Business Fleet’s sister publication, Automotive Fleet surveys commercial fleet managers each year on personal use charges and policies. In this year’s survey, fewer respondents were lenient on the idea of granting anyone other than the employee the ability to drive a fleet vehicle for personal use.

As unbelievable as it may seem, many fleets, large or small, do not have a policy regarding personal use of company-owned vehicles. Failing to have policies and procedures “give the employee the feeling of having free rein when it comes to use of a company vehicle,” according to Nicole Long, senior vice president of Brown & Brown of Florida Inc., an insurance and risk management firm.

According to Bill Stueber, regional vice president of Merchant’s Fleet, a fleet management company, many fleets have never even thought about the need for such a policy. “From a safety and liability perspective, they need to have some type of policy and it needs to be written down and signed by the affected employees.”

Stueber adds that the policy should include specifics about what employees can and cannot do. Owners often think that the employees understand that although they can take the vehicle home, they cannot drive it for personal use. “From an insurance perspective, did you tell the employee that? Were they aware of the policy? Did you have it in writing?” he says.

Common Practices

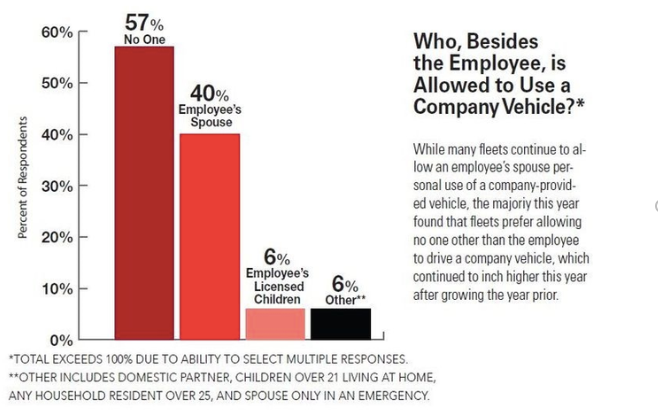

While there is no set formula for what to include in a personal use policy, there are some common things to consider. In addition to the employee, will the spouse or children be allowed to drive the vehicle?

According to data from Business Fleet’s sister publication, Automotive Fleet, 40% of fleets surveyed (see chart) allow an employee’s spouse to drive the vehicle, while only 6% allow an employee’s licensed children. Long says the best practice is “not to let the spouse or any family member drive the vehicle.”

Long says many policies have a provision that any driver must be over the age of 25. It goes without saying that anyone who is going to drive the vehicle must have a valid driver’s license.

Both Stueber and Long advise that the fleet owner check the motor vehicle records for anyone who will be driving its vehicles. The MVRs should be obtained initially and then reviewed annually.

The fleet can set time parameters for various violations. For example, someone who has had three speeding infractions less than 20 miles over the posted speed limit in a three-year period should consider preventing this person from driving a company-owned vehicle. Some fleet owners check MVRs as far back as five to seven years, while others just look at the last three years.

Other Restrictions

In addition to checking MVRs, the fleet owner can set policies for other things based on their risk tolerance, Long says. This would include things like pulling a trailer or a boat, having infants in the car, or taking a vehicle across state lines.

The fleet owner should consider setting mileage limits for personal use of a company vehicle. The policy should also address cell phone use and any other distracted driving behaviors.

“All of this should be spelled out in the employee handbook or the fleet safety policy, because no what matter what when someone is driving a company-owned vehicle and is involved in an accident — even if it is not on company time — the accident would be placed on the employer’s insurance policy,” Long said. This means the employer’s insurance and ultimately the employer would be responsible for paying for repairs, damage and penalties.

Charge for Personal Use?

There is some question about whether an employee should have to pay in order to use a company vehicle for personal use. One reason is because the IRS says the use of a company vehicle for personal use is a fringe benefit and is taxable.

“If you use the vehicle solely for business there is no issue,” Stueber says. “But if you drive around on the weekend or use the car for vacation or to go to the grocery store, it will be considered a fringe benefit,” Stueber says.

Some fleets are setting monthly fees for personal use of company-owned vehicles. “It can be $100 to $500 and is typically done as a payroll deduction,” he explains. The employee gets use of a car — usually including having maintenance, gas and insurance paid for — and the fleet gets to offset some of the cost of the car.

Tools to Help

The biggest mistake most fleet owners make when it comes to personal use of company-owned vehicles is not paying attention to the MVRs. MVRs need to be checked when the employee first gets use of a company car, and then reviewed at least yearly, Long says.

Fleet owners can purchase programs that monitor MVRs on a daily basis. “If the employee were to get a speeding ticket and it shows up on the MVR, the program would let the employer know immediately via an email stating that an infraction occurred,” Long says.

The other way fleet owners can protect themselves is by installing a telematics system for the fleet. “This allows them to monitor speed, hard braking, hard acceleration, and can track where the employee is,” Long says. She says the employer can use the information from the GPS to set up a reward system for drivers who are following the set guidelines.

Another option is to install a camera-based safety system in the vehicles. The recorded video is an added resource to determine fault for a crash. “We can tell if it was distracted driving and also tell if it was not the employee’s fault,” she says.

“Many employers are not spending money on cameras, GPS or monitoring MVRs, but those things make a big difference from a safety and loss prevention perspective,” Long adds.

Fleet owners might want to consider these investments because recently there have been increases in auto insurance on the commercial fleet side anywhere from 20% to 200% if a company had bad losses. “It is very important to mitigate your losses on the fleet side,” Long says.

The Flip Side

While it is important to have policies and procedures in place for personal use of company vehicles, it is equally important to have policies and procedures for employees who use their own vehicles for company business.

“The reason this is important,” Long says, “is if the employee is driving his or her vehicle for the company and gets into an accident, while their insurance policy is primary, once those limits are exhausted the employer’s insurance policy can be tapped.”

In order to mitigate the risk, the business owner needs to make sure that they have employed safe drivers. The MVR is a good tool here and it can be used to check the driving record of potential and current employees just as it might have been used to check the driving records of employees and their family members who might be driving a company-owned car for personal use.

“A lot of employers don’t understand that [the accident] can come back to them after the policy limits of the employee’s personal auto policy are exhausted,” Long explains.

A good way for fleet owners to protect themselves is by insisting employees who are driving their own vehicles for company use carry high liability limits on their insurance policies. Those limits should be at least $250,000/$500,000 according to Long. “The higher the limits on the employee’s insurance policy, the less liability it puts on the employer,” she explains.

Top Down Support

Regardless of the steps a fleet takes to mitigate risk, “it is important that the rules and regulations come from the top of the company on down,” Long says.

“If the owners and managers are not on board and they are not preaching safety every day, the employees will not take it seriously. It is very important to be consistent in the messaging. Companies that are consistent are the companies that are doing well from a loss reduction standpoint.”

MVR Checks: What to Look for

Fleet owners should check the motor vehicle records for anyone who will be driving its vehicles. Common things to look for on a person’s MVR include:

- Type of license

- Status of license

- Number of violations

- Severity of violations

- Frequency of violations

- Number of accidents

- Restrictions to license

Information from the MVR that should raise red flags about whether to allow someone to drive a company vehicle for personal use — or at all — include:

- Violations for driving while intoxicated or impaired

- Speeding more than 20 miles over the posted speed limit

- Driving on a suspended license

- Reckless driving

by Denise L. Rondini

Source: https://www.businessfleet.com

CUT COTS OF THE FLEET WITH OUR AUDIT PROGRAM

The audit is a key tool to know the overall status and provide the analysis, the assessment, the advice, the suggestions and the actions to take in order to cut costs and increase the efficiency and efficacy of the fleet. We propose the following fleet management audit.