The ability of OEMs to add electronic feature content via over-the-air (OTA) updates is changing the traditional business model for vehicle feature/options. (BMW)

I write and talk about automated and connected vehicles every day for a living. But my personal ride is a first-generation Mazda Miata built 31 years ago this month. I know that as long as I maintain it in proper working order, it will always bring the same level of joy every time I drive it. Forever. No policy change by Mazda will ever change that. Unfortunately, the same cannot be said for an increasing number of vehicles now and into the future.

The auto industry is faced with many challenges from a business and technology perspective. The financial markets have long turned up their noses at traditional “durable goods” manufacturing businesses like automotive. They tend to be capital-intensive, low-margin enterprises. When an automaker sells a vehicle, it earns revenue once. It then must invest in developing the next generation – and then convince customers to come back for another.

Investors have come to love businesses with recurring revenues. Despite being hugely profitable, Microsoft’s stock price was largely stagnant for nearly 15 years through the first part of this century. In the last half dozen years, its valuation has increased nearly 10-fold as it moved products like Office to a monthly subscription model. The rule of thumb for financial analysts is that recurring revenue is given three times the multiplier of one-time revenues in valuation models.

Tesla has just barely scraped together profits over the past year, due entirely to sales of emissions credits. But its stock price has exploded in 2020 despite falling revenues on Elon Musk’s promise of a future subscription business driven by electric robotaxis (a fantasy I won’t address in this column).

The rest of the auto industry would love to add recurring revenue to their income statements. So far, however, the incumbent companies have struggled to get consumers to sign on in sufficient numbers. For the record, Tesla has yet to prove its customers will provide recurring revenue in any significant quantity. But it certainly is getting credit for the promise of it, unlike Tesla’s competitors.

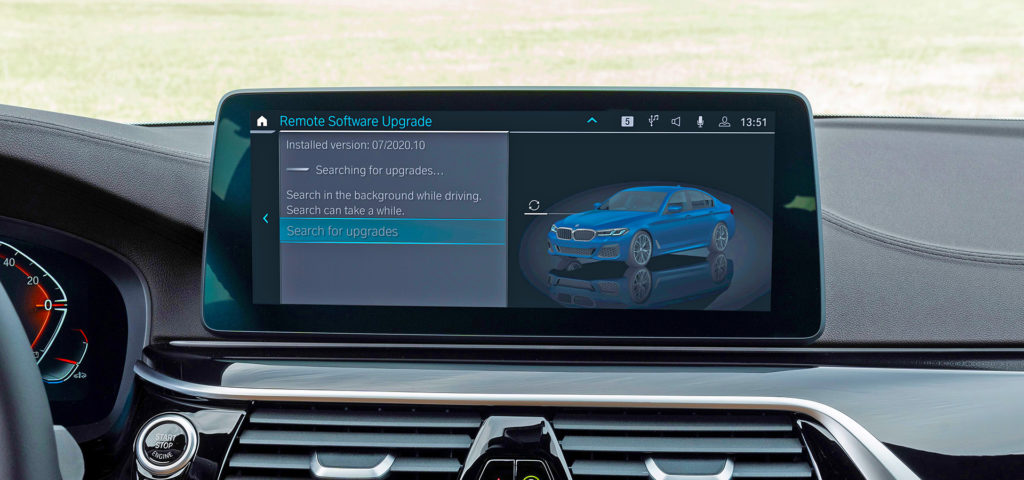

It used to be that when you paid up-front for a feature on your new vehicle, it was there for the life of the vehicle. But automakers want to change all that. BMW announced support for over-the-air updates a few months ago and talked about offering features like heated seats through a monthly subscription.

More recently it came to light that General Motors’ Super Cruise automated-driving system requires a premium OnStar connectivity subscription of at least $25/month. When the first Cadillac CT6 customers got Super Cruise starting in late 2017, they paid $5,000 for the option. The cars came with three years of OnStar bundled. I suspect few realized that OnStar was needed to get the map updates that Super Cruise also requires.

It is becoming increasingly clear that anything that we think we are buying today that includes or relies on connectivity is not actually owned by us. Instead, we’re renting it. If the auto industry is going to shift to a recurring revenue business model, it is going to have to start providing customers with a much better value proposition if they expect them to keep paying in perpetuity. Personally, I like not having any ongoing car payments for a while, especially when I pay monthly for so many other things in life.

Sam Abuelsamid is a principal research analyst at Guidehouse Insights, focused on E-Mobility and Automated Vehicles. A mechanical engineer, he has more than two decades of experience in product development of advanced automotive electronic control systems and embedded software and architecture.

by

by

CUT COTS OF THE FLEET WITH OUR AUDIT PROGRAM

The audit is a key tool to know the overall status and provide the analysis, the assessment, the advice, the suggestions and the actions to take in order to cut costs and increase the efficiency and efficacy of the fleet. We propose the following fleet management audit.