The fleet management industry is evolving its offerings. Big data analytics lies at the heart of moving from a market worth $13 billion today to one worth $50 billion already by 2020.

Companies offering fleet management, like TomTom and FleetMatics, are turning your data into a golden goose that will grow their revenue this year, next year and for many, many years to come.

Before the end of 2020, the current $13 billion market will grow to $50 billion, as fleet management spreads beyond the roughly 20% of the fleet market, which is currently serviced by their solutions.

The industry – also referred to as telematics – is standing at the gates of its golden fourth age, which is about harnessing the power of the growing Internet of Things through big data analytics.

The result is new products such as updated benchmarks and KPIs applicable across numerous industries, and a developing business model that focuses more on recurring revenue.

The explosive market growth also means that M&A (mergers and acquisitions) activity revolving around acquiring technology and client bases is likely to increase. This is especially true for ‘the big four’ in the space.

Explosion in data over four ages of fleet management

Fleet management is based on the gathering of GPS and vehicle data. It is a relatively young industry, which has seen rapid growth, and can be split into four distinct ‘ages’.

- First age (2000-2005): Focuses on safety, navigation and fuel management

- Second age (2005-2010): Vehicle diagnostics, maintenance and order management

- Third age(2010-2015): Driver behaviour, prognostics and usage-based insurance

- Fourth age(2015- ): Dealership network intelligence, big data and business intelligence

Over time, the amount of data generated by telematics companies has grown almost exponentially. This is, in part, due to the growing number of sensors in vehicles, more fleets using telematics solutions and deals with vehicle manufacturers.

For example, TomTom has deals with the likes of Nissan, Renault, FIAT and Daimler that all include its products in some of their vehicles.

Bringing your data back home – again and again

Another defining development has been a shifting focus on core markets. Early on, fleet management was focused on selling hardware to end-users.

That gradually changed into a mixed of B2B and B2C focus.

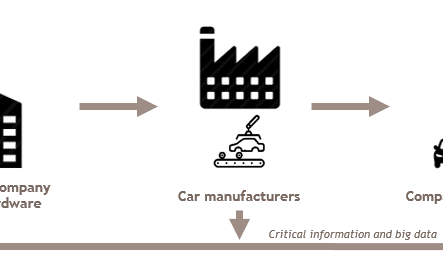

Today, the industry has moved to a business model that could be described as B2B2C.

Behind this alphabet soup lies the fact that telematics companies are selling GPS and telematics products to businesses, such as car manufacturers and fleet managers.

The products then generate a revenue loop.

Business to business deals often involve some sort of exchange of data generated by these companies’ vehicles, potentially augmented by data generated by products sold to end-users.

Gathering, curating and analysing the data makes telematics companies able to create benchmarks, KPIs and business insights, which can then be sold to both industries and end-users, who generate new data for updated KPIs, and so forth.

Industry set for continued growth

The B2B2C model generates more recurring revenue than the industry has previously seen.

Collecting and analysing the data is not cheap. However, it is very easy to scale these operations, without seeing equal rise in costs.

Currently, telematics companies service approximately 20% of the world’s fleet market. While this is enough to generate some profit, reaching critical mass, which is forecast to be around 40%, will see profits explode.

Growth figures indicate that this will be achievable. North America, which is the biggest market, is likely to see double-digit growth for the near future.

At the same time, many industries are realising the benefits of telematics and starting to invest in these kinds of solutions.

The ability to track vehicles, make more efficient use of them, lower maintenance and repair cost, and now also compare your performance with other parts of your industry has industries like construction, waste management, retail and public transport, just to mention some, very excited.

This is part of why I agree with industry analysts who project the market size to reach around $50 billion by the end of 2020.

Big four in hunt for same capabilities

While there are many companies involved in telematics, four could be said to dominate above all others.

The ‘big four’, Telematics, Fleetmatics, Telenav and TomTom, have all been pursuing growth through M&A activity over the last few years.

Judging on their activity, as well as on their R&D (research and development), four core elements/services are important:

- Convenience and entertainment: Capabilities like real-time navigation, caretaker communication services and in-car entertainment

- Vehicle diagnostics: On-quest diagnostics, vehicle sensors and fuel consumption monitoring

- Safety and security: Driver feedback, customized insurance, safety and emergency services

- Value adding services: Gathering driver information, creation of KPIs, reselling and creation of big data

It has led to a number of deals that have been based around two clear, strategic goals.

Technology acquisitions: A number of acquisitions by the big four, as well as other companies in the space, have been of companies offering various technological solutions. This includes big data capabilities.

Customer acquisitions: Especially the big four have been making strategic acquisitions based on consolidating or expanding their presence in certain geographic areas. These deals have been about acquiring customers.

On a side-note, the EBITDA multiples of deals in the space have been 14 on average, compared to 12 for the technology, media and telecoms space in general.

Future ditches drivers

Judged on current developments, continued high levels of M&A activity is likely for the foreseeable future. Both acquisition of customers and expanding technological offerings will drive M&A for the larger companies in the space.

Another trend set to continue is the increasing amount of data available.

To take an example from the aircraft industry, a Virgin Atlantic Boeing 787 supposedly generates half a terabyte of data per flight.

While cars, trucks and other road vehicles are unlikely to reach similar levels – at least in the short term – finding ways of efficiently storing and analysing the increased amounts of data could be an area, which will generate a number of acquisitions.

Another trend is that vehicles will start gathering different kinds of data. This will include data about road conditions, congestion and surface details. It could also be gathered real-time.

I believe that the fifth age of fleet management, which could start around 2020-2022, will involve real-time virtual maps. At the same time, it is likely to involve less and less human drivers, as driverless vehicles become commonplace.

I am not alone in this vision. For example, TomTom has already spent five years preparing for a future where driverless vehicles can react in real-time to the world around them.

“You need a living map, one that is always being updated. TomTom is building a system within which a sensor-equipped car can compare what is on the map with what it sees on the road. Discrepancies will be reported, verified and updated info distributed to every car on the road,” TomTom CEO Harold Goddijn recently told Wired.

(LINK: http://www.wired.com/2015/07/tomtom-alive-getting-self-driving-cars/)

Head of BDO Corporate Finance, Denmark