According to US National Academy of Science, “Mobility refers to the time and costs required for travel. Mobility is higher when average travel times, variations in travel times, and travel costs are low.” The dynamics of mobility are undergoing transition and mobility scenario a few years from now would be very different from what we see today. In this article, NRI Consulting & Solutions, part of the Nomura Research Institute (NRI), a leading global management consulting enterprise, explores the new trends in mobility, and how they might impact OEMs in the future.

DRIVERS OF NEW MOBILITY

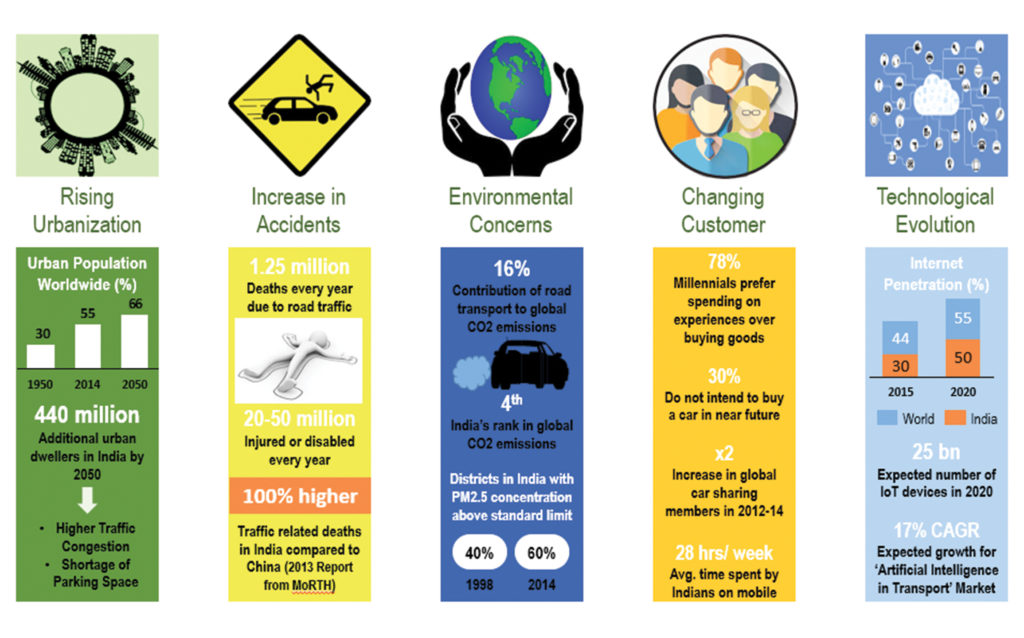

Rising Urbanisation

As per United Nations estimates, 55 % of world population resided in urban areas in 2014, compared to 30 % in 1950 and this number is expected to rise up to 66 % by 2050. India is projected to add 404 mn urban dwellers in this period. This rise has resulted in increased traffic congestion and shortage of parking facilities.

Increase in Number of Accidents

WHO numbers show that more than 1.25 mn people die each year as a result of road traffic crashes and 20-50 mn are injured or disabled. Unsurprisingly, younger population is more prone to rash driving, and road traffic injuries are the leading cause of death among people aged between 15 and 29 years. India sees 100 % more traffic related deaths than China, despite having a much smaller automotive market (as per a 2013 report from MoRTH).

Environmental Concerns

Globally, road transport is responsible for about 16 % of man-made CO2 emissions, as per data from International Organization of Motor Vehicle Manufacturers. Studies show that India is the fourth biggest CO2 emitter in the world. Furthermore, percentage of districts with PM 2.5 concentrations above Indian standard of 40 µg/m3 (WHO guideline is 10 µg/m3) increased from 40 % in 1998 to 60 % in 2014, in part due to increase in road transport vehicles – two-wheeler, cars, trucks and buses – that are a major source of PM emissions.

Change in Customer Preferences

The youth of today is markedly different in its mobility preferences.

Firstly, car ownership used to be a prestige symbol and fulfilled esteem needs. However, the new generation prefers to spend on experiences rather than goods. A 2014 nationwide study of Americans aged 18-34 years revealed that 78 % would choose to spend money on a desirable experience or event over buying something desirable. Another survey found 30 % of them do not intend to buy a car in near future. Consequently, sharing economy is on the rise. Two-fold increase was observed in global car sharing memberships between 2012 and 2014. Thus, there is a clear shift in mindset from car ownership to car access. These trends could appear in India as well.

Secondly, the advent of smart devices and social media has transformed the way people interact with each other and their environment. Today’s youth wants to remain connected at all times and exhibits ‘Fear of Being Offline’. An average Indian spends about 28 h/week on mobile phones.

Technological Evolution

Technology has progressed rapidly in the 21st century, driven by internet penetration, which is expected to rise from 44.3 % to 54.6 % worldwide and 30 % to 50 % in India in 2015-2020. New generation technologies like Internet of Things, Artificial Intelligence and Virtual Reality have heralded arrival of a new era in several sectors, including transportation. IoT is expected to hit the mainstream in the next two to three years and number of smart connected things is projected to grow to 25 bn in 2020. The market for ‘Artificial Intelligence in Transportation’ is expected to register CAGR of 17 % over the next five years.

TRENDS IN FORMS OF MOBILITY

Autonomous Driving

Autonomous vehicles are capable of navigating without any human assistance by sensing the environment, through a complex interplay of sensors, control algorithms and connectivity. The Society of Automotive Engineers (SAE) has defined six levels of autonomous driving, depending on the level of input required from the driver, (2). The most recent breakthrough is the testing of Google’s autonomous car ‘Waymo’ without a driver for assistance, the highest level of automation. Autonomous cars are finding their way into cab hailing fleets of Lyft and Uber. Advanced Driver Assistance System (ADAS) are already present in several cars today. NCAP safety standards will be applicable for assisted driving from mid-2018.

This trend of autonomous driving has also pervaded public transport through concepts such as (a) Hyperloop and (b) Aerial Drones.

(a) Hyperloop

Conceptualised as the ‘fifth mode of transport’ by Elon Musk in 2012, Hyperloop is a proposed system of transport, where pods or containers travel at speeds of up to 1,200 Km/h through low pressure tubes, (3). An electric motor is used to propel the pods initially, after which the low air-resistance in the tubes enables the pods to travel at very high speeds. Hyperloop One aims to have three functioning services by 2021.

Hyperloop provides a lot of advantages over bullet trains – 3X speed, cheaper construction and less expensive for passengers. The challenges of high acceleration for passengers, vulnerability of vacuum tubes and possibility of service disruptions due to minor ground shifts need to be tackled.

(b) Autonomous Aerial Vehicles

Personal and fully autonomous drones with pods for point-to-point transit without a pilot license are set to proliferate civilian travel. Manufactured by China-based entrepreneurs, the Ehang 184 is the only commercial passenger drone available with speeds up to 100 Km/h and can carry one passenger, (4). Dubai is set to become the first city in the world to launch these drones for passenger transport.

Though drones can be developed faster than autonomous cars and are a lot faster as straight line paths can be taken, concerns over air traffic regulations for traffic control, advancements in battery technology, ethical dilemmas in autonomous driving, data security and safety need to be addressed.

Autonomous driving presents a large number of advantages – reduction in accidents, time saving, freeing-up of parking spaces and enhanced mobility for young, old and disabled. Despite that, autonomous driving is not as pervasive as yet due to challenges like cybersecurity, ethical dilemmas in navigation, inability to handle chaotic environments and places, where non-autonomous vehicles also exist.

Personal Public Transport

Public yet personal transport is an emerging trend in mobility due to changing customer preferences in favour of affordable personal transit system for specific routes.

(a) Personal Rapid Transit (PRT)

PRTs combine the exclusivity and privacy of personal vehicles with the efficiency of mass transit. PRTs provide direct, on-demand and point-to-point transit service for groups or individuals in autonomous pods on specific routes. The government of India has recently approved a proposal to test PRT systems from three major global players. PRTs are cheaper and easier to construct than metros as modular parts are used and networks can be easily expanded. Limited capacity and inability to handle individual requests during peak hours can prove to be challenges in large cities. Also, testing at a large scale has not been completed yet.

Connected Living

Cars today have the processing power of 20 personal computers and process 25 GB of data per hour. Further extension to this are connected cars, which have the ability to connect to other cars, infrastructure and a wider network through cloud, generating a huge amount of data. This helps in optimising vehicle performance and minimising accidents and breakdowns. Connected cars provide an end-to-end solution to the passenger through IoT integration, (5). New business models like algorithm-based repair services, smart home integration, infotainment, predictive & context-based services, data feedback to OEMs and road-traffic control have thrived with connected cars. Concerns on cyber security and data sharing, however, need to be addressed.

Shared Mobility

Shared mobility provides access of transport options to passengers for a short period of time without the need of owning a vehicle. Various ride-sharing, renting and cab hailing business models have come up in the recent years. This asset-light model of transport leads to greater fleet utilisation, lowers traffic congestion and mitigates pollution problems. Challenges of passenger security, legality issues, trust concerns with the drivers and preference to own a car in developing countries need to be tackled.

Electrification

Vehicle electrification refers to the use of electricity at varying degrees to propel vehicles. Electrification will likely reduce emissions, improve fuel economy, increase energy security and lower fuel costs. Electrification is viewed as a disruptor of the traditional automotive supply chain. Range anxiety among passengers, lack of charging and support infrastructure, slow charging speeds and large investment required to push adoption are some of the issues that need attention.

IMPLICATIONS FOR AUTOMOTIVE OEMs

The emerging trends in forms of mobility provide an array of opportunities for OEMs to gain dominance in the market, (6).

Extend Existing Capabilities to New Forms of Mobility

Though the new forms have disrupted traditional mobility systems, commonalities exist between traditional cars and new technologies like Hyperloop and Autonomous Aerial Vehicles. Electronic components and lightweight body materials are set to gain more importance in the coming years. OEMs possess capabilities in durable & lightweight body parts, heat-resistant plastics and impact-resistant plastics manufacturing at low costs. This higher focus on cost consciousness by automotive OEMs and OESs, as compared to those in aerospace industry, could provide an opportunity to be the supplier of choice for new-age vehicles like PRTs.

OEMs can leverage their ability of mass manufacturing, coupled with their expertise in aerodynamics, styling & design of interiors, safety and ergonomics to remain an active participant in the development of these new forms. For instance, Mercedes partnered with Lufthansa Airlines for designing world-class interiors. Indian auto trim & body plastics suppliers like Jay Bharat Maruti also supply to Indian Railways.

Expand Through Partnerships & Acquisitions

Industry lines have blurred with global technology giants disrupting the landscape. For instance, Google and Apple have invested in ride-hailing companies like Uber and Didi. At the same time, niche players and start-ups have emerged in this space. Focus on technology, capabilities to build platforms and process large amounts of data are some of their strengths. With more than 100 mn lines of code in the car of the future, software development and expertise in semiconductors, network buses, high-speed processors and algorithm optimisation rather than mechanical integration of components, is going to prove to be a differentiator. OEMs are also keen to acquire mid-sized companies in the embedded software domain to tackle these challenges.

Areas like imaging, radars and camera technology, where the aerospace and defence industry has had expertise traditionally, will gain in importance. Ford and Baidu, each invested $ 75 mn in Velodyne Lidar, a technology company specialising in surveying methods with laser light and sensors.

OEMs can forge partnerships with these niche players to provide a differentiated product to the customer. General Motors, for instance, has bought Cruise Automation – an autonomous driving technology car company for $ 1 bn. Renault-Nissan has partnered with Intel Mobileye for development of ADAS. Daimler has partnered with Matternet, a start-up building autonomous delivery drones for future drone development. VW, BMW and Daimler partnered together to buy Nokia’s HERE maps.

Explore New Business Models to Challenge Traditional Offerings

Consumers will likely think of vehicles as a service rather than as a product. Offerings and new features that enhance experience rather than the product will be the game changer for connected vehicles. Exploring new business models like investing in car sharing fleets, data- and analytics-based services, remote diagnostics, content-based services and also services for in-car entertainment, on-demand food ordering and shopping could be a potential opportunity for OEMs.

General Motors recently rolled out a new dashboard marketplace for in-car shopping. Ford, with its FordPass app for smartphones, provides vehicle information, fuel tracking, parking locations and payment options, thus granting a seamless experience for customers. BMW, through its BMW Prive programme, provides a customised and hand-picked experience to its customers on a regular basis through access to finest luxuries and privileges around the world. Solutions such as Honda Smart Home System (HSHS) envision a zero-carbon living ecosystem, wherein electric vehicles are charged using solar panels in daylight and sell power back to grid, when the power demand is higher and the EV is not being used.

WAY FORWARD

With actors outside the traditional automotive industry disrupting the industry landscape, it is essential for incumbent players to be more responsive and agile. OEMs need to take account of the newer technologies shaping the landscape, zero-in on the relevant ones and make long-term investments for their development. This could go a long way in ensuring continued relevance in the future mobility market.

AUTHOR

ASHIM SHARMA is Partner & Group Head at NRI Consulting & Solutions in Gurgaon (India).

(The author can be reached at mailto:ashim.sharma@nri.com. NRI’s consultants, Deepika Bhat & Mukul Jain made significant contributions to the article.)

By Ashim Sharma

Source: https://autotechreview.com

CUT COTS OF THE FLEET WITH OUR AUDIT PROGRAM

The audit is a key tool to know the overall status and provide the analysis, the assessment, the advice, the suggestions and the actions to take in order to cut costs and increase the efficiency and efficacy of the fleet. We propose the following fleet management audit.