With three zero-emission trucks now in production, the OEM is seeing fleet interest grow for zero-emission solutions beyond just California fleets. Those looking to join the transformation need to start planning early.

SUNNYVALE, California—Kenworth is preparing its fleet customers for their inevitable zero-emission vehicle future. The OEM recently unveiled its Class 8 battery-electric truck, which joined two medium-duty EVs in its Driving to Zero Emissions program, which includes a package of fleet solutions.

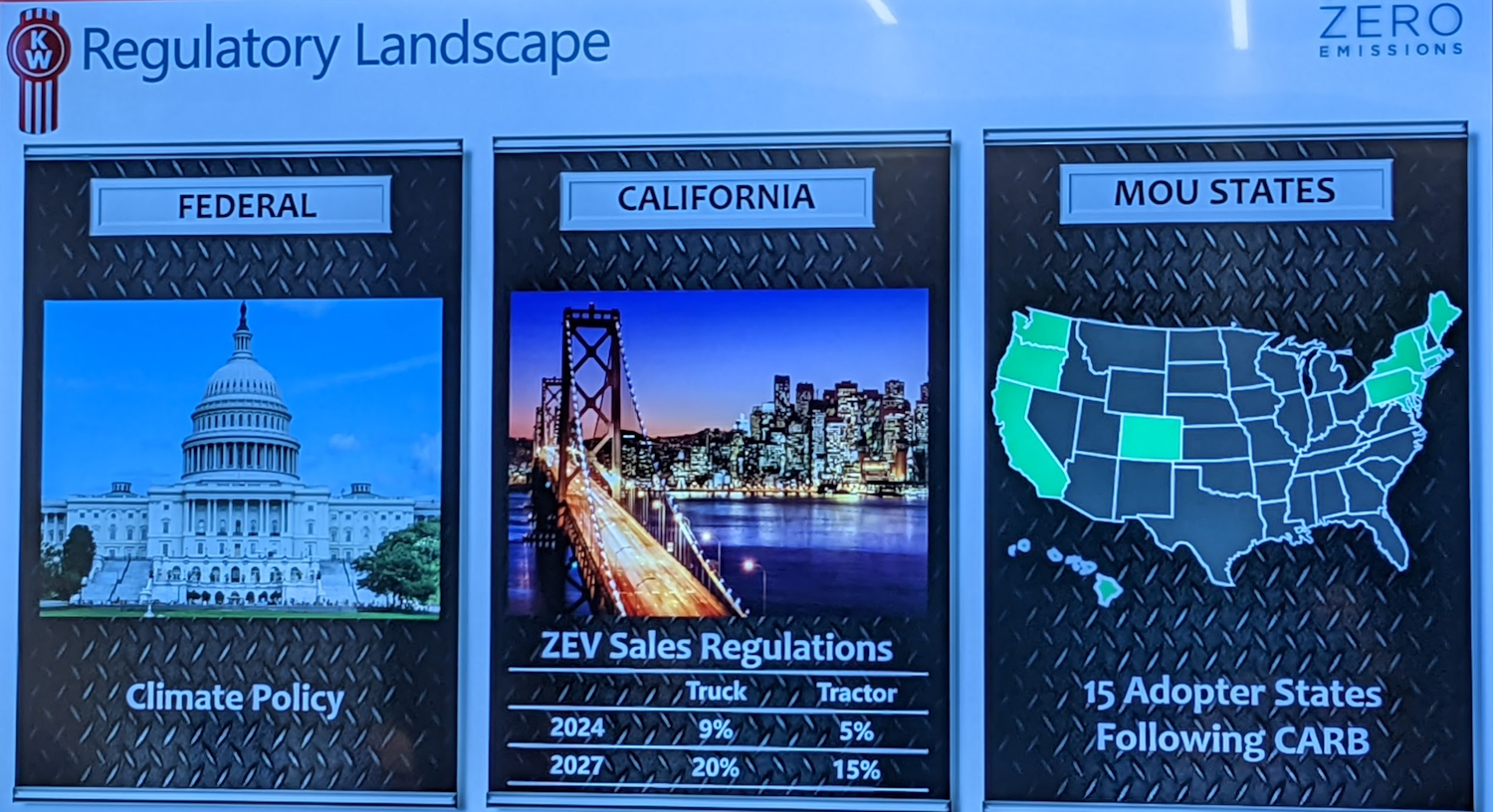

Kenworth and parent company Paccar are meeting with fleets interested in moving away from diesel. The company’s zero-emission solutions include three trucks, advanced vehicle chargers, and infrastructure support. A majority of early orders are coming from California fleets, which face harsher exhaust regulations in the coming years. But interest has come from all over the U.S. and Canada, according to Hank Johnson, Kenworth general sales manager for vocational and medium-duty. At least 15 other states plan to match California’s goals to eliminate diesel vehicles on its roads by 2050.

The types of fleets interested in the EVs “is all over the map,” he added. “We’ve got municipalities interested. We’ve got grocery companies, beverage companies. Basically, any customer that a T680 daycab will work in their current application, they’re definitely interested in electrification.”

See also: Paccar shows how trucking technology can make the world a better place

Johnson was among several Kenworth and Paccar executives who welcomed industry media to the Paccar Innovation Center here in Silicone Valley. The OEM showed off the medium-duty cabovers K270E/K370E and the new Class 8 T680E, which made its public debut at the Consumer Electronics Show 2022, held the first week of the year in Las Vegas. The T680FCEV, a hydrogen fuel cell EV that Kenworth and Toyota developed, also was shown.

“The interest in purchasing these trucks has just grown tremendously over the last 90 days,” said Joe Adams, Kenworth’s chief engineer. “And we continue to see as we bring this information out to our customers just a ton of interest, because they are on a journey as well, to reduce their carbon footprint.”

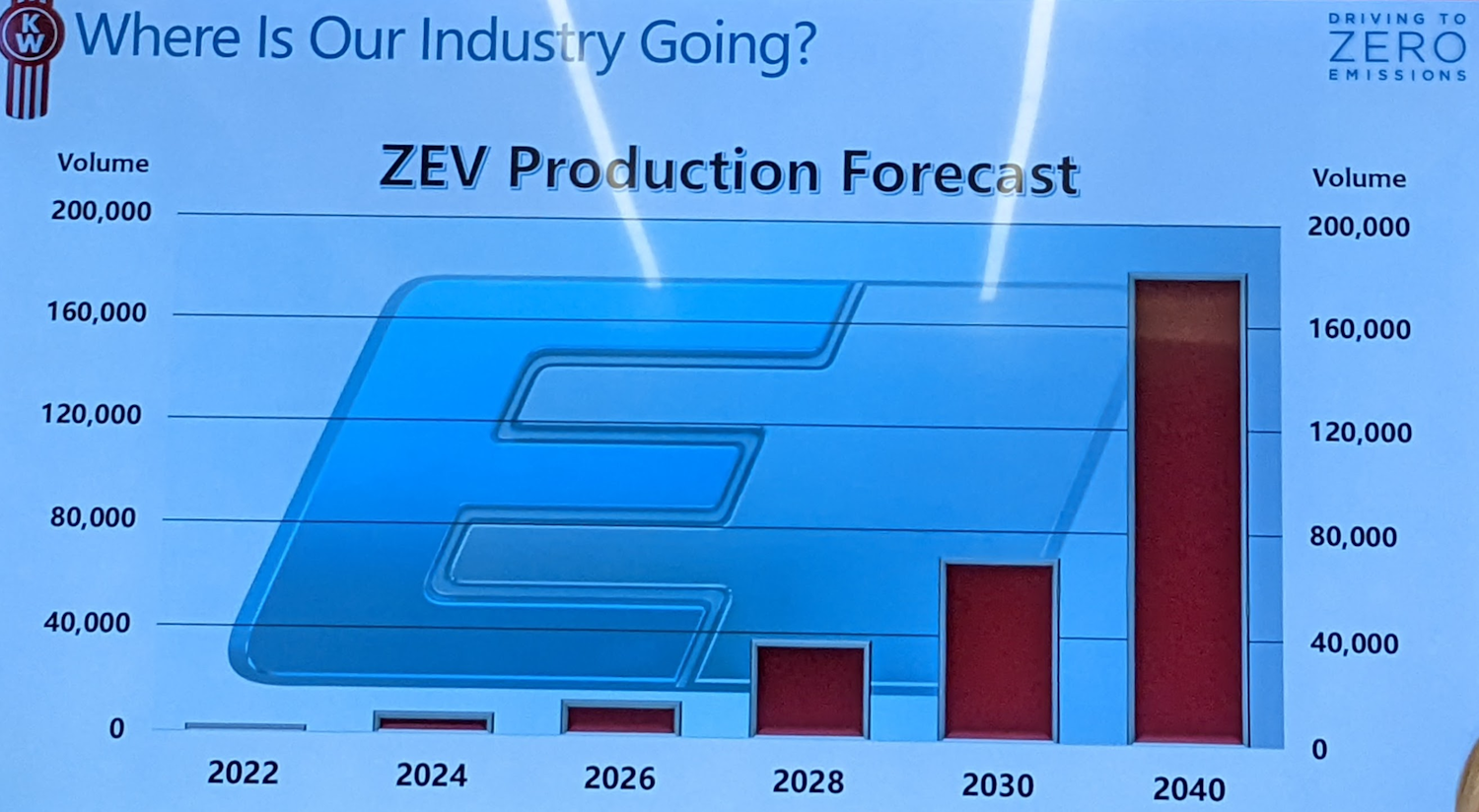

Zero-emission vehicle production, which includes battery-electric, fuel cell, and other clean-energy solutions, is heating up. Adams said Kenworth forecasts the commercial vehicle industry to build nearly 80,000 ZEVs a year by 2030. By 2040, Adams said that number is expected to more than double.

EV benefits beyond a smaller carbon footprint

Adams said that fleets converting to EVs, such as the Kenworth models the company showed off on a partly cloudy, brisk California morning, also could lower the total cost of ownership along with that carbon footprint.

“It’s not just about the initial acquisition price. It’s also about the chief operations officer coming in and saying, ‘Hey, I’m focusing on reducing maintenance, I’m focusing on reducing my fuel consumption or other things.’ There are benefits of these products that we bring to those customers.”

Some TCO benefits include switching from diesel, which regularly fluctuates in price, to more stable electricity rates and the potential to use renewable energy. Adams said this could cut fuel costs by 50%. With fewer moving parts on EVs and no need for after-treatments, he said maintenance can fall by 30%. At least in the short term, there are infrastructure and vehicle grants available to fleets.

“Finding the right route for the customer is really where our team comes in and works with them to make sure you understand that if you go this-many miles, you have to make sure you have a charging opportunity,” Johnson said.

Medium-duty fleets that traditionally don’t consider cabover trucks like the diesel-powered K270 and K370 are coming around on the EV versions of the models. “They’re interested in this because of the maneuverability once they actually test it,” Johnson said. “That interest will continue to expand as the product and technology grow. But I will tell you, we’ve done presentations to Fortune 150 companies, we’ve done presentations to mom-and-pops. It’s all over the map.”

Johnson said that Kenworth’s EV sales process involves customer education about the technology and determining if it fits within a fleet’s current business model. “As the technology sits today, it doesn’t work the haul freight from California to New Jersey with an electric truck,” he said. “The infrastructure is not there, the range isn’t there, etcetera.”

But the EVs do fit into several other regional routes and shipping lanes.

How fleets make the move to EVs

To make a move to EVs takes a lot of planning. Along with setting up charging and working with local utilities to ensure the infrastructure can handle a fleet of electric trucks, “there is the supply chain issue,” Johnson noted. “Everything just takes longer than it did a year ago. Whether it’s getting workers out to upgrade your utility. Whether it’s getting the chargers, the hardware, things like that. You have to start planning this stuff six to 12 months in advance.

“This is a new piece of equipment for these customers to put into their fleet,” Johnson continued. “So they want to make sure that they are investing properly. That they’re prepared. It just takes a little bit longer to get customers ready. And that’s where the grants and the incentives that we put together really helps to bridge that gap for them.”

Before a Kenworth customer adds EVs to its fleet, the OEM meets to go over what it will take to make it work within its operations. And how quickly it can happen often depends on how much electricity is available to charge the gigantic batteries that power the trucks—and how many EVs a fleet wants.

The T680E—which offers a 150-mile range, speeds up to 65 mph, 536 horsepower, 1,623 lb.-ft. torque—has a 396 kWh battery pack that weighs about 7,000 lb. Government regulations allow Class 8 electric trucks a 2,000 lb. exemption, which allows a gross vehicle weight rating (GVWR) up to 82,000 lb.

The K270/K370E are equipped with 141-282 kWh battery packs, offering 100-200 mile range, 469 HP, 2,540 lb.-ft. torque, and can reach 65 mph. The GVWR is 26,000 lb. and 33,000 lb.

Johnson said it could take at least half a year to set a fleet up for success with EVs. “If there hasn’t been a lot of investment in the utilities [that power the fleet location], they probably need a little bit more lead time to get ready,” he said, adding it could take more than a year depending on a fleets’ needs.

He said customers are often surprised when they find out all that goes into setting up the charging infrastructure. “You really see the lights go on when you meet with them about this, and they say, ‘Oh boy, I need to get going on this.”

Getting the electricity infrastructure set up to support Paccar Parts’ 24kW to 350kW chargers can take four to six months, depending on how powerful a charger fleets want. And if a midsized fleet wanted to revamp its trucks to EVs completely, that would add more time to set up the utility infrastructure.

“If they’re going to make the full investment, that’s probably going to take a little bit longer than getting just enough infrastructure to charge one or two trucks,” Johnson explained. “If you’re literally going to electrify your fleet at your full-scale plan—for 50 to 100 trucks—that’s probably a one- to two-year process at least.”

While Kenworth is ready to build these EVs, like other OEMs, it contends with supply problems that have created manufacturing backlogs. “We all know what our backlogs look like right now within the industry,” Johnson said. “But we can deliver a chassis and probably have both of these models ready to be put into service for the customers in six, seven months from now. As we scale up our capacity, we’ll shorten that a little bit.”

Johnson said fleets have placed orders ranging from one truck to “double-digit orders. It really just kind of depends on the customers’ willingness to put one foot, one toe, or two feet in it.”

By Josh Fisher

Source: https://www.fleetowner.com/