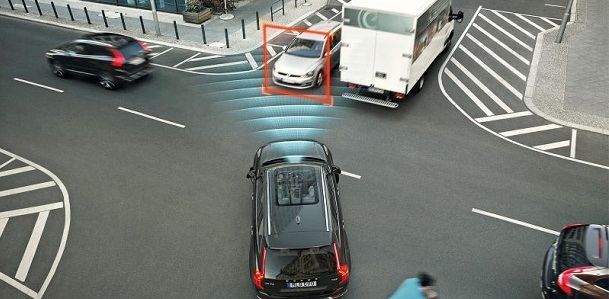

Surging demand for safety features, greater convenience and high efficiency in vehicles is fueling the demand for ADAS.

That’s the view of Dr Anuja Sonalker, founder, CEO at Steer. She estimates that: “The global ADAS market is expected to grow to $80Bn by 2030. Enhancing driver and passenger safety is the number one driver for the ADAS market, followed by convenience, efficiency and economy.” Driven by government mandatory requirements that kick in the next several years this trend is not expected to slow down.

On the advancement of ADAS, Karthik Krishnan, business development manager, ADAS and AV solutions at Germany’s Vires Simulationstechnologie, said: “With the onset of a major global pandemic, investment and hopes for full autonomy with no short term revenue possibilities have gone down significantly. The focus instead has shifted more towards ADAS systems as major automotive OEMs try to catch up with Tesla in creating a software defined car.” The additional safety features offered by Level 2+ ADAS systems already offer significant safety benefits to drivers as well as vulnerable road users such as pedestrians and bicyclists, he added.

“ADAS have been around for over a decade. These systems assist drivers during driving or parking maneuvers increasing safety and comfort for the drivers and passengers,” said Soumendu Chanda, ADAS expert based in the US. Chanda added that in recent years, with the introduction of advanced sensor technologies and superior computing power along with increased safety regulations, has resulted in increased use of these systems. From blind sport monitoring to auto emergency braking, these features are now increasingly being offered as standard on many new vehicle models.

James Hodgson, principal analyst, smart mobility and automotive at ABI Research, said: “The more commoditized ADAS becomes, the more vehicles will feature the technology resulting in map with greater geographic coverage and more frequent updates. Possible services include user-generated maps, real time on street parking, traffic information services and hyper local weather information.” He explained that as ADAS has matured, more functions have been enabled by either standalone cameras or by radar-camera sensor fusion. These camera sensors offer rich semantic insight into the environment or road situation around the vehicle, primarily to enable the obstacle detection and collision avoidance use-case but with an almost limitless scope for feature extraction. By crowdsourcing these insights from numerous camera-equipped vehicles, automakers can develop a wide range of services informed by a near real time, accurate digital model of the world.

Revenue streams

Talking about the increased revenue streams using ADAS technology, Hodgson said: “ADAS and active safety technologies are becoming increasingly commoditized. As every OEM either sources or develops ADAS to pass common tests developed by testing agencies such as EuroNCAP or IIHS, ADAS have ceased to be differentiators and have become common to most new vehicles, often featuring as standard equipment. This trajectory of market maturity is common to all safety focused technologies and can be observed historically in ESC, airbags and inertial reel seatbelts. Therefore, the best way for OEMs to monetize active safety/ADAS technology is to monetize the data that the enabling sensors generate.”

Chanda feels that: “The cost of these ADAS systems is a fraction of what is needed for a full autonomous (SAE Level 4/5) systems and the risks to deploy and validate at scale are lower. The potential benefits to the customers are huge and will continue to attract next generation of vehicle owners. For OEMs, these systems offer new opportunities to attract a next generation of tech savvy customers and grow new revenue streams. With the improvement of connectivity technologies in vehicles, OEMs can also use OTA programming to deploy or update ADAS software throughout the lifecycle of the vehicle, thereby increasing customer satisfaction.”

Sonalkar said: “This remarkable shift has caused a gentle push by the industry not only towards ADAS sensors and systems. Surround cameras are becoming more standardized, drive and shift by wire systems are being implemented across several lines not just the top of the line models. Convenience features like Key as a service, dynamic warning systems during drive like LKAS are no longer options, and who knew that dynamic suspension handling can be an absolutely must need feature once you try it.” She adds that these features are clearly revenue building tools.

In-car payments

Back to recurring revenue streams are quickly taking root with drivers can now pay for power seat options, remote parking, remote keys, and more not while taking possession of the car but on a usage basis or a flat monthly fee. This by far, is the strongest residual revenue that ADAS has seen since airbags were made mandatory.

According to Krishnan: “There will be a significant investment in Tier 1 companies to provide integrated platform solutions while major OEMs create new organizational structures with cross-functional agile teams that are software driven. This is a good time for revenue growth in companies that are involved in the areas of providing simulation tools on the desktop and cloud, in vehicle operating system software, mapping technologies and advanced sensor and Machine Learning algorithm development.”

Chanda concluded that: “While these systems are not perfect yet, they are increasingly seen as a necessary by many customers owing to their many benefits. According to The National Highway Traffic Safety Administration (NHTSA), front collision warning (FCW)and autonomous emergency braking (AEB) systems has a potential to reduce 52% of all police-reported crashes involving pedestrians and 90% of fatal vehicle-pedestrian crashes.” These driver assistant features not only increase the safety level and decreases insurance costs but advanced ADAS will eventually become the main feature differentiating automotive brands, as well as one of their most important revenue sources.

Source: https://www.tu-auto.com

CUT COTS OF THE FLEET WITH OUR AUDIT PROGRAM

The audit is a key tool to know the overall status and provide the analysis, the assessment, the advice, the suggestions and the actions to take in order to cut costs and increase the efficiency and efficacy of the fleet. We propose the following fleet management audit.