During the past few years, the warehouse automation market has seen double-digit growth rates driven in part by the rise of e-commerce and omni-channel retail, finds new research from market intelligence firm Interact Analysis.

Consumer demand for faster and cheaper online delivery options has many retailers investing in warehouse automation to cut order processing times and to cope with the increasingly complex network of distribution channels.

Labor availability has also been a significant driver for automating warehouses, the research finds. Recruiting and retaining qualified staff is plaguing retailers and manufacturers alike.

This especially affects companies exposed to e-commerce, where demand is more difficult to forecast and seasonal spikes can be several times higher than the rest of the year. Many retailers and manufacturers have implemented automation to alleviate these pressures.

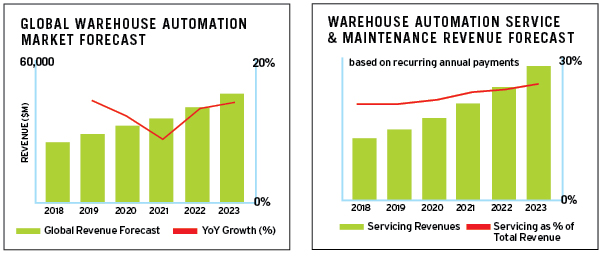

The research report forecasts that the warehouse automation market will grow at a CAGR of 12.6% over the next five years; however, it also predicts a temporary dip in revenue growth between 2020 and 2021. With growing trade tensions between the United States and China, coupled with slowing demand in Europe, the global economy is looking increasingly vulnerable and many businesses are delaying capital expenditures. This is reflected in warehouse automation vendors reporting a sharp drop in orders.

The Interact Analysis report also provides insight into slowing market growth. With forecasts demonstrating the potential to slow in 2020 and in particular 2021, service, maintenance and aftermarket sales will become an increasingly important part of system integrators’ business models (see chart).

Service and maintenance contracts are paid on a predictable and recurring basis, which means that as the installed base increases, revenues generated from service and maintenance contracts also increase over time. This alleviates some of the pressures from weaker order intake in the short term.

Furthermore, while typical margins for equipment sales tend to be between 3% to 5%, margins for service and maintenance can be as high as 15%, which has a positive impact on profitability.

Source: https://www.inboundlogistics.com

CUT COTS OF THE FLEET WITH OUR AUDIT PROGRAM

The audit is a key tool to know the overall status and provide the analysis, the assessment, the advice, the suggestions and the actions to take in order to cut costs and increase the efficiency and efficacy of the fleet. We propose the following fleet management audit.