Here’s What Fleet Managers Want in a Vocational EV

Full electric vehicles have neither emissions nor exhaust systems that ultimately require repairs. There are no fuel expenses, which represent 60% of the operating costs of a conventional powered fleet vehicle.

There is a growing number of electric vehicles and hybrids in the marketplace. When you look at OEM future model cadence, more and more future product is forecast to be either full battery-electric or hybrid.

From a fleet perspective, there are many advantages to EVs. First, maintenance costs for EVs are roughly 30% less than a conventionally powered vehicle that uses gasoline or diesel.

Full electric vehicles have neither emissions nor exhaust systems that ultimately require repairs. There are no fuel expenses, which represent 60% of the operating costs of a conventional powered fleet vehicle. The lack of an internal combustion engine means oil drain intervals are a thing of the past.

In addition, because EVs have regenerative braking (using the electric motor instead of the friction brakes to slow the vehicle), brake life has the potential to be longer on EVs. Hybrids and EVs will go a long way toward attaining corporate sustainability goals. Also, EVs or electric-powered auxiliary equipment offer application advantages, such as the capability to extend work hours in residential neighborhoods by not violating the noise abatement ordinances.

This doesn’t mean that EVs are completely maintenance-free. While most EVs do not have transmissions requiring maintenance or fluid changes, there are still battery and inverter cooling systems which require fluid changes, and there will always be a need for regular tire rotations. Plug-in electric hybrids still have gasoline engines that require scheduled maintenance, along with other associated systems, such as fuel, emissions, and exhaust.

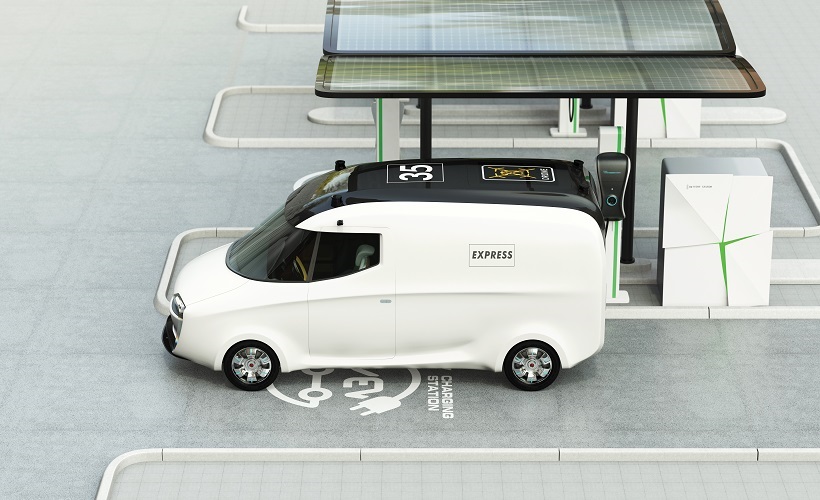

Most EV products coming to market seem to be geared toward retail buyers and are not suitable for most vocational applications. Fleet managers want EVs that are configured the same as traditional vocational vehicles, such as a compact cargo van, full-size van, or a 1/2-ton pickup. Historically, EVs have been a tough sell in the vocational market with companies taking a wait-and-see approach.

Due to past missteps, fleet managers want to see more years of experience with EVs in actual fleet service to determine duty cycle applicability and true total cost of ownership (TCO).

What OEMs & Modifiers Need to Do

Every month, I communicate with dozens upon dozens of fleet managers via e-mail or over the phone. I am connected to more than 7,000-plus fleet professionals via LinkedIn, most of whom I have gotten to know personally after being in the industry for multiple decades. Here is what they tell me that OEMs need to do before they will acquire a vocational EV. First, not every fleet application can be fulfilled by an EV.

On average, the rule of thumb is that only 12% of the vehicles in a diverse fleet can be electrified based on today’s battery technology. With this as a baseline, what vocational fleets want is the ability to operate a vocational EV anywhere they operate a conventional-powered vehicle.

Fleet managers want a real-world electric-only drive range of 200-250 miles, which is the absolute minimum, with ideally a 300- to 400-mile range to alleviate range anxiety and pushback from drivers. In real-world use, many fleets report that they are only able to achieve 70% of the advertised range due to operating in a start/stop environment, varied terrain, hauling max loads, and congested traffic conditions.

Employees who have to drive long distances or cover large territories are reluctant to use an EV, but recognize that a hybrid powertrain can be a viable alternative. However, most hybrid body configurations do not fit their fleet applications. The ideal EV application is operation from a centralized base of operations to take advantage of off-peak charging.

This discussion segues to another challenge for vocational fleets, which is the limited charging infrastructure. Many drivers have large territories whose calls vary day to day and are concerned about finding a convenient charging station when needed. A vocational EV must have the ability for quick charging to minimize the disruption from recharging during work hours.

The main obstacle to acquiring full-electric EVs is the upfront acquisition cost, decreasing federal and state incentives to offset the high cost, an unknown TCO, and weak residual values. There is also a fear of the unknown of whether the vehicle will be truly able to fulfill the daily fleet application.

Other concerns include an uncertain battery life and managing mixed fleet maintenance with limited national account support capabilities for EVs. There are legitimate concerns about the limited number of third-party repair technicians who are qualified to work on EVs.

When calculating TCO without any extraneous biases, the relatively cheap cost of fossil fuels presents a cost-effective TCO alternative to EVs. The TCO of an EV should not only include the mobile asset, but also the cost of dedicated charging stations at either the driver’s home or a centralized location.

Other friction points to EV adoption include lukewarm management and driver interest at some companies. There are also concerns about the financial stability of the some EV companies. In the past several decades, many suppliers in this segment have gone belly up, creating difficulties for customers operating orphan EV models.

Lucrative Vocational EV Market

Companies able to address and resolve these obstacles will find a receptive and lucrative vocational fleet market. The commercial fleet market wants EVs as evidenced by the increased number of national fleets that are adding low- or zero-emission equipment requirements into RFPs. If you catalog all the fleet applications ideal for EVs, it is breathtaking.

For instance, it includes shuttles for university, government, and corporate campuses; electric utilities and cooperatives; patrol units for security companies, delivery vehicles for pizza chains, or ground maintenance.

Other EV candidates are local use fleets that operate in small, well-defined areas, municipal parking enforcement, use at large malls for security, and OEM dealers who operate customer shuttle services. EVs are a cost-effective vehicle for the growing direct store delivery (DSD) system, which involves delivering product from a supplier/distributor directly to a retail store, bypassing a retailer’s distribution center. In fact, any fleet domiciled at a central location that operates within a 100-mile radius is an ideal EV candidate.

There is a lucrative market is for vocational EVs for manufacturers who can successfully address these objections. After all, the essence of any sale is overcoming the objections.

Let me know what you think.

Author

Mike Antich

Editor and Associate Publisher

Source: https://www.automotive-fleet.com

FLEET MANAGEMENT AUDIT

Fleet management is the use of a set of vehicles in order to provide services to a third-party, or to perform a task for our organization, in the most efficient and productive manner with a determined level of service and cost.

Fleet management activities are shown in the following graph 1:

Graph 1: fleet management activities

The proposal audit analyses and assesses all fleet management activities shown in the graph 1, and its main goals are:

- Know the overall status of the fleet management activities

- Provide the analysis, the assessment, the advice, the suggestions and the actions to take in order to cut costs and increase the efficiency and efficacy of the fleet management activities

With the information obtained, we’ll elaborate a report that holds the overall status of the fleet management as well as the suggestions, recommendations and the measures to take in order to cut costs and optimize the fleet management activities.

CLICK ON THE FOLLOWING LINK TO DOWNLOAD THE PROPOSED FLEET MANAGEMENT AUDIT: