More than a third of companies, mostly smaller organizations, are not using software solutions.

This was among the findings of a Continental survey about the use of software for managing drivers, vehicles and logistics operations in the transport industry. Although logistics and transport companies that use software solutions are now more satisfied with them overall, SMEs are not yet convinced the software can significantly benefit them.

Gilles Mabire, head of business unit commercial vehicles and aftermarket for Continental, explained in the transportation business, operator margins are generally rather low compared to other industries. “This makes for some hesitance to invest, in all areas of business generally,” he said. “Also, decision makers need to be certain that the investment will pay out in, as a rule of thumb common in this industry, only two years or less.”

Mabrie noted it might also be concluded that transport companies in Europe (the survey had been conducted in Germany) tend to be smaller and have less vehicles than in other regions of the world. “Therefore, they sometimes simply lack the specialized person to analyze the issue, evaluate the software and estimate the possible effects,” he said. “From our point of view, it is not that transport companies aren´t convinced that software could help them to be more efficient or improve their processes.” Rather, he said it seems to be the case that some companies shy away from the matter completely in order to avoid “failing expensive”.

Gartner analyst Pedro Pacheo also noted the sector’s major resistance to change, which includes embracing digital solutions. “Many of the companies who do invest in software and digital don’t necessarily have an holistic strategy,” he said. “For instance, if these companies don’t have great data capabilities, then many technology investments can lead to frustration simply because they don’t have the foundations in place to fully leverage those investments. This, in turn, leads to disappointment which leads to skepticism against technology.”

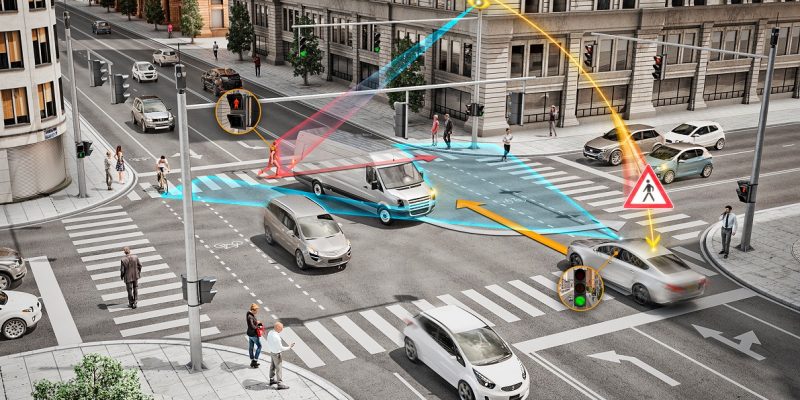

The technologies where transport companies had the highest level of interest, such as ADAS functions and fuel-saving technologies, are driven by the pressure to be cost efficient. “From what the findings of our study indicate, and from what we hear from our customers, which are fleets as well as truck builders, driver assistance functions play an important role when convincing a professional driver to join the company, the better the vehicles the more likely will a driver sign on,” Mabire said.

As Mabire noted, logistics providers are most interested in more driver assistance functions and fuel-saving technologies, which Pacheo said makes sense simply because these directly address two key concerns of fleets. “Deploying a comprehensive data strategy is something costly, time-consuming where many technology-lagging companies fail to see the benefit,” he said. “However, ADAS reduces accidents, which means less disruption to their operations. Similarly, fuel is one of the major costs for vehicle fleets.”

As Pacheco pointed out, any technology that manages to bring a substantial reduction in fuel consumption will be able to easily evidence an ROI. Mabire noted, however, that it is not indicated that transport companies are in favor of driver assistance with the end of full automation in mind. Full automation is still seen with reluctance, if not outright skepticism.

Drivers and fuel

He explained the total costs of a road transport consists of almost a third of the costs for qualified drivers, and of the costs for fuel. “As you can imagine, with the pressing scarcity of drivers and the foreseeable increase in taxation of fuel for reasons of climate protection are both roadblocks that will likely keep growing disproportionately in the future,” he said.

The study also revealed that cyber-security is critical, especially for the efficiency-driven road transport sector, since without connectivity it is almost impossible to work efficiently. “Cyber-security protects the benefits of digitalization, which is vital for the transport industry in particular,” Mabire said. “If they are hit by a cyber attack in their transport management system, for example, it will be in the heart of their business and could bring their operations to a complete halt.”

However, smaller companies are still hesitant to invest in protecting themselves and their vehicle fleets from attacks, and therefore solutions should be more closely tailored to their needs and budgets. “In the future, it may well be that the intrinsic value of cyber-security will become more evident, for example when the increase in digitalization causes more attacks on transport and logistics companies’ systems,” he said. “Certainly, the recent regulation of the field of vehicle cybersecurity, WP.29 of the UN Economic Commission for Europe, could greatly improve the cybersecurity posture.”

Pacheco said rather than just developing software, they need to be consultants or advisors to logistics companies. “Logistics companies are looking for operational solutions and not just software per se,” he said. “As such, software and tech companies must work together with their logistics customers to understand their problems and advise on the best way forward. From then on, software will be just an enabler and technology companies need to help their logistics customers assembling the complete solution.”

In some other cases, Pacheco said technology vendors should also focus on becoming better at demonstrating the ROI of their software solutions. “Often there is too much tendency to mention benefits without conclusively proving their financial value,” he said. This approach, when addressing a customer, especially a technology-skeptic one, can be detrimental.”

by Nathan Eddy

Source: https://www.tu-auto.com