Establishing a standard process for warranty identification and tracking can help calculate the true value of a vehicle warranty and total cost of ownership.

When it comes to maintenance operating costs, fleets look to any opportunities possible to reduce spending and improve efficiencies. One option that could be improved for many fleets is the management of warranty claims.

The standardization of warranty claims can be inherently challenging because of the many variables associated with the identification and tracking of vehicle warranties.

Unlike a passenger vehicle, which often has a full warranty handled by the automaker, commercial vehicle warranty identification and tracking face additional challenges due to the infinite specifications a vehicle may have.

“As soon as something becomes a component that can be swapped or interchangeable, manufacturers have got to have the flexibility to have the warranty in total that people are looking for for their drivetrain, but also ala carte,” explains Craig LaPinta, marketing manager, aftermarket service products for the Daimler Trucks North America Extended Warranty Program. “Whether you have a [Detroit] DT12 or Allison [transmission] in between the axle and the engine, the axle coverage is the same, the engine coverage is the same. But what warranty you have with Allison was decided by Allison.”

Every commercial vehicle specification includes systems and components from different manufacturers or suppliers. Each of those vendors may have a different process for submitting warranty claims. Additionally, the age of the vehicle, the types of components, and the locations where warranty service is performed all factor into the warranty identification and tracking process.

The initial setup

To adequately track warranty claims, fleets would do best to use a digital process or software application – most often as part of their business or shop information systems – to track, identify, process, and file warranty claims.

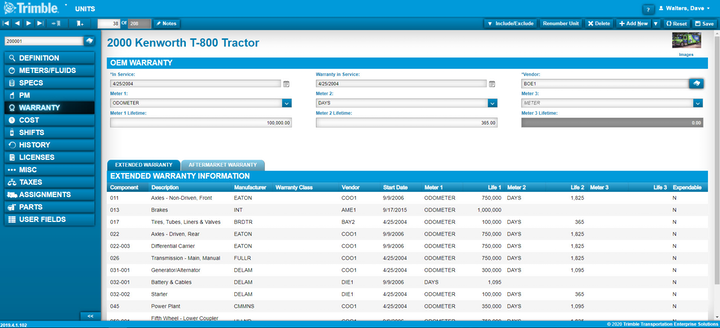

Dave Walters, senior solutions engineer for Trimble Transportation, stresses the most important step in tracking warranties is the initial setup for each asset in the system when the truck or trailer is first added to the fleet.

“When a new asset is added to the database, getting the warranty parameters on that asset set up properly is mission-critical,” he says. “Nothing happens if we don’t get the warranty established and set up properly on the front end of an asset when we add them to our business information system. If that’s done correctly, the system should be alerting you every time there’s a potential warranty opportunity.”

Trimble’s TMT Fleet Maintenance solution includes a warranty module that allows fleets to identify, track, and submit warranty claims (warranty setup screen displayed here).Photo: Trimble Transportation

Walter explains that regardless of the type of warranty – OEM, other component, or aftermarket – the system should alert the fleet of any warranty opportunities when a repair order is created.

“Identifying the warranty helps [the fleet] make a better decision on how to get that vehicle repaired,” Walter says.

With warranty tracking, if an issue arises with a vehicle, the fleet should be able to see what repairs and warranties were handled and direct a driver to the appropriate service.

Defining warranty coverage types

The first step to tracking warranty claims is to identify the type of warranty. Warranty identification refers to the information and warranties available for a particular asset.

There are different types of warranties fleets must consider when identifying and tracking warranty claims, according to Trimble’s Walters. They are:

- Base warranty. Also referred to as the OEM warranty, this warranty type is covered by the truck manufacturer. It can cover the full vehicle, but will at minimum cover the drivetrain – engine, transmission, and axles.

- Extended component warranty. This refers to any warranty that extends beyond the base OEM warranty.

- Aftermarket parts warranty. “Any part that gets purchased from a vendor, or a repair part, may have a warranty on it from the vendor who you’re purchasing the part from,” Walters advises. “We call that aftermarket parts warranty.”

“Through the repair process, your business system should be identifying, ‘Is this vehicle covered under OEM base warranty? Is the job we’re about to perform covered under extended or aftermarket parts warranty?’ Ultimately, if we replace a component, does that part itself have its own unique warranty associated with the part?” Walters says.

Due to the nature of individual specifications for commercial vehicle assets, one vehicle will likely have several warranty types. Identifying the manufacturer of the system or component is critical to the identification and tracking of warranties. An example asset may be a Class 8 tractor with an integrated Detroit drivetrain – engine, transmission, and axles; a Bendix braking system; and a BorgWarner starter. The warranty tracking system should note these different manufacturers and suppliers for every asset.

Managing the warranty process

A proper software management system to track warranty claims is critical. Additionally, proper training of technicians and standardized steps to manage the entire warranty process should also be in place.

“It is very important that technicians know that the repair they’re about to do is in a warranty situation,” Trimble’s Walters says. “Knowing that going in, and alerting the technician that the repair [they are] about to perform is under warranty automatically puts the technician into a category of knowing ‘I need to save the part, I need to understand why it failed, I may need to take a picture because a warranty claim is going to be filed.’”

Walters adds that fleets would do well to take photos during any warranty service to document the appearance of the failed part while it is still on the vehicle.

“Alerting technicians and having an information system that integrates with how a technician performs his daily functions is mission-critical and gives us a better warranty process at the end,” Walters says.

Many fleets appoint an individual to manage and oversee the entire warranty process.

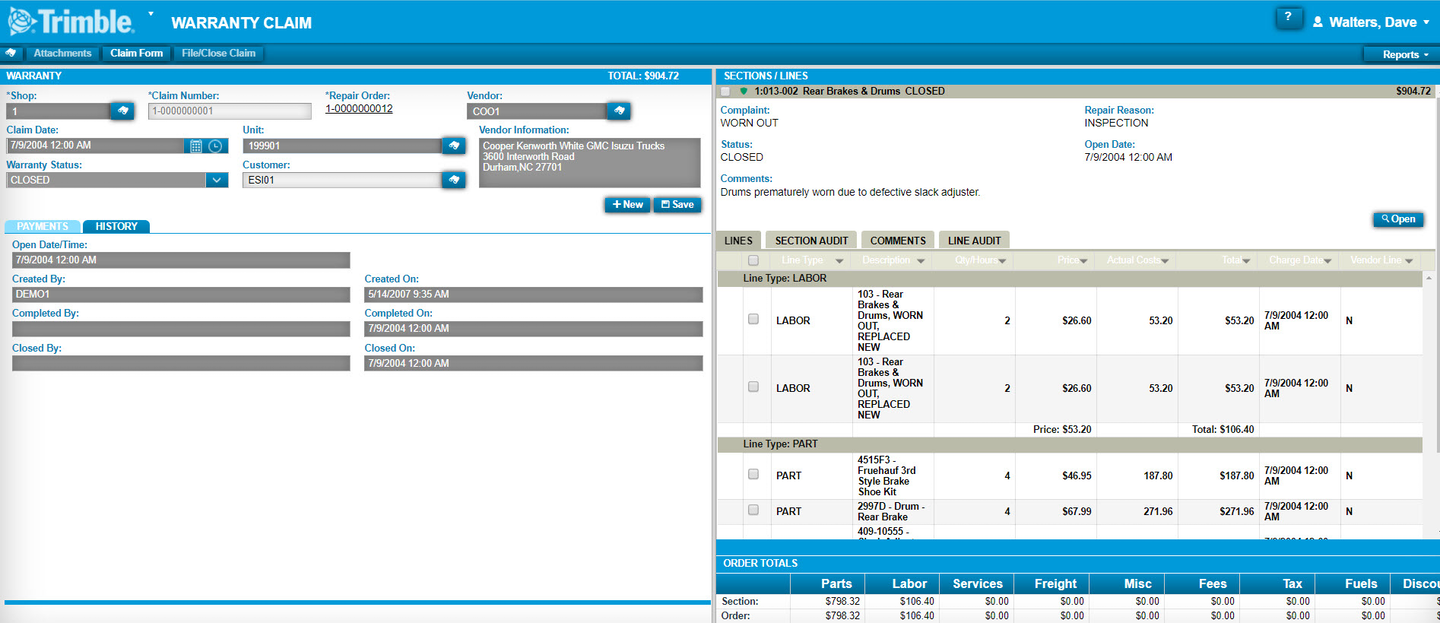

“Most fleets have a warranty administrator, an individual person that deeply reviews what we call potential warranty claims,” Walters adds. “As repairs are being completed, the [software] system is identifying those repairs as warrantable. Then, it’s typically a warranty administrator that will review those potential warranty claims and decide whether they’re going to actually create the fileable claim to the vendor providing the warranty coverage.”

This is exactly what Brandon Pasby does.

Pasby is the warranty administrator for Memphis, Tennessee-based Ozark Motor Lines. Nearly all maintenance service and warranty claims are handled in-house. Ozark manages more than 750 tractors – nearly all of them Detroit powertrains – and 1,500 trailers. Ozark’s trade cycle is done by mileage – every 600,000 miles, which equates to about five or six years for the fleet.

Ozark’s technicians receive regular online and in-person training and certifications to stay updated on Freightliner and Detroit vehicle service and repair processes.

As far as the service process at Ozark, Pasby says the maintenance department has a shop foreman who will review and assign service jobs to one of the 25 technicians in the shop.

Freightliners currently run by Ozark have a one-year, 100,000-mile warranty. This means any component – whether it is manufactured by the OE or through an OE supplier, is covered by Freightliner. Examples may include the diesel exhaust fluid (DEF) hoses or wheel seals. Once that full coverage warranty expires, the Detroit drivetrain – meaning the engine, transmission, and drive axles – is still covered for an additional amount of time. But, the process for filing warranty claims on OE supplier and aftermarket parts may vary depending on the company who made the part, Pasby says.

“[For example], say you’ve got a truck with 300,000 miles on it [and] the starter fails,” Pasby says. “It’s out of Freightliner’s warranty, but BorgWarner still has [a] warranty on it. We submit a claim to BorgWarner.”

Pasby advises he will be switching to a software program to manage much of the warranty tracking process. Prior to that, he has been tracking through daily reports and reviewing every work order “on a daily basis” to spot any potential warranty claims. He is optimistic the new process will help make warranty tracking more efficient and catch additional warranty claims Ozark may have otherwise missed.

Chris McQuillen, warranty manager at Hirschbach, reviews and tracks all warranty work for the dedicated fleet.

“As far as the day-to-day operation of the shops, our shop managers supervise all repair techs and repair orders but I review all repairs to ‘catch’ anything that may be coded incorrectly for our system to create a pending claim,” McQuillen says”

He advises Hirschbach has set a goal to complete 70 percent of all maintenance, service, and repairs in-house. This includes preventive maintenance (PM), warranty and non-warranty work, repairing accident damage, etc. When it comes to dealer relationships as it relates to vehicle service, McQuillen works with OEMs to expedite work and ensure warranties are filed correctly, along with negotiating the best price for parts possible.

McQuillen is also responsible for all of the technician training at Hirschbach.

“I manage our technician training in an effort to have a leg to stand on if a warranty repair is questioned,” he says. “This has also proven to boost our tech efficiency which is key in fleet maintenance.”

When it comes to managing warranty work for Griffin Pavement Striping, Fleet Manager Eric Moore works with a small team that includes the shop foreman and vice president of operations to determine the viability of filing a warranty claim.

“When we discover a need for repairs that may qualify, all of us work with the information we have on-hand with our fleet maintenance system, the type of repair, length of time the vehicle will be out of service, along with any lost opportunity costs that could be incurred,” Moore says. “We then make a unified decision whether we have the vehicle repaired under warranty or if we pay out of pocket and seek reimbursement after completion of repairs.”

Moore confirms Griffin tracks in-house warranties through its computerized maintenance management system (CMMS). He advises much of the fleet’s warranty work is tracked by the dealership, which requires a trusted relationship and thorough communication to ensure the warranty is handled quickly and correctly.

“More than likely, the OEM will be doing the repairs, and it’s a simple matter of having good communication with the service adviser or manager, and the warranty manager,” Moore says. “It definitely helps to have a good relationship with your selling dealer and their team. We have found out first-hand how far that goes when we have had troublesome failures or breakdowns. Having that relationship helped expedite the resolution and repair process.”

Adhering to the vehicle manufacturer’s recommended PM schedules is integral to not only maintaining the vehicle but also adhering to warranty requirements.

For example, “if the engine manufacturer has a requirement that says, ‘In order for my warranty to be enforced, I need to change oil every X number of miles,’ then our PM schedule needs to support that to retain that particular warranty,” Walters says.

PMs are of critical importance to Griffin Pavement Striping, Moore advises. The trucks in this vocational fleet will remain in operation for upwards of 20 years.

“Since forecasted for such a long-term of use, we make sure to maintain the vehicles not only to the manufacturer’s specifications but in most cases our own experience-based schedules,” Moore says. “We factor in idle time, time spent operating at high rpm [vehicles with PTO or hydrostatic drives], as well as actual mileage incurred while operating on the road.”

Moore says vehicles that are still under warranty are sent to the dealer for PMs. This helps to build on the established relationship with the dealer. Due to the nature of Griffin Pavement Striping’s business, Moore confirms other component warranties are often managed in-house.

“We normally will perform all the maintenance on any of the vocational components, since those items are so specialized,” he says. “Any warranty issues that arise are handled on a case-by-case basis with the body builder or component OEM.”

The collection and organization of failed parts

Depending on the vendor, a different process may be required for submitting the warranty claim, conducting the service, and returning the part.

If warranty service is handled at the dealership, the dealer will retain the part, so return of failed parts is a non-issue. Tracking warranty parts returns can become more of a challenge when a fleet opts to handle the warranty service in-house.

“Your business information system should manage that process for you,” Trimble’s Walters advises. “We actually will alert the mechanic to save the part coming off the vehicle, and give the mechanic the option of printing the warranty core tag that goes on the part that he’s removing from the vehicle, because we have to hold those for 90 days in case the vendor providing the coverage requests the part back.”

Ozark’s Pasby says with their current warranty process, Ozark technicians do not necessarily know if a part is under warranty. And they shouldn’t necessarily have to, as long as they follow the proper shop procedures. The fleet has a designated area in the parts room where technicians must place all failed components. Pasby also requests technicians include a tag with the vehicle number to more efficiently track the parts.

“In a perfect scenario, regardless of what they’re repairing, [technicians] should be putting [failed parts] on the warranty shelf, and that’s for me to decide if we need to file a claim,” he says.

Pasby then reviews these components and determines if the part is warrantable. If so, he ships the components back to the suppliers as needed. Some suppliers require the failed part be returned for analysis and to assess that the issue was indeed a defect and not an installation issue, for example. Others do not.

“It’s really a case-by-case basis on who you’re filing the claim to,” Pasby adds. “I know for a fact that ConMet is going to want every seal back. BorgWarner is going to want every starter back, but a lot of components they may not even want back. It really just depends on who makes it.”

Even for manufacturers or suppliers that do not require a failed part be returned, Pasby says he will keep the failed part on-hand until he receives credit for the warranty.

Penske Truck Leasing’s Senior Vice President, Procurement and Fleet Planning, Paul Rosa, confirms their process is similar because sending in the failed parts can assist with diagnosing the issue for future vehicle system or component designs. Due to the volume of warranty claims Penske handles – with the company’s fleet size of more than 320,000 vehicles, Rosa says they will not send in every part.

“We want to be sure we’re giving them parts that can help them deduce what the issue might be,” he says. “While we don’t send every warranty claims part, we certainly do a representative sampling of what they need in order to render some solutions for what’s going on.”

Given the volume of vehicles serviced and maintained through Penske Truck Leasing, if there is an issue with one type of vehicle unit, Rosa advises Penske has the means to offer real-world feedback on vehicle issues.

“One of the things that we provide to many of our partners – meaning the OEMs, the suppliers, the component providers – is early predictive analytics to help identify an issue before it becomes a larger one,” Rosa says. “If you have more of your vehicles operating and they start to develop a problem and we’re finding it when we’re analyzing the work that’s done on a unit, you start to say, ‘Wow, X percent of a brand new unit went into service. Something’s going on.’”

Rosa confirms Penske shares this information with the companies to assist with diagnosing the issue.

“We gather that information, we send it out to the respective OEM, and we start to work together to find solutions,” he says.

This process can also allow those companies to proactively alert other fleets of the issue and can help address future designs of components and systems.

Submitting the warranty claims

Currently, Ozark’s Pasby adheres to the directives of the given manufacturer or supplier to submit claims. This may mean logging into an online portal to file the claim as is the case with Freightliner and Detroit, or it may mean printing off a form, completing it, and mailing the form and failed parts to the supplier, such as with companies like Stemco.

Pasby is hoping with the new TMT Fleet Maintenance business information system his company is implementing there may be a more streamlined process. As it stands now, he must be familiar with and track all of the different warranty claims separately. His filing system consists of manila folders for each manufacturer or supplier. Once a warranty check comes back and clears, he removes the claim from the folder.

Trimble’s TMT Fleet Maintenance solution includes a warranty module that allows fleets to identify, track, and submit warranty claims (warranty claim screen displayed here).Photo: Trimble Transportation

Trimble’s TMT Fleet Maintenance solution includes a warranty module that allows fleets to identify, track, and submit warranty claims (warranty claim screen displayed here).Photo: Trimble Transportation

Penske’s Rosa advises that due to the number of truck manufacturers and component suppliers the organization works with, Penske has built an internal system to manage the various companies honoring warranties.

“We have a very sophisticated in-house-built warranty tracking system that integrates with each one of the partners that we work with,” he says. The appointed team member managing warranties for a given location can go to one computer application to file warranty claims for various companies. Of this in-house tracking system, “it connects to all of them through an electronic interface,” he adds.

Daimler recently launched One-Stop Warranty, which allows warranty claims for both the base warranty and extended warranties from other suppliers to be filed and managed on one portal through the dealer. One-Stop Warranty is monitored through the Daimler Online Warranty Link (OWL).

“Prior to One-Stop, customers were simply charged for the repair, or if the dealer wanted to file a claim to a particular supplier, [the dealer] reimbursed the customer when [the dealer was] reimbursed,” notes David Dole, Director, Customer Service & Warranty for Daimler Trucks North America. “DTNA provides exactly what the supplier is covering during their extension so there is no question what should be filed through OWL and what is the customer portion, if any. DTNA simply passes the One-Stop claims to the supplier for reimbursement.”

This means that a with vehicle under warranty – regardless of base OE warranty or a warranty covered by the OE supplier – the claim would be filed through OWL at the dealership or the fleet, and the fleet would receive reimbursement for the claim when it is filed. Daimler would then work on the back end internally, with their OE partners, to manage the filing process. “The entire DTNA network can file for One-Stop claims, and fleets can file for them too,” Dole adds. One-Stop Warranty currently has the ability to file claims for six suppliers, with plans to add more suppliers by the end of 2020.

Finding the value

Fleets can handle their own warranty work in-house by having technicians certified to manage the work, working with a third-party vendor such as an independent maintenance contractor, or going directly through the dealership.

“If it is an OEM-based warranty or an extended component warranty, those repairs typically end up at a dealer,” Trimble’s Walters says. “And the reason for that is that there’s no investment in stocking parts in an inventory to do those types of repairs. Most fleets will outsource OEM-based warranty and extended component warranty to the dealer that’s providing the warranty coverage on that component on the vehicle.”

Penske’s Rosa confirms their organization uses a combination of services to manage warranty work.

“Some of it is done at [the] dealer, some of it is done in-house, some of it is done by another provider that could be deemed by the component provider or the OEM,” he says. “We actually have all three happening, depending upon what the issue is.”

While many of these warranty claims are handled through a dealership, it can be difficult to quantify the value of that warranty to the fleet, Walters explains.

“The dilemma is that if a dealer performs a warranty, the invoice that comes back has no cost associated with it,” Walters says of warranty claims handled at a dealership. This is why, he suggests, fleets still request details on what the dealer billed the OEM for the parts and service, even though that cost isn’t passed along to the fleet.

“It’s always a struggle of how does the fleet identify the savings,” Walters explains. “There was cost, but there was no cost to the fleet. Our system gives you the ability to input the detail, and we can assign a cost to those details so that when we run unit lifecycle cost reports on an asset, we can look at warranty as a component of that.”

This cost information can then be added to the asset tracking software to calculate the value of the warranty and the number of warranty dollars recovered for each asset.

Having this cost information can provide a full picture of the recovered warranty costs for a fleet. Walter suggests, as a benchmark for a fleet managing assets with a four- to seven-year lifecycle, warranty claims should make up 5 to 8 percent of the total maintenance spend for a fleet.

“That’s what you should be recovering on an annual basis from warranty claims,” he notes.

Where are fleets missing the most of these recovery dollars? Aftermarket warranty recovery, Walters says.

“Rarely do people miss the major components – the engines, the transmissions, the drivetrains,” he says. “Most fleets are really good at catching those major repairs. What they miss is [the] aftermarket parts warranty, which is a huge opportunity that we’re seeing nowadays. A lot of the systems on assets today have long-term warranties.”

He provides LED bulbs as an example, which are often replaced but many times come with an unlimited lifetime warranty.

“We should never be buying and paying for replacement bulbs because the original bulb has a lifetime warranty,” Walters says. “Aftermarket parts warranty identification eliminates and recovers those dollars back to the fleet.”

Aftermarket warranty claims are even more integral to smaller fleets, or fleets maintaining vehicles on an extended trade cycle, since those fleets more often use aftermarket parts.

Source: https://www.fleetowner.com

CUT COTS OF THE FLEET WITH OUR AUDIT PROGRAM

The audit is a key tool to know the overall status and provide the analysis, the assessment, the advice, the suggestions and the actions to take in order to cut costs and increase the efficiency and efficacy of the fleet. We propose the following fleet management audit.