Acting as intermediaries and the theoretical sales and marketing arm for carriers, today’s brokers and 3PLs have put more focus on building relationships and analyzing data to keep freight moving.

In the earlier days of the industry — more specifically in 1980 when the Motor Carrier Act deregulated interstate trucking — freight brokers were essentially contract salespeople for commercial fleets. Today, however, the role of modern brokers has evolved.

Brokers now are not only intermediaries and the theoretical sales and marketing arm for carriers, but they also handle the more broad-based carrier management for shippers. And while all brokers are third-party logistics providers (3PLs), not all 3PLs do brokerage.

Many of the larger, integrated 3PLs might follow freight shipments and handle procurement all the way from ocean containers to final-mile delivery. They also handle carrier and shipper billing, warehousing, and carrier monitoring and management. Over the last few years, a great deal of emphasis for 3PLs and brokers has been put on building relationships with fleets and shippers. Ken Adamo, chief of analytics for DAT Solutions, which operates the largest truckload freight marketplace in North America, explained that 2018 was a year that brought these relationships into focus, as many relationships were put to the test.

“A lot of the talk you hear now about broker transparency was the other way around [in the earlier days],” Adamo said. “It was essentially to make sure the brokers were getting paid the right amount because they didn’t necessarily see the whole transaction.”

Mark Ford, chief operating officer of transportation for BlueGrace Logistics, one of the largest 3PLs in the U.S., has seen a lot evolve in the last 25 years he’s been in the industry.

“Historically, if you look at how companies operate in our space, it has been more or less call driven, manpower driven, and a lot of human effort involved in the sales process in general,” Ford explained. “That’s because it’s a highly fragmented industry, and you have to have a lot of touchpoints to actually facilitate the transactions.”

Data utilization

Ford explained that the industry has been moving in a more “seamless and frictionless” operational direction, with 3PLs and brokers alike spending more time collecting and analyzing data.

“Traditionally speaking, most brokers focused and relied on load boards and the transaction in general,” Ford said. “What technology allows us to do these days more so than in the past is to collect data and utilize that data, so we’re spending less time trying to figure out who to call and more time on building relationships and getting carriers to give us access to that data.”

In 2013, Chris Arredondo worked at Cargo Chief while the company was a technology-enabled brokerage firm. About a year ago, Cargo Chief discontinued its freight brokering services to license its technology, which includes leveraging key data integrations, machine learning, artificial intelligence, and advanced automation, for 3PLs.

Arredondo, who is now co-founder and director of customer success for Cargo Chief, explained that back in 2014 when technology integrations really began ramping up, trucking wasn’t quite ready for it. But that has begun to change.

“I think even today when you think about a shipper and carrier, the industry still favors a phone call or a conversation over anything,” he said. “It took a big event like COVID to get carriers and companies to digitize and focus on where to deploy and execute solutions.”

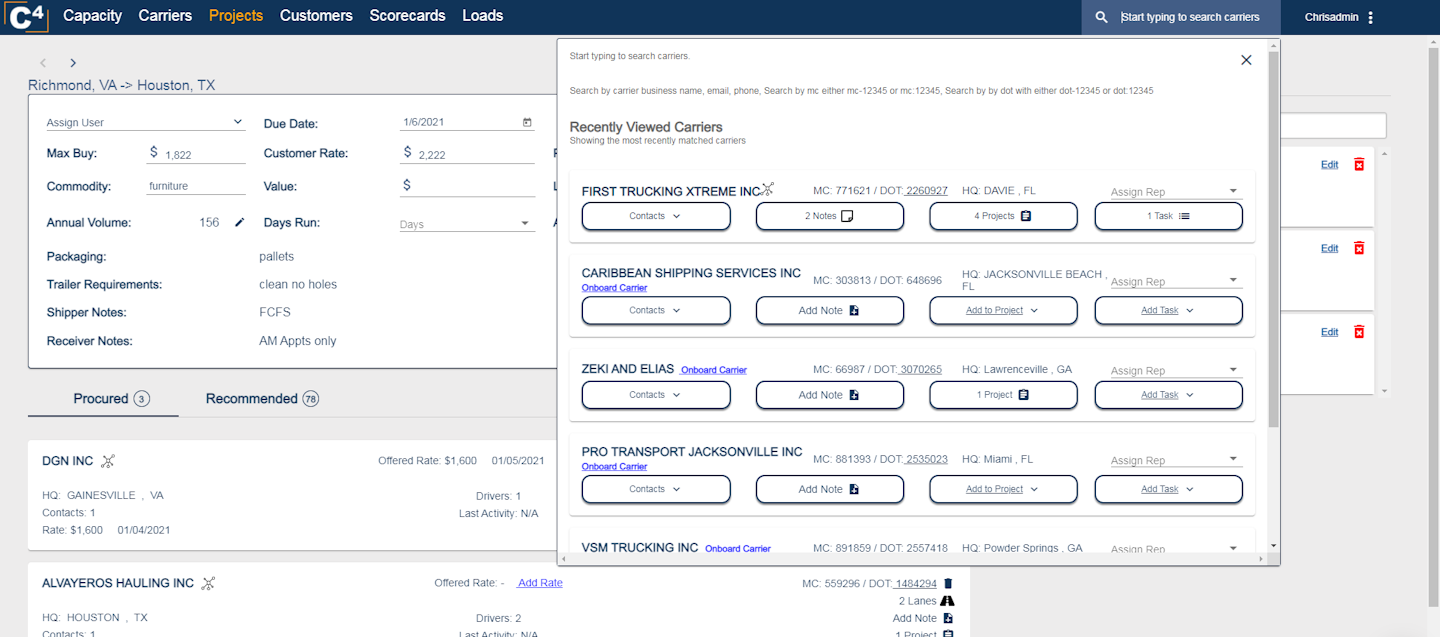

Cargo Chief now offers a platform called C4, which gives carriers the ability to see real-time lane pricing, prioritized load opportunities, capacity management, and customer relationship management (CRM) capabilities. Today, Cargo Chief allows brokers to not just pair with carriers, but the platform gives carriers the ability to determine the lanes they want to run and at what price.

“Carriers like to work with consistencies and find those shippers or 3PLs that not only have that freight, but who could also think outside of the box and be flexible and creative,” Arredondo explained. “Carriers want the business for their trucks in the lanes that fit their business, and they want to run freight every time — not just today — with that same company. In turn, the same benefits for a broker or 3PL are very much the same for carriers.”

Digitization and transparency

In an industry that’s been largely reliant on what Sagar Shah, Uber Freight’s director of carrier operations, calls “inefficient processes like paper, phone calls, and fax machines,” today’s technology can provide a more seamless experience for both fleets and drivers. Uber Freight, for instance, offers interfaces that feature upfront pricing, instant booking, payment, and facility ratings that help shippers reduce driver detention time.

“For fleets in particular, carriers will want to look for tech platforms that can manage and dispatch fleets easily, allowing them to operate and plan for several trucks at once, so they can streamline operations and maximize productivity,” Shah said. “In working with a 3PL, fleets can expect incremental value – whether through load selection or operational ease.”

Over the last few years, the market has seen a tremendous shift toward eliminating friction among partners. Digitization has helped firms inject transparency into the market, as more companies are adopting tools to help them respond and react to market changes faster, DAT’s Adamo explained.

DAT offers tools that show shippers, carriers, and brokers five-day forecasts for inbound and outbound market activity. These tools allow fleets to plan out a theoretical week for themselves, so they are not as dependent on the next one-off shipment.

“The evolution is really just being creative and flexible in how you can get that true capacity with that spot market transactional rate and simulate it to more of an actual rate,” Cargo Chief’s Arredondo pointed out. “The more data, tools, and network solutions that we can give our customers, the better it is for their carriers.”

Arredondo also emphasized the importance of turning those one-off shipments into more long-standing carrier-broker relationships.

With its C4 end-user tool, Cargo Chief offers the data it has collected to small and mid-sized brokers, so they too can develop relationships with carriers in a more real-time way. When Cargo Chief first launched C4 in 2018, Arredondo explained that only the bigger brokerage firms and larger fleets had those types of freight-booking apps. Now, it has become a requirement for everyone working in the space.

Cargo Chief’s C4 platform gives carriers real-time lane pricing, prioritized load opportunities, and capacity management capabilities.Photo: Cargo Chief

Cargo Chief’s C4 platform gives carriers real-time lane pricing, prioritized load opportunities, and capacity management capabilities.Photo: Cargo Chief

“You want to be the expert in whatever you’re doing,” Arredondo said. “From a broker standpoint, a carrier can sense that confidence in what you have and what you’re trying to sell them. At the end, it’s that carrier’s liability; it’s their trailer. Do they really want to load your freight? You have to think about being the expert in your lane and finding your niche—whether it’s flatbed, van, refrigerated, whatever it may be.”

In the 40 years the trucking industry has been deregulated, Adamo explained that the industry has overbought capacity and suffered the consequences in a repeatable and predictable cycle.

“From where I sit, we have the tools now to help mitigate that volatility by making better decisions in all aspects of our business,” Adamo said.

For instance, fleets have been able to better oversee their assets with telematics and other visibility tools, which, in turn, help all parties in the freight transaction process manage their operations more efficiently. Technology and data can also help mitigate some of the areas of friction that exist—think driver detention time.

The data is there, whether companies decide to use it or not, Adamo explained. But those who don’t leverage it are at risk of being left behind.

According to BlueGrace’s Ford, the “old way” of doing business consisted of posting loads on load boards, with few companies adapting to or investing in technology. On the truckload side of the business, BlueGrace has made a continued effort building its own CRM system by taking years’ worth of data and using it from a predictive analytics standpoint.

“It’s useful in connecting our carriers to our internal loads,” Ford said. “It’s also useful for our sales reps to go out and start targeting some of the freight that our carriers have pinpointed as painful areas. We are looking at how we can help our carriers in the network and fill the gaps in back hauls and things like that.”

Data also helps 3PLs pattern out where fleets are consistently available.

“When we get a load, even if it’s three or four days in advance, our system is telling us, ‘Hey, these 25 carriers are most likely going to have capacity for that lane,’ and it prioritizes those carrier relationships that we’ve built,” Ford added.

Silvicom Inc., a truckload carrier operating in all 48 contiguous states, has been working with BlueGrace every day for the past two years. At the end of the day, Silvicom’s main objective is to do business with trusted 3PLs.

Miro Balabanov, a dispatcher for Silvicom, said that by keeping the carrier informed of incoming shipments, BlueGrace has been able to help the fleet position its units in areas that will generate the best loads. “Every morning we send them a list of our available units because we always try to provide availability to put BlueGrace loads on our trucks,” Balabanov said.

Another key element of carrier satisfaction is how 3PLs and brokers handle interactions for commercial drivers. The point is to make an already difficult job as smooth as possible for the driver, Ford explained. That means not making the driver jump through hoops, wait for prolonged periods of time to pick up or drop off a load, or to continuously call the driver from the time he or she picks up the load until the time it’s delivered.

“One of the questions that our reps will ask is, ‘Where do your drivers need to be next?’” explained Mark Derks, chief marketing officer for BlueGrace. “So, the reps will have forward-leading driver questions about whether a driver needs to get home, where they live, and how we can help get them there.”

BlueGrace Logistics reps use data to pattern out where fleets are consistently available.Photo: BlueGrace Logistics

BlueGrace Logistics reps use data to pattern out where fleets are consistently available.Photo: BlueGrace Logistics

Uber Freight’s Shah also emphasized the importance of fleets and shippers taking advantage of the most up-to-date, transparent pricing.

“Uber Freight’s pricing algorithms can quickly understand leading market indicators, including feedback from carriers about how they’re engaging with their networks and what kinds of loads they’re interested in and accepting,” Shah said. “We can identify more nuanced load interactions, and scale that feedback. This ultimately leads to more objective and accurate insight into load trends and market equilibrium.”

How COVID changed logistics

Throughout the industry, there has been a much greater movement to minimize touchpoints for drivers and digitize efforts to keep frontline workers safe.

Arredondo explained that over the course of the pandemic, Cargo Chief has also noticed that more companies are trying to pivot from the one-and-done spot market and better prepare for the next major shakeup that comes along.

“It’s harder to predict what’s going to happen in three months,” he said. “People are a lot more aware of those sudden impacts that could happen, and they are trying to be more in tune with those incremental changes or even the big swings.”

Those incremental changes and big market swings have also made carrier-broker-shipper relationships and transparency in pricing structure that much more important.

In addition, Arredondo has also noticed more of an industry-wide sense of urgency lately. For instance, Cargo Chief has seen an uptick in team drivers, where many brokerages are having more opportunities to move expedited freight than they were before.

“A year-and-a-half ago it wasn’t as big of a part of their business. But now when you think about the driver time spent at a port when they are rejecting containers and are so backlogged and drivers are having to wait to get screened for COVID, that adds up to the last free day of that container at a port,” Arredondo said. “Then, suddenly, that freight has to get somewhere before it spoils or doesn’t hit the store it needs to in time. The equipment types and driver capabilities as far as team driving goes have shifted during COVID.”

DAT’s Adamo explained that COVID has changed the business significantly when it comes to advancements in digitization and customer touchpoints—whether it’s an electronic bill of lading, electronic tendering, status updating, or proof of delivery. DAT is also seeing increased trailer pools to help with drop and hook opposed to live load and unload.

There has also been increased adoption of modern transportation management software from both carrier and broker-carrier management perspectives.

“Efficiency has become much more important, and as you are seeing increased detention and fewer dock workers, loading and unloading times may be longer,” Adamo said, adding that carriers are thinking more about rate-per-hour pay for drivers compared to rate-per-mile.

Adamo also noted that 2020 was the year of relationship-building across the industry—starting with the restocking boom last March and drivers protesting in front of the White House last May because they couldn’t afford to run empty. The industry also saw rates end at all-time deregulated highs in 2020.

“If that doesn’t force you into changing how you build relationships with your shippers and brokers and all the relationships you have, I’m not really sure what will,” Adamo stressed. “We’ve seen a lot of positive success stories about those relationships. In 2018, a lot of brokers compromised service at the benefit of price, and that burned a lot of relationships. In 2020, we saw much more weight toward protecting service than we did in 2018, which was a big positive for our industry.”

BlueGrace’s Derk also pointed out that COVID prompted a heightened level of focus on safety, the driver, and on trucking companies in general. He added that because capacity was so tight, 3PLs and freight providers had to be intentional in their strategy to keep frontline workers safe.

In 2020, there was a major acceleration in the adoption of technology and automation across industries. Shah pointed out that this was particularly true in logistics, as supply chains were squeezed by panic-buying and markets became unbalanced, with both high and low freight volumes.

“The industry needed to be flexible and resilient – and for both shippers and carriers, that meant investing in new technology that helps the supply chain adjust quickly and offer stability during times of volatility,” Shah said.

Moving forward, momentum toward advancements in freight technology is likely to increase, with even more emphasis being put on building relationships throughout the entire freight transaction process.

CUT COTS OF THE FLEET WITH OUR AUDIT PROGRAM

The audit is a key tool to know the overall status and provide the analysis, the assessment, the advice, the suggestions and the actions to take in order to cut costs and increase the efficiency and efficacy of the fleet. We propose the following fleet management audit.