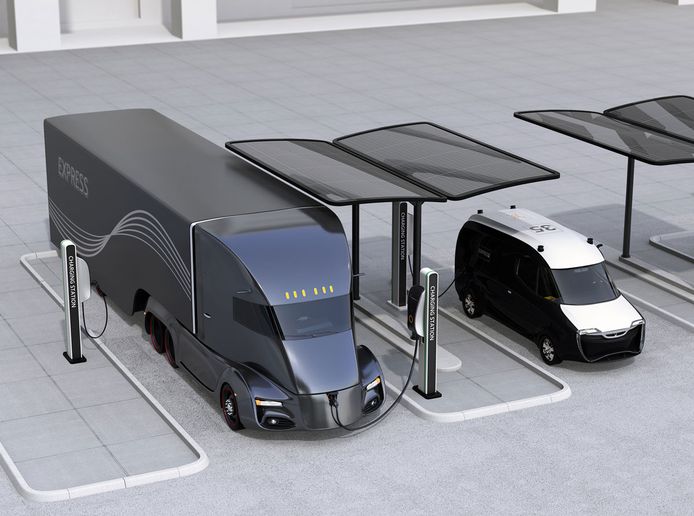

Illustration: Black & Veatch

Utilities, the electric vehicle industry, and fleets will need time to figure out the challenges of adding EV charging to stressed electric grids.

California and other states are scrambling to find electricity this summer amid record heat, with a growing risk of blackouts. The Texas power grid that failed in February winter storms, leaving millions of homes and business without power and resulting in more than 100 deaths, has already had 1,280 summer outages. If our power grids already can’t handle the extremes being caused by climate change, how are they going to handle the addition of battery-electric vehicles?

A 2019 study by the U.S. Department of Energy estimated that increased demand for electricity — much of that for electric vehicles — could see a 38% increase in energy demand by 2050. And the Biden administration wants to build 500,000 EV chargers and “electrify thousands of school and transit buses across the country.” As Reuters recently reported, the city of Austin, Texas, has budgeted $650 million over 20 years for electric buses and a charging facility for 187 such vehicles.

“The electrification of the transportation sector will catch most utilities a little bit off guard,” Ben Kroposki, director of the Power Systems Engineering Center at the National Renewable Energy Laboratory (NREL), told Reuters.

A New Business Model for Utilities

ACT Research analyst and economist Jim Meil talked about the issue in an HDT interview about the firm’s recent electrification report.

“Right from the get-go, you have a very interesting problem or challenge with the fact that utilities traditionally deal with a stationary customer set,” Meil explained. “With the potential for electrification of the transportation sector, all of a sudden, you’re going to be dealing with customers who will be working and where the final node for electricity will be these vehicles that run all over a city, a region, a country. So the utilities are dealing in a way with, how do we deal with our business model? How do we deal with regulators? So you have a bit of a transition right there.”

Noting that another issue is the fact that some of the utilities leading the way in pushing electrification also have an electric grid under duress (looking at you, California), Meil pointed out that utilities and fleets will also have to figure out issues with rates.

“For many utility customers, including California customers, you have the highest rates set for many of their current market segments in that five to 9 p.m. period, when the grid is under stress as people return from their work day, go into their house, and crank up their air conditioning because it’s a 95 degree day out in the Imperial Valley,” Meil said. “And if you’re running a parcel delivery service, [that’s the same time] you’d like to be plugging in your vehicle, and you’d like to be using cheaper power.”

Not an Overnight Switch

But Reuters also quoted Robert Barrosa, senior director at Volkswagen AG’s Electrify America, which is building out fast-charging stations throughout the nation, as saying the gradual pace of EV adoption will allow utilities to adapt. “We’re not in a doom-and-gloom situation,” Barrosa said. “We’re not going to 80% battery electric sales overnight…it will be a natural transition.”

In addition, Reuters noted, electric vehicles — especially commercial ones with large batteries — can actually help stabilize the grid in the long run by feeding power back into the system during times of peak demand, using chargers that allow electricity to flow in both directions.

RMI recently noted that, regarding the situation in Texas, “if properly integrated into grid planning, electric pickups can not only provide backup power for their owners during broader grid outages — but also for entire communities.”

Of course, that takes planning.

“We like to think that the industry, that both industries [trucking and utilities], will have time to find the way to a solution,” Meil told HDT. “That might be a little bit Pollyanna; we know there are going to be some bumps in the road, especially in the first year or two or three, as utilities recognize and start accommodating and pricing this influx of electric vehicle demand. And hopefully, we’ll see government utility and user willingness to do the infrastructure necessary to shore up the grid for this new source of demand.”

Source: https://www.truckinginfo.com/