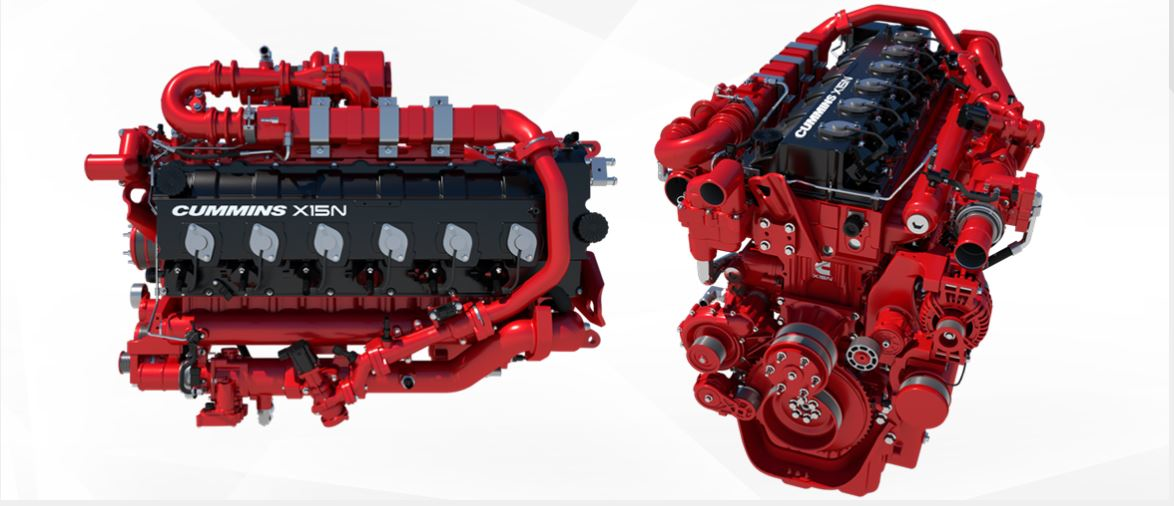

For natural gas, Cummins recently launched its 15-liter natural gas engine for linehaul applications in the North American market. Cummins also offers its 2021 X12 engine designed for the medium-duty market.

“We have been working on the gasoline side for over 20 years,” Padmanabhan said. “And it has always been the chicken or egg [scenario]. As the CARB regulatory requirements came in, it actually felt like there is no other product to deliver the requirements that we have for California.”

Overall, Padmanabhan noted, these diesel, natural gas, and hydrogen internal combustion offerings will be the suite of technologies that will eventually get to battery- and fuel cell electric powertrains.

“Where the technology is ready and where the total cost of ownership is good, we should go and do it sooner in terms of battery electric,” Padmanabhan said.

Infrastructure is another major piece of the puzzle, and as governments assist with infrastructure related to charging, that will force the industry into battery- and fuel cell electric, Padmanabhan noted.

“It’s a 30-year journey, I think,” he added. “ICE power and new power will help position our customers in whatever way they want.”

Source https://www.fleetowner.com/