After weathering the uncertainty around the pandemic, the corporations running private trucking fleets have set themselves up with more safety technology, loyal drivers, and more control of their services, according to the annual NPTC benchmarking survey.

Customer service, safety, efficiency, and stability are helping private fleets retain drivers and keep corporate costs down during the unstable conditions and limited capacity created over the past year. The National Private Truck Council published its annual benchmarking survey of its members, which helps private fleets across the country enhance their operational performances.

The annual NPTC benchmarking survey of its members establishes a “dashboard of national standards to measure, monitor, and improve performance,” Tom Moore, EVP of education for NPTC, said during a press briefing on the 2021 study, which included insights from 112 companies that run private fleets.

“For an operation like us, the participants in this particular benchmark study are probably the most like in operations to us, which make for the most meaningful comparisons and insights that are the most relevant to our business,” Mari Roberts, Frito-Lay’s VP of transportation, said during the Nov. 16 briefing. Frito-Lay, a division of PepsiCo, is the third largest private fleet in the U.S. (according to the 2021 FleetOwner 500).

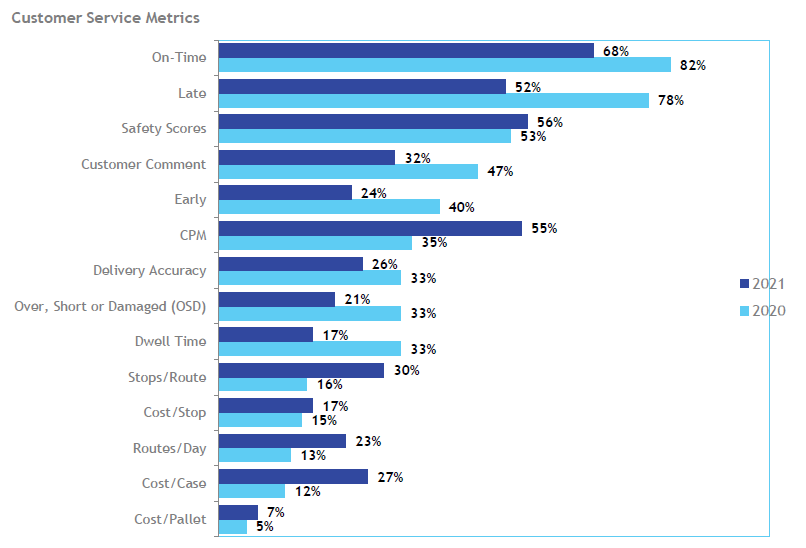

“Service is one of the main reasons companies operate a private fleet—we still pride ourselves on service,” Roberts said. “What was astonishing for me was that 80% of private fleets are measuring service within a 10-, 15-, 30-, or 60-minute delivery window. That’s pretty impressive.”

Measuring on-time performance is the primary way private fleets track customer service, according to the NPTC study. But other metrics—such as late and early deliveries, safety scores, customer comments, cost per mile—are growing in acceptance. Surveyed private fleets report that on-time delivery performance is a matter of individual customer expectations. What is essential is the ability to measure, monitor, and manage on-time performance through the nearly universal implementation of onboard technology.

Roberts said that seeing those numbers was a good way for Frito-Lay to reevaluate measuring service internally and set its future “service agenda.” Customer expectations have changed in recent years, Roberts explained. “We’ve got a shorter lead time. We have smaller delivery windows. And we have expectations around track-and-trace capability. Those have all been new developments over the last few years that have started to become more expectations from external customers.”

Private fleet benefits

St. Joseph, Missouri-based Hillyard, a cleaning products company, has used the annual benchmarking survey to help it track its costs and grow its driver pool, according to Chuck Amen, Hillyard’s transportation operations manager.

Hillyard runs a private fleet that delivers to its 24 corporate-owned locations and other independent distributors throughout the lower 48 states. The fleet has participated in the NPTC benchmarking survey for more than a decade. Amen said it’s a lot of detailed work to participate in the survey, “yet it’s kind of fun to do—it’s especially fun to see how you compare.”

A few years ago, Hillyard adapted the NPTC study into its operations so the private fleet could track its work on a monthly and rolling-12-month basis tied to its financials. “By doing this, we were able to see not only where we were but where we are and in which direction we’re headed,” Amen said.

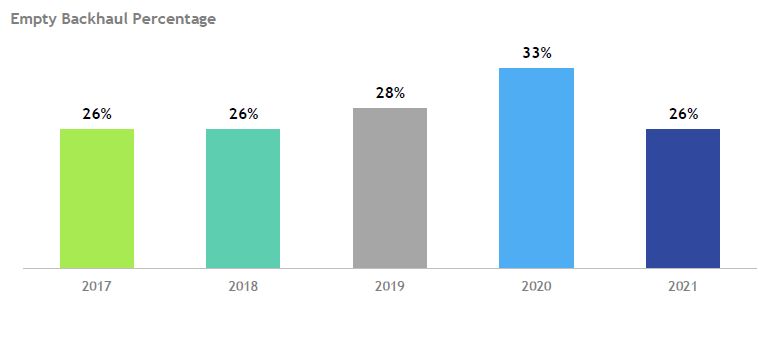

This internal benchmarking has shown the value of having a private fleet, Amen said. Knowing the private fleet’s delivery cost, how backhauls helped reduce empty miles and contribute revenue, and, most importantly, Amen said, it showed “the savings the private fleet has over outsourcing.”

“We do have a for-hire authority, so we keep our trucks loaded coming home,” Amen added. “But we’re running around 15% empty miles—so most of the time, we’re loaded.”

This year, private fleet managers continue to improve productivity by incorporating backhaul strategies to reduce the number of nonproductive empty miles. Reversing a two-year increase in the number of empty miles, in 2020, the empty mileage of 26% was down from 2019’s 33.3% and 2018’s 28.4%.

More than a third of all the challenges private fleets reported in the 2021 study were driver-related. The NPTC benchmark points to an aging driver population, driver recruiting, driver turnover, driver hiring, driver retention, and the general driver shortage as obstacles to productivity.

Hillyard, however, has “been fortunate the last few years that we’ve been at capacity on drivers,” Amen said. “But earlier this year, we had some quality applicants come to us, and we wanted to figure out how we could bring those individuals on board. So, once again, we went to the benchmark. We plugged in our fixed costs, our variable costs, the costs of renting additional equipment, and hiring personnel. We were able to find that it was very beneficial for us to go ahead and grow. So that’s what we were able to do at the time.”

Amen said the NPTC benchmarking survey had shown his company the value of running a private fleet and growing that fleet. As capacity has tightened in the trucking industry the past two years, “for Hillyard, it’s been a very good two years. So being able to show the benefit of maintaining and growing the private fleet was really great.”

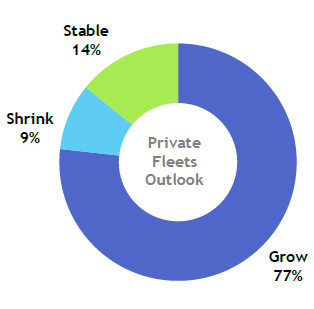

Hillyard isn’t alone in its growth. More than 75% of private fleets surveyed in 2021 expect their fleets to grow by adding more equipment and/or freight over the next five years.

“Chuck talked about growth—and it’s all relative,” Frito-Lay’s Roberts said. “That’s what I love about NPTC—whether you have one truck, 10 trucks, 100 trucks, or 1,000 trucks—a lot of the insights in the best practice sharing are valuable. We are looking to grow our private fleet, and you’ll hear a lot of companies say they’re going to hire X amount of drivers, which is different than growing. A lot of us have to hire to maintain that turnover that we just looked at. But we’re looking to grow our fleet by 25% over the next few years. I have a target of plus-500 to our base by 2025.”

Technology adoption

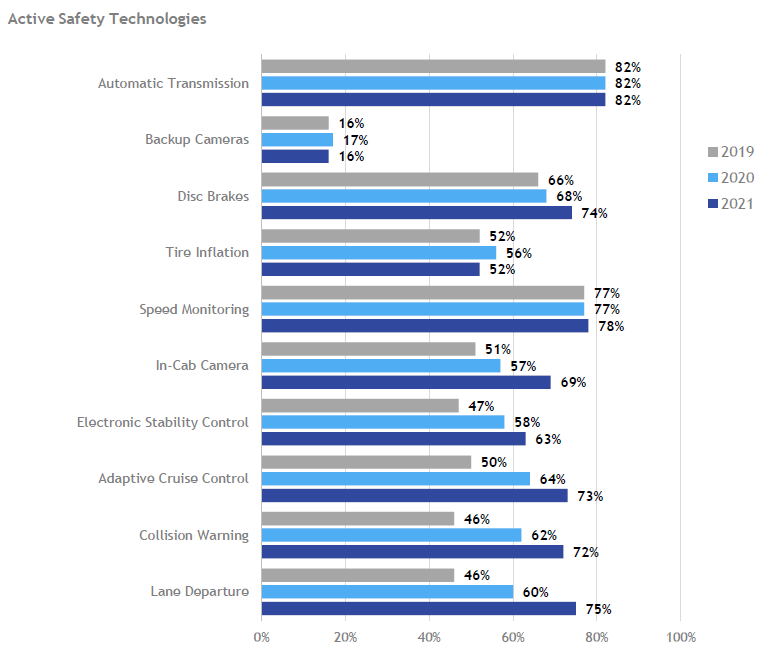

Another growth within the industry is in technology. For example, back in 2014, only 9% of private fleets used cab cameras. By the 2021 study, it was up to 69% of private fleets using cab cameras. “By a factor of two-to-one, fleets report installing both forward-facing and driver-facing options,” the study finds.

Active safety technologies are essential to the Frito-Lay fleet, Roberts said. “We always want to continue to invest in all the leading safety technologies to make our drivers safer,” she said. “The safety culture is probably the thing that I’m the proudest of about our organization. Being able to keep up with the trends and seeing what everybody else is working on is helpful in addition to the environmental strategies.”

Safety technology has been standard on Penske’s rental fleet for years, according to Jim Lager, SVP of sales for Penske Truck Leasing, which sponsored the NPTC report. “Our logistics fleets had it for over a decade—whatever the latest technology is—and we’re starting to move that way on medium-duty and some other things,” he said. “I think everybody realizes the benefit in doing this. There’s a direct tie back to the drivers. Drivers want to get home safely. They want to be in a truck that has the latest equipment, keeps them out of trouble, keeps them safe, keeps them uninjured. I think there are just a lot of benefits and I think that’s reaching the marketplace.”

Fleets are seeing the merits in safety technology that help prevent accidents and, in the case of video recording technology, can help exonerate drivers and fleets involved in crashes, Lager said. “I think it behooves us all to run the safest equipment that we can so we can avoid those kinds of things and keep the image of the industry up,” he said during the briefing. “It’s not overly expensive to put this equipment on trucks—and the payback is certainly multifold.”

Frito-Lay’s Roberts said she’s seen the industry rally around safety technologies to achieve “a common goal. Everybody has the goal to make our roads safer and the motoring public safer, our drivers safer. There is demand for this, and the OEMs are making it easier and more available as a standard issue. I think it’s just been a really great combination as you start to see all this head together because we’re all going in the same direction.”

Hillyard’s Amen said his fleet has been seeking newer technologies for years, noting that his fleet started using electronic logging devices in 2004—15 years before the federal ELD mandate. And Hillyard has tried to be an early adopter of safety technologies too. “Private fleets, in general, look at how to be safe, how to deliver product in a timely fashion at a best-cost scenario—and get home safely.”

Sustainability movement

Environmental sustainability continues to be a priority for the vast majority of private fleet respondents. The survey found 89% of fleets invest in green initiatives, up from the 85% reported in 2020.

PepsiCo and Frito-Lay have “a pretty aggressive sustainability target to hit over the next few years,” Roberts said. She added she was pleased to see the sustainability solutions growing in trucking. About half of Frito-Lay’s heavy-duty equipment runs on compressed natural gas. “As we continue to expand our portfolio into more electric vehicles, it’s just really neat to see how the private fleet industry is leaning more towards some of the alternative fuels.”

Equipment mileage

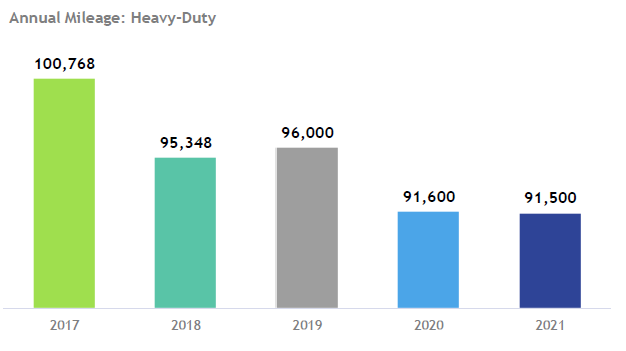

The average heavy-duty truck on a private fleet logged 91,500 miles in 2020, according to the 2021 report. That was down slightly from the 91,600 miles reported the previous year. Moore linked this lower number to COVID-19 impacts but noted that private fleets can be more stable than for-hire fleets in milage—at least for now.

“Private fleets are pretty well-positioned in terms of doing what they do well now in their service,” Moore said. “So I wouldn’t anticipate wild fluctuations in the various annual mileages per unit. Where I do see some changes is because of the commercial vehicle shortage. I anticipate that fleets may be pushing out their trade cycles a little bit longer because they just can’t get the equipment in.”

“From an industry standpoint, I would anticipate that (mileage) to start to go up,” Roberts said. “As supply chains recover from post-COVID and manufacturing and inventory positions, I do anticipate we’ll start to see those supply chain bottlenecks starting to ease. You’ll start to see a little bit more of that freight. From a Frito-Lay perspective, in general, I would say our network expands and contracts based on capacity. As we continue to add additional capacity—whether it’s an increase of utilization of our existing fleet or we’re adding incremental capacity—we do anticipate to see miles continue to grow.”

Penske’s Lager added: “Everybody’s going to have to operate more efficiently in the coming years because of that (equipment) constraint and the driver constraint,” Lager said. But because fleets are moving toward shorter driver routes to keep those employees closer to home, the average miles for drivers could come down. “But I do think most fleets are going to end up running more miles on these trucks and more per year, most likely, because they’re going to have to be more efficient with the equipment that they have.”

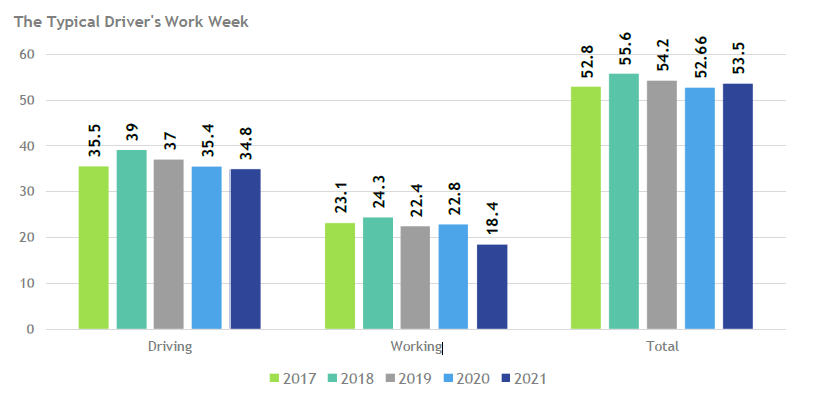

As the equipment and driver capacity crunch continues, Roberts said it will be interesting to see how the average private fleet driver’s work percentages change between on-duty driving time and unloading time “because that’s going to impact the utilization of the equipment.”

Surveyed fleets reported that their drivers, on average, spend 34.8 hours per week driving and another 18.4 hours working at non-driving tasks, such as loading (6.4 hours per week), unloading (12 hours), and “other duties” (5 hours), such as paperwork, pre- and post-trip inspections, and fueling.

The survey showed that the average power unit is utilized 13 hours a day, up from the 12.2 hours last year. Those 13 hours mean there is room to increase equipment utilization, Moore said. “We have a number of our fleets that are slip seating and we’re still just getting 13 hours a day.”

Driver retention

The “culture of retention” is helping private fleets during the driver shortage, which American Trucking Associations pegs at around 80,000. “It’s not any one thing that you’re seeing,” Moore explained. “It’s kind of a combination, where the drivers are treated like people, they’re part of a team. Their contributions are valued, their contributions are recognized, they’re paid for that.”

He added that private fleets are becoming more sensitive to that culture and working with drivers. Moore also believes the safety technology adoptions are a key. “Technology is not just implemented as a gotcha, it’s also implemented to reward very good behavior. And our members are recognizing those drivers that do produce and I think that’s a really good trend here.”

During the height of the pandemic and lockdowns around the nation, Roberts said that Frito-Lay drivers saw the stability that comes with driving for a private fleet like hers. “A lot of drivers are looking for careers, not jobs,” she explained. “One of the things that we have in our advantage is that stability and growth. I think a lot of our drivers want to be in an organization where they know, even during a COVID shutdown, we were still working. We were still hiring. We never slowed down. We never took even a partial day off.”

By Josh Fisher

Source: https://www.fleetowner.com/