It’s critical government fleet managers are aware of the impacts this shortage has on their vehicle replacement cycle.

Modern-day automotive vehicles are increasingly relying on advanced technology to deliver an exceptional driving experience coupled with innovative safety and mobility features. But there’s currently an unprecedented global shortage of an integral part to these vehicles—semiconductor chips—that’s affecting nearly every industry, from automotive to consumer tech, and many more in between. While this shortage has affected consumers, it’s also impacting various government fleets as they are unable to access new vehicles until supply bounces back.

By the end of 2019, government agencies operated nearly 1.2 million vehicles of the 279.6 million vehicles on roads nationwide. Given that many of these vehicles are likely due to be replaced, it’s critical government fleet managers are aware of the impacts this shortage has on their vehicle replacement cycle.

Here are five of the top questions fleet managers may have regarding this shortage:

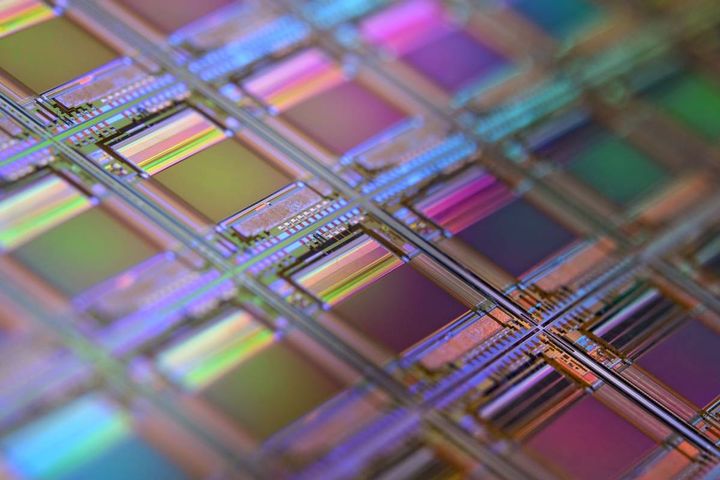

1. What is a semiconductor chip, and how critical is it?

Though semiconductor chips are small in size, their impact is massive. Older cars were more mechanical, but newer cars rely on more advanced technology and can require hundreds of chips for virtually every feature in a vehicle. Government fleet vehicles, such as patrol cars, require even more of these chips to support the various computers embedded within them, as well as other features including sirens, lights, and even the parking sensors that roll up the windows and lock the doors when they detect a pedestrian approaching.

2. Are semiconductor chips only used in cars and trucks?

Semiconductor chips are heavily present in many other products and industries aside from automotive, including in retail tech products such as laptops, computer monitors, tablets, and phones. Considering how many different tech products can be found in a singular patrol car or emergency vehicle, this further emphasizes the need for these chips to operate any given government fleet vehicle.

These chips are in extremely high demand, and according to the Semiconductor Industry Association, global chip sales are expected to grow 8.4% in 2021 from $433 billion in 2020. While a growth in sales is good for chip manufacturers, it is bittersweet for other industries looking to secure the chips necessary to manufacture and sell their products. The current disruption to the global supply chain could stunt projected growth, but any growth in the industry could further exacerbate the current shortage.

3. How did we get here?

Due to the nature of the pandemic and resulting stay-at-home orders last year, parts manufacturers—including those who manufacture semiconductor chips—prepared for a possible prolonged automotive shutdown by halting production and adjusting operations.

Facing this, along with the decreased demand for automotive vehicles early on in the pandemic, semiconductor chip manufacturers pivoted to meet the influx in demand for consumer electronics such as laptops, monitors, and desktop printers and scanners as millions of workers shifted to working from home. In fact, in 2020, the consumer electronics industry saw nearly $442 billion in retail sales revenue, making it the biggest year for sales on record.

When demand in the auto industry bounced back much quicker than anticipated, chip manufacturers found themselves scrambling to produce enough inventory to meet demand once new vehicle orders started piling up in tandem with the rising demand for consumer electronics.

4. What does this mean for my fleet, and how can I ensure continuity despite this shortage?

Because of the shutdown, fleet orders for the 2021 model year have been cut off much earlier than normal, and as a result, government agencies that are currently looking to replace or add vehicles to their fleets may have noticed it’s becoming increasingly difficult to do. For example, Ford—a major supplier of government fleet vehicles—has recently projected it will produce 1.1 million fewer vehicles than planned this year (compared to the previously projected shortfall of 40,000 vehicles). Though local and state governments may be a priority for automotive dealers and leasing companies when the shortage resolves, there will still be significantly less inventory available.

Since the standardization of almost any government fleet is a crucial component to the agency’s image and operation, fleet managers may want to consider waiting until the 2022 model year to replace their vehicle(s). The 2022 order banks are opening now, but unless the chip shortage situation improves, production constraints will continue. If managers decide to wait, they’ll need to extend the service life of the existing vehicles until the shortage has been resolved, and they should complete any necessary maintenance now to ensure the vehicles will be able to continue running safely, enabling first responders to have a presence without any interruption.

5. When will this shortage end?

Unfortunately, this shortage won’t be resolved anytime soon, as even the slightest ripple in the supply chain can have serious ramifications across multiple industries. There are projections this shortage will continue through Q3 of 2021, or even into 2022.

In an effort to maintain workflow, some auto manufacturers are currently building vehicles with everything but the chips and keeping them in storage yards. Once the shortage has subsided, they will install the chips and ship the vehicles to dealerships and leasing companies.

Fleet managers should consult a fleet management partner if they haven’t already—having a dependable partner to help navigate the situation and share updates on the latest developments in the shortage can alleviate some of the pressure they may be feeling.

Originally posted on Government Fleet

by Jeff Barron, The Bancorp Bank

CUT COTS OF THE FLEET WITH OUR AUDIT PROGRAM

The audit is a key tool to know the overall status and provide the analysis, the assessment, the advice, the suggestions and the actions to take in order to cut costs and increase the efficiency and efficacy of the fleet. We propose the following fleet management audit.