FLEET MANAGEMENT TRENDS

TENDENCIAS EN GESTIÓN DE FLOTAS

It’s hard to predict what the future of fleet will look like, but following current trends may help create a window that can provide clues to the direction it may head. The automotive industry is in the midst of undergoing changes that will greatly impact the future of fleet management as we know it. While certain developing technological concepts such as autonomous vehicles aren’t anything fleets need to immediately worry over, changes are happening at a rapid pace.

Fleets that lag behind current trends may ind themselves scrambling to become relevant in an industry that continues its march forward. Keeping a close eye on incoming innovations, and simply being prepared for industry changes, can help fleets obtain a better sense of what their operations may look like in the future.

Automotive Fleet reached out to several major leet management companies, including Merchants Fleet Management, Donlen, Enterprise Fleet Management, Mike Albert Fleet Solutions, Element Fleet Management, ARI, EMKAY, and Wheels Inc. to help create a sense of what some aspects of the future of leet will look like in the coming decade. Some key ideas mentioned were the evolution of the leet manager, new methods of mobility, and the continued strength of telematics.

THE FUTURE ROLE OF THE FLEET MANAGER

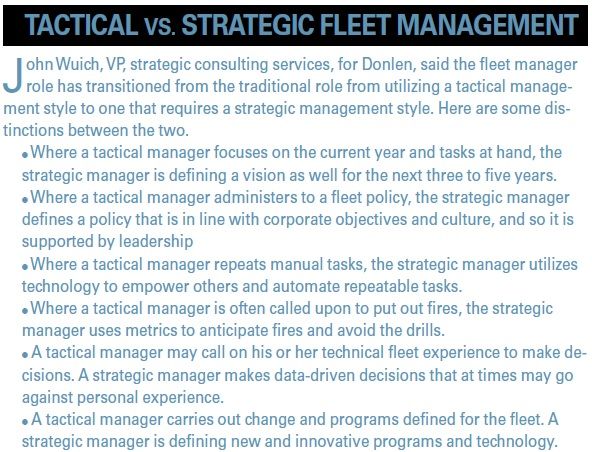

The average fleet manager today has a number of duties that need to be juggled on a day-to-day basis. What exactly deines that role is starting to change as it heads into the future. The role of the traditional leet manager is changing,” said John Wuich, VP, strategic consulting services, for Donlen. “It is being inluenced by technology and data and analytics; and the mobility revolution and autonomous vehicles loom ahead.

In order to be successful given these inluences, a fleet manager more than ever must understand and align with company product lines, objectives and culture. In turn, the role must evolve.” Current fleet ideas are helping forge a new future of Fleet management. “Today’s fleet manager is working in an environment that has successfully outsourced or streamlined the tactical side of managing their leet,” said Laura Jozwiak, sales and client relations for Wheels Inc. This has allowed them to expand their scope globally, impact more internal strategic initiatives, leverage the data we produce in leet to improve productivity, costs and safety, as well as share new ideas that are emerging from mobility as a service (MaaS).”

Processing relevant leet data and analyzing it critically is no longer a far-fetched idea; fleets are able to do this now. And future fleet management advancements only bolster the capabilities of the industry. Rob Bradley, sr. strategic consultant for Element, spoke on the topic of data and its place in the future of Fleet. “We have a wealth of data from drivers, and using that data and getting in front of problems before they happen is starting to become more the standard,” said Bradley. “his is particularly noticeable in the safety space.

As accident-prevention features are starting to become more available and less cost prohibitive, fleet managers are looking to these options as a way to invest in their drivers from both a safety and long-term cost perspective.” Due to the continued emphasis on data analytics and being more strategic minded in the future, the leet manager of tomorrow may be better deined as an IT professional rather than someone in the automotive space. he diligence toward collecting and evaluating data will become more important than ever.

As accident-prevention features are starting to become more available and less cost prohibitive, fleet managers are looking to these options as a way to invest in their drivers from both a safety and long-term cost perspective.” Due to the continued emphasis on data analytics and being more strategic minded in the future, the leet manager of tomorrow may be better deined as an IT professional rather than someone in the automotive space. he diligence toward collecting and evaluating data will become more important than ever.

The increasing amount of data will undoubtedly lead to improved eiciencies, reductions in accidents and safer environments for drivers – all of which will ultimately lower costs for leet operators. We want to get to place where we can use machine learning to help us amalgamate and interpret raw data,” said Dain Giesie, AVP of business development for Enterprise Fleet Management.

Having these IT skills to review fleet data are not only aimed to help improve vehicle utilization, it may also help in areas related to security, a growing concern as the world becomes more connected digitally. As data breaches continue to be problematic for numerous industries, the automotive industry and leet in turn will need to prepare itself for ways to be protected from hacking as vehicles become more closely bound to personal data and leets continue to collect more data on their drivers.

“Integrating technology into vehicles is no new endeavor,” said Mark Donahue, manager of fleet analytics for EMKAY. “What is new is the level at which vehicles are connected to our mobile devices, houses, and other personal items. As technology continues to be integrated into the automotive industry, it’s clear that increased security measures need to do the same. As a hard-to-believe reference point, a recent report found that there are over 100 million sotware lines of code in modern automobiles. the reality is that no sotware product of this size and complexity can be expected to run free of error or security laws. And when those laws could result in data breaches as well as public safety issues, it’s imperative to mitigate any risks,” Hardesty of Mike Albert Fleet Solutions echoed the signiicance of data privacy and security as the technology continues to evolve.

IT security and data security is going to be important, as more and more information needs to change hands, you have to make sure it’s secure, the privacy aspect surrounding it, you have to make sure that stuf doesn’t fall into the wrong hands,” said Hardesty. “I think that’s the direction in general you’re going to see a lot of things happen in leet. It’s all going to be about the data and protecting it, understanding IT and accessing that data, I think that’s really the wave of the future.”

Recent developments in Europe have already impacted how fleets in North America manage data for their multinational operations. Recently, Europe implemented the General Data Protection Regulation (GDPR) to help eliminate issues that relate to user privacy. The GDPR is a European Union regulation that requires organizations to inform users of its services regarding the personal data that it gathers of them and what the information will be used for. For multinational leets, this has meant properly managing user data of its drivers in leets who operate in Europe.

Hardesty said developments ongoing in Europe may offer clues as to the direction that certain segments of the industry may head. “As history has told us, what happens in Europe will eventually happen in the U.S.,” said Hardesty. “Europe is already altering driver behavior within large cities. For example, license plates ending in even numbers are allowed in the city on speciic day and odd numbers other days. Ride sharing, no drive zones are all starting to limit driver access. his is causing fleet management to look at fleet diferently.”

EVOLVING FLEET PORTFOLIOS

The sweeping interest of SUVs that continues to dominate the automotive industry isn’t new, but it helps provide details about the direction it is headed. Trends like these ultimately have an efect on fleet, and impact concepts like rightsizing and vehicle selection. “As vehicle costs and interest rates continue to rise, rightsizing becomes more and more important,” said Giesie of Enterprise Fleet Management. the trend toward fewer manufacturers offering sedans combined with improved engine technology in small SUVs will make the decision for leets to switch easier since they likely won’t see much of an increase in operating expenses for small SUVs.

As a result, I expect a majority of sedan Fleets to transition to SUVs. he decision to phase out sedans by some OEMs wasn’t made to force a new habit; it was based on customer preference and demand.” Fleets who are making moves toward SUVs are rightsizing not only for efective utilization, considering TCO, current gas prices, etc., but also because major OEMs, including GM and Ford, have expressed a desire to shit away from sedan production. Because of this, certain fleets will be susceptible to shits in asset portfolio.

Rightsizing initiatives are poised to remain a particular area of focus for many organizations as we look toward 2019 and beyond, Mike Bryan, department head of ARI’s business intelligence and analytics team. Whether it is through comprehensive spec’ing strategies aimed at optimizing a vehicle for a certain task or through larger initiatives designed to ensure you have the ideal amount of vehicles to support operational demands, leet rightsizing is critical to helping companies achieve their ultimate goal of operating in the most eicient,cost-effective way possible.”

Making major asset portfolio shits going forward is something leets should consider on a case-by-case notice, as moving to strictly SUVs for fleets is certainly not applicable for every industry, for example, oil and gas services. “Fleets should regularly evaluate if their vehicles are meeting their needs, especially as job requirements or product specs change,” said Bradley of Element. “While SUVs typically ofer more space and comfort, that benefit comes with a financial cost. So companies should continue to evaluate if that incremental space (and, potentially, revenue per trip) is worth the incremental cost, especially as fuel costs continue to rise” Tom Cofey, sr. VP of sales for Merchants Fleet Management, added to the idea of rightsizing as it relates to leets inding the best vehicle suited for a job, and needing to consider the OEMs decisions to drit away from utilizing sedans.

“Picking the right vehicle for the job (rightsizing) is only one piece of the equation,” said Cofey. “OEMs are streamlining their vehicle model options and leets need to adjust and consider the impact to their leet overall. As OEMs discontinue models, much like where Ford and GM announced this year with their sedans, it impacts resale values, replacement costs, maintenance variances, and fuel economy. When models are discontinued new car sales can experience a decline. However, the average wholesale resale price does not necessarily experience the same dramatic decrease.”

Several OEMs have also proposed big investments toward producing more zero-emission vehicles, including GM which recently proposed a national mandate that would require 25% of the vehicles sold by manufacturers in 2030 to be zero-emission vehicles. LeasePlan Corp. also announced its goal of achieving net zero emissions from its total leet by 2030. The impact this will have on leet is remains to be seen, but is another aspect that leets should not ignore moving forward. “he number of EV models and the availability of those models is limited; though we know the automakers are investing millions in the future development of electric vehicles, said Tim Cengel, manager, manufacturer relations for Wheels Inc.

As the number of available models grows, the battery technology improves and charging infrastructure grows, we expect to see demand for electric vehicles grow. In addition, many of our customers have green initiatives that include goals for fuel economy or emissions across their leet which we expect will drive them to consider electric vehicles.”

ALTERNATE MODES OF MOBILITY

As asset selection changes for fleets in the future, the traditional ideas of leasing or owning vehicles may also be phased out as new modes of mobility become feasible options for some fleets. “In terms of ride sharing and mobility as a service, companies will need to determine if their drivers need a leet vehicle or simply a ride,” said Don Woods, director of client information systems for ARI. “We’re working closely with our customers to help them answer this question with their specific needs in mind. Together, we’re leveraging their fleet data to align their employee’s job functions with the most appropriate method of transportation.” Some fleets have implemented alternative methods of vehicle utilization and utilized their leet management company as a means of support.

The subscription-based model continues to gain traction across our portfolio,” said Cofey of Merchants. “We are seeing the most traction where customers are launching new locations or entering new markets and the exact needs is not yet known. Another area where the subscription-based model is working is with organizations with seasonal or project-based needs.

Cofey said that his team mainly observed this trend in the short-term truck rental space, which resulted in Merchants developing a new truck rental ofering to meet the demand. “A year ago, our subscription-based customers were exclusively closed circuit meaning one company using a pool of vehicles, Cofey added. “However, we are beginning to see that circuit open slightly where like organizations that are in tight metros areas may share the same pool.

The leet space is slowly blending the line between open and closed-circuit sharing. We anticipate the leet space will continue to shit toward a model that looks more and more like the consumer model we know today, we are not there yet but we are moving in that direction.” Hardesty of Mike Albert Fleet Solutions also suggested that leet managers of the future may be given a budget for aspects of mobility, transitioning from analyzing total cost of ownership (TCO) and instead factoring mobility funds.

Considering future vehicle application, Hardesty said operating with a sedan-heavy fleet may be viewed as an antiquated form of transportation in a vehicle sharing fleet,as the vehicle would need to service multiple duties, depending on the fleet. “If you’re going to go to a vehicle sharing system, you’re going to have vehicles serving all kinds of purposes, you’re going to have to get an all-purpose vehicle,” said Hardesty.

The idea of having a sedan when multiple people are going to use it for multiple functions just doesn’t make sense, but you’re going to get the most versatile vehicle you can to be in your pool so anybody who needs to use it can use if for what they need it for not just the sales person.

Because of these shits, the role of the leet management company is also expected to evolve in the future, which will mean FMCs need to stay current and adapt to the changes along with fleet managers. I believe that the relationship between fleet and the FMC will always be there just not as we view it today,” said Hardesty. “Only the progressive, advanced thinking FMCs will survive the future. All FMCs may not be able to do all things for all people but they better be thinking about what phase of the ‘new future’ they can focus on and be the expert in. As leets go to a ‘payonly-when-you-need-it’ model, FMCs will have to igure out how to adapt to that rather than staying the course of what they are doing today.”

However, these alternate methods of mobility are not going to be commonplace overnight, as fleets will need to find ways to best leverage the solution. “Fleets, particularly in North America, remain truck-centric with an emphasis on moving both people and equipment,” said Woods of ARI. “While some leets may be able to leverage these emerging trends in certain scenarios, mobility solutions such as ride sharing are still likely several years away from signiicantly impacting the leet sector.” Giesie of Enterprise Fleet Management noted that a majority of its customers may not be suited for a sharing model, as it currently stands.

The majority of our customers are service providers whose vehicles require a high degree of specialized upitting specific to the services they ofer, and therefore are not easily shared,” he said. “hat doesn’t mean we don’t think there will be a sharing opportunity. We’re keeping a close eye on emerging technologies and markets to determine what role ‘sharing’ will play in the leet management space.”

Likewise, leet professionals should continue to keep an eye on the ever-changing industry, as these changes gradually occur, potentially creating new opportunities to eiciently run a fleet. “As an example, instead of a sales person having a car to use on their time, there is a pool of cars, and you can assign a car to a driver in the same way that you can sign out a conference room,” said Hardesty. “I think all those things are really going to change the way people start looking at leets, because now you’re managing the fleet for the time it’s being used rather than having your leet car in somebody’s control for the whole term of the lease.”

Meanwhile, Bradley of Element addressed doubts about certain mobility concepts, speciically with services like Lyt or Uber. “We have looked at ride sharing or using Uber/Lyt in lieu of a leet vehicle for urban drivers,” said Bradley. “If they are low mileage drivers who typically drive in a concentrated area there are some scenarios where this can make sense. hat said, I don’t expect this to become a prevalent solution in the future. his approach is generally more cost restrictive (i.e., an unexpected 40-mile drive with Uber vs. a company car) and less predictable (i.e., Uber’s surge charging, timely arrival of car sharing) which limits its potential cost beneit.”

He added that many drivers consider a company car to be a job perk, so this decision to utilizing services like these could be taking away a beneit from the driver. While most leets haven’t implemented these mobility solutions, this could all change in the coming decades. According to a recent study from Cox Automotive, mass adoption of autonomous vehicles should begin ramping up in 2023 and will ultimately drive a shit in vehicle ownership from consumers to larger mobility service providers with large leets of battery-electric, autonomous vehicles.

HOW TELEMATICS WILL EVOLVE Telematics is another major leet tool that will impact much of future fleet decision making, and is continuing to create a stronger presence in the leet space. The fleet management space is buzzing with a variety of new technologies, but telematics and advanced analytics continue to be the fuel that drives innovation,” said Lou Vella, telematics product development manager, ARI. “By the end of 2018, telematics devices will be in use across approximately 30% of all North American leet vehicles – with that number expected to rise to almost 50% by 2022. Telematics and advanced analytics are driving eiciency today and are poised to continue to do so for the foreseeable future.” Telematics technology today already helps leets understand more about vehicle utilization, driver trends, etc., and is becoming more ubiqituous across the industry.

“As these programs continue to be more and more afordable, widespread adoption of driver monitoring programs can be expected,” said Donahue of EMKAY. “he immense beneits these programs ofer to leets has always been attractive. Now that they’re not only afordable, but also much simpler to start-up and administer, it’s hard to resist the numerous beneits they can provide. Big Data is taking over the industry, and the best way to obtain massive amounts of data is to track your own fleet.” Moving forward, it will only become a more essential tool to leets to understand more about their operations.

“Telematics as we know it today is going to evolve,” said Hardesty. “Maybe it will track utilization a little bit more; maybe it will track how oten certain people are using certain cars. You’re still going to be making your decisions based of of data that the telematics is going to gather, and I think that that is just going to be diferent in the future, with whatever is important at that point.” Cofey of Merchants echoed the significance of what telematics will do for fleets moving forward. “Analyzing data to ind actionable insights will continue to gain importance as leets become more connected and the amount of data produced continues to grow. It will remain essential to start with creating a baseline and then manage to the baseline creating alters and thresholds. he biggest challenge many leet professionals experience is the lack of time to consume and analyze all the data inlows that can come with a robust telematics program,” said Cofey.

Changes to the technology will mean leets will need to stay privy to the latest technological developments going on in the industry, but also make sure their fleet partners are staying current. There are many steps that will need to be taken in this rapidly changing space. Fleets should embrace new and evolving technology that is available now. For example, telematics already provides a lot of information that can help leets run more eiciently and safely. Some leets are enjoying a lot of success by using it. And it will not be long before the majority of vehicles on the road will be manufactured with an embedded modem.

Fleet managers should evolve as vehicle technology evolves,” said Giesie of Enterprise Fleet Management. The beneits of this may lead to new key changes, including improved safety, reduced cost via improved utilization, improved assessment of rightsizing, etc. But, as mentioned earlier, the leet professional needs to be skilled at assessing this data, which will become an increasingly common requirement for leet managers as the role of the position becomes more about efectively reviewing and assessing.

In order for a fleet organization to beneit from the increasing amount of data, it will need to adhere to an efective analytical process,” said Wuich of Donlen. That process should begin with asking the right question so that clear and quantiiable objectives are set. he process ends with key performance indicators used to measure just how well those questions and objectives were met. In between, an organization must collect the right data and transforming that data into meaningful insights with actionable steps.

Source: Automotive Fleet José Miguel Fernández Gómez, es experto en gestión de flotas de vehículos, y el director de Advanced Fleet Management Consulting que suministra servicios de consultoría en gestión de flotas de vehículos

José Miguel Fernández Gómez, es experto en gestión de flotas de vehículos, y el director de Advanced Fleet Management Consulting que suministra servicios de consultoría en gestión de flotas de vehículos

]]>

]]>