In its endeavour to be the powertrain supplier of choice, Cummins, the global power and technology leader, is working on developing a broad portfolio of technology capabilities so that it is able to offer its customers the right technology suited to their specific markets. In India during the Auto Expo in February this year, the Cummins leadership team made it clear that the US-headquartered company is focused on adding that critical piece of value leveraging on the deep understanding it has built over a century of its existence.

Electrification clearly was the buzzword at the New Delhi Auto Expo 2018. Passenger or commercial vehicles – OEMs showcased to the world their capabilities in the area of electrified vehicles. Cummins, the leading manufacturer of diesel and natural gas engines, as well as related technologies, believes that future vehicles would most certainly be powered by some kind of electrified powertrains. But the transition wouldn’t be as drastic as is being projected by some.

The message Julie Furber, Executive Director – Electrification, Cummins delivered was fairly clear. For decades, the automotive industry has been following the “one size fits all” principle, but that’s not going to hold good in the years to come. The demand will be for multiple solutions – technology and applications will be “horses for courses, not one size fits all,” she said.

ELECTRIC ROADMAP

The company claims it offers the industry the broadest, most energy-diverse power portfolio. And many of those solutions were on display at the Auto Expo, including an electric powertrain for commercial vehicle operations, which is aimed to complement the company’s clean-diesel, near-zero natural gas and diesel-hybrid products.

Even as Cummins is making heavy investments in the electrification of engines, it is aware of the gaps it needs to plug. Towards that, the company is making both inorganic and organic investments. In the past six-odd months, the company has made a couple of acquisitions and will continue to make further investments and acquisitions in the future.

Furber believes her division can leverage many of the skills and attributes from the diesel side. Notably, Cummins’ diesel engine success is not just attributed to investments in engines, but also the sub-systems, including fuel systems, controls, air handling, filtration and emission solutions. Similarly, in the electrification business, the company is already investing in battery, motor and power electronics technology to ensure it develops the right expertise in the sub-systems required for electric powertrains. “We must be able to successfully integrate all the sub-systems together with the powertrains that we make; and be able to service them in all the markets that we operate in,” said Furber.

In October 2017, Cummins announced the acquisition of Brammo, which designs and develops battery packs for mobile and stationary applications. At the end of January 2018, Cummins acquired Johnson Matthey’s automotive battery systems business, and signed an agreement to collaborate on eLNO high energy battery materials. The understanding between the two companies is to collaborate on materials for the future.

The company has clearly devised a detailed strategy on batteries. We asked Furber if Cummins also intends to offer batteries as a solution to the industry, beyond its own internal consumption. Responding in the affirmative, she said Cummins is already selling a lithium-ion battery solution to Raymond forklifts – Toyota’s material handling business. Here too, she drew a parallel to the diesel engine business. Cummins’ components business sells turbochargers to engines made by other manufacturers. That’s the model it wants to pursue for batteries as well.

These are significant investments to further Cummins’ electrification business. Although both these acquisitions are in the battery domain, the company isn’t going to make cells, clarified Furber. The idea is to buy cells from the big suppliers, while Cummins will manufacture the modules, work on battery management software and thermal management to deliver battery packs, she said. Similarly, the company has strategies for other components for electromobility.

From an Indian perspective, Furber is aware of the Indian government’s ambitious plan to move to a complete EV ecosystem by 2030. If not all, certain applications can certainly have a head start. An intra-city bus, which can return to the depot to charge at night, is an ideal application. The right battery size, offering the requisite range and at the right cost, makes good sense. However, forcing the same solution on a long haul inter-city truck without charging infrastructure in place and without sufficient battery technology to carry the load would be jumping too far, she said.

Ultimately, it’s also not just about the technology being viable for the cost-sensitive Indian market. Tim Proctor, Executive Director – Product Management & Market Innovation, Cummins said there’s a need to develop an ecosystem of the supply base. Having in place the right charging infrastructure is necessary, but having the supply base to support electrification of the powertrain is equally important. That’s a critical hurdle that the industry will have to address, commented Proctor. “It’s inspiring that leaders are putting out these challenges, but we have to see how the whole community responds,” he said.

ALTERNATE SOLUTIONS

For now, company officials believe they are still better-off with largely predominant internal combustion engine solutions. But between the IC engines and electrified powertrains, there is a spectrum that is available for exploration. Proctor recognises the fact that there is great potential for hybridisation in the sector. “I think we’ll create opportunities for new products and maybe in some new spaces for us. We don’t think it’s an either or. We see a great opportunity to benefit customers when we make the right blend of these technologies as well bringing electrification to really complement the capabilities and strengths of the diesel engines,” said Proctor.

That aside, the company is also working on fuel cell technologies in addition to its investment in natural gas-based solutions. Furber does recognise that nature gas could be more of a bridge technology, but it does make sense in many markets globally.

Broadly, the company is essentially looking at near zero well-to-wheel CO2 and near zero well-to-wheel NOx emissions. That’s obviously not an easy goal to achieve, unless the source of electricity generation itself is renewable. “It’ not the case yet, but it continues to get cleaner every day. Equally, if you have biofuel and burn it in a natural gas engine, we manage to achieve near zero emissions,” said Furber highlighting the fact that multiple alternative energy sources and powertrain options are in play today. Depending on the availability of the types of fuels, and depending upon the emission types, there is still a big opportunity for IC engines and diverse energy sources to power them.

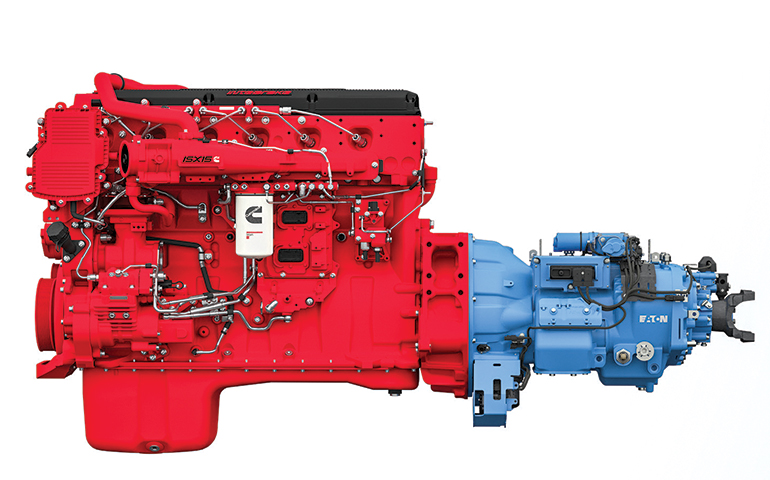

At the Auto Expo, Cummins showcased its intent to evolve into a fully integrated powertrain supplier, and displayed the Eaton Cummins AMT solution. The two companies had signed a JV in 2017 to leverage their respective technical strengths and experience, with a target to become the world’s leading powertrain supplier. The JV’s objective is to deliver the most advanced automated transmissions and develop an integrated powertrain and service network that supports Cummins’ customers, Tom Linebarger, Chairman and CEO, Cummins had said.

INDIA AN EXCITING MARKET

Cummins has had a long association with the Indian industry, starting its operations in 1962. In the current context, the company is well prepared to meet the stringent upcoming emission norms. At the Auto Expo, the company displayed its all-new BS VI emission compliant engines, turbocharger technologies, exhaust after-treatment technologies and solutions for BS VI compliant engines. The BS VI engines promise better performance in terms of increased power & torque density, improved reliability, extended service intervals and advanced telematics offerings, said Ashwat Ram, VP – Engine Business, Cummins India.

He talked about the company’s intention to be a one-stop shop solution provider by offering the complete package of the engine as well as after-treatment system. The new BS VI engine architecture, for instance, is a non-EGR architecture to reduce the system complexities and to provide better value to the customers. Ram confirmed it’s not entirely a new architecture, and is based on platforms that are already sold globally. This engine, in fact, is an evolution of the engine Cummins first produced in 2013 to meet BS VI equivalent emission norms.

Ram also spoke about the single module after-treatment solution, exclusively developed for the BS VI compliant engines. The solution is approximately 60 % smaller and 40 % lighter than competing products in the market, and comes with Cummins’ advanced AUS32 dosing & mixing technologies for driving higher efficiencies in NOx conversion. This is clubbed with smart controls strategy to drive improved fluid efficiency of the vehicle in a variety of applications. Additionally, the company’s experience in SCR technology in the Indian market provides it a definite edge in the BS VI regime, said Ram.

Proctor added, “We may have gained from similar applications of similar emissions levels elsewhere in the world, but it’s important to note that while we launched those products in 2013 or thereabouts that technology hasn’t stood still in the intervening five years. This clearly is not just a copy and paste. What we’ve been able to do is learn how our architecture works, and then leverage not only our experience but bring advances in the technology.” For instance, in dosing systems and catalyst systems, the company has been able to produce a system that not only meets the unique needs of Indian commercial vehicles, but also bring the benefit of proven technology combined with the latest innovations.

CONCLUSION

The company recently opened its largest technical centre at the Kothrud campus in Pune, with state-of-the-art labs, engine test cells and engineering facilities. Confident of continued growth in India, Cummins believes the more stringent emission norms – the move to BS VI – present the company significant opportunities to provide its customers with technologies that will help them succeed in their businesses. To support every global business and product line the company produces, the new facility houses 36 engine test cell slots, two turbocharger rigs, one emissions burner test rig, eight product line specific labs and nine shared services labs.

The new tech centre will also house an electrification team, working not just for India but also globally. The company recognises India is a great source of skills and resources for its global business. India’s electromobility target may be very optimistic, considering the foundations are not yet in place. But there is no doubt that the transition to electric is inevitable, though it will take time.

TEXT: Deepangshu Dev Sarmah

PHOTO: Cummins

By Deepangshu Dev Sarmah

Source: https://autotechreview.com

CUT COTS OF THE FLEET WITH OUR AUDIT PROGRAM

The audit is a key tool to know the overall status and provide the analysis, the assessment, the advice, the suggestions and the actions to take in order to cut costs and increase the efficiency and efficacy of the fleet. We propose the following fleet management audit.