From materials handling workhorses to voice-activated picking systems and DC reconfigurations, let’s take stock of the warehouse solutions powering e-commerce success.

Art Eldred recalls sitting in the audience at a recent industry conference session listening to a major department store chain executive talk about the importance of data analytics to e-commerce inventory strategy.

“He talked about a consumer in Atlanta ordering a tie online. Should the retailer ship the tie from a local store, the nearest warehouse, or its Manhattan store, which has an overabundance of ties that they’ll have to mark down?” says Eldred, client executive, systems engineering, at systems integrator VARGO in Ohio.

“E-commerce strategy used to be about just transportation,” he adds. “Now, transportation, delivery time, and profit factor into the analytics.”

All these factors combine with ongoing, explosive e-commerce growth and a labor shortage to drive continual innovation in warehouses coast to coast. Many of the innovations relate to three areas: technology, equipment, and warehouse size and layout.

Lack of labor, or increasing competition for existing labor in distribution center-dense markets such as Ohio and Florida, is forcing warehouse operators to adopt technology that can supplement work done by humans.

“Four years ago, innovation was about how to become more efficient,” Eldred says. “Today, a lack of labor while trying to get volume out the door and delivered is driving innovation.”

Some of this innovation comes in the form of automated guided vehicles such as “Chuck” from 6 River Systems in Massachusetts. Chuck and other vehicles like it act as “cobots,” navigating warehouse floors alongside staff to improve order-picking efficiencies.But Chuck does more than just transport bins from pickers to packing stations so employees do less walking and are more productive. Chuck is a “thinking” member of the warehouse team.

“Chuck takes advantage of artificial intelligence to develop the most efficient pick path,” explains Fergal Glynn, vice president of marketing, 6 River Systems. Chuck’s cloud-based software also uses artificial intelligence to spot trends that can help optimize inventory placement in a facility.

That’s not to suggest that there’s a robot in every warehouse, though. Glynn says his company’s technology isn’t yet widely adopted, although he believes that companies are slowly becoming less skeptical.

Supermarket chain Kroger is anything but skeptical. The company recently announced the location of its fifth automated robot warehouseto fulfill online grocery orders. Kroger plans to open a total of 20 of these warehouses that use digital and robotic technology in partnership with UK online grocer Ocado.

Even so, Kroger is atypical. “There’s a lot of good warehouse technology out there, but many companies are standing on the sidelines, still apprehensive about it,” says Russell Wells, director of business development at third-party logistics provider Kenco Logistics.

That apprehension is one reason Kenco introduced a Supply ChainInnovation TestLab in October 2019. The facility, located at the company’s Chattanooga, Tennessee, headquarters, evaluates and assesses new technologies outside of a live operation.

You Wear it Well

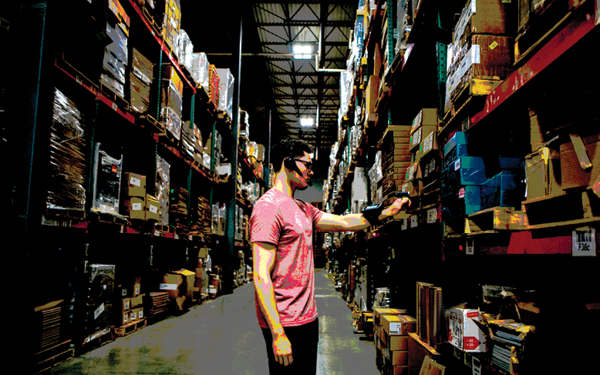

Innovations continue in wearable technology as well, including finger scanners, wrist screens that display instructions, and headsets for voice-directed picking, putaway, and replenishment.

“These innovations leave workers with both hands available to scan, verify, and collect,” explains Mark Wheeler, director of supply chain solutions for Zebra Technologies Corporation in Illinois.

More companies are also analyzing data gathered by increasingly sophisticated software to generate a perfect order report.

“Rather than run inbound, outbound, and order fulfillment rates, companies want to know more about orders where everything went right,” says Tom McFadden, a partner at Columbus Consulting. “Cost per order isn’t the best metric, because reducing that cost won’t produce the perfect customer experience. Take care of customer service and cost will take care of itself.”

There’s innovation in materials handling equipment as well, whether it’s forklifts, conveyors, or racking products. This equipment not only needs to help facilities pick and pack more efficiently, but it has to do so in smaller spaces.

“Companies are shifting to smaller facilities closer to customers,” says Brian Neuwirth, president of UNEX Manufacturing, a picking solutions company. “These facilities hold the same merchandise as larger warehouses, but in smaller quantities.”

UNEX’s SpeedCell high-density storage product responds to this trend by optimizing storage space within racks. Vertical storage units suspended from steel tracks can compress 200 feet of rack or shelving into 40 feet of storage space with more pick facings and greater SKU density.

As fulfillment space requirements grow in environments that also ship high volumes on pallets, there’s an increase in the number of conveyors moving goods from high-volume sections to the e-commerce fulfillment area. Equipment is getting smaller as well, because of low-level unit picking and other needs. Safety-focused proximity sensors on equipment and people are also more prevalent.

“The most common approach is to put a proximity monitor on a piece of equipment plus sensors on badges and vests that pedestrians wear,” Wells says.

Calling for Backup

Forklift and other equipment batteries are getting smaller and more powerful, which reduces the amount of storage needed for backup power. A reduced battery storage footprint also contributes to trends in warehouse size and configuration.

“We see a push for higher ceiling heights and support column spacing that’s in line with automatic guided vehicles,” says Tray Anderson, logistics and industrial service lead, Americas, for commercial real estate services firm Cushman & Wakefield in Chicago. Wider column spacing—50 feet by 50 feet for example—allows more space configuration and layout flexibility.

The trend toward smaller warehouses in more locations is a key indicator of how companies have changed the way they approach e-fulfillment in recent years. “Before e-commerce, warehouses employed a hub-and-spoke system, with a large facility distributing a significant volume of products to brick-and-mortar retail stores,” notes Joseph McKeska, senior managing director at A&G Real Estate Partners, Chicago. “Today, it’s more of a spider web. Large warehouses still supply stores, but there are also smaller fulfillment centers plus some distribution from stores.”

Ongoing warehouse innovations will continue to help weave and strengthen that e-commerce fulfillment web.

Source: https://www.inboundlogistics.com

CUT COTS OF THE FLEET WITH OUR AUDIT PROGRAM

The audit is a key tool to know the overall status and provide the analysis, the assessment, the advice, the suggestions and the actions to take in order to cut costs and increase the efficiency and efficacy of the fleet. We propose the following fleet management audit.